Quick Take

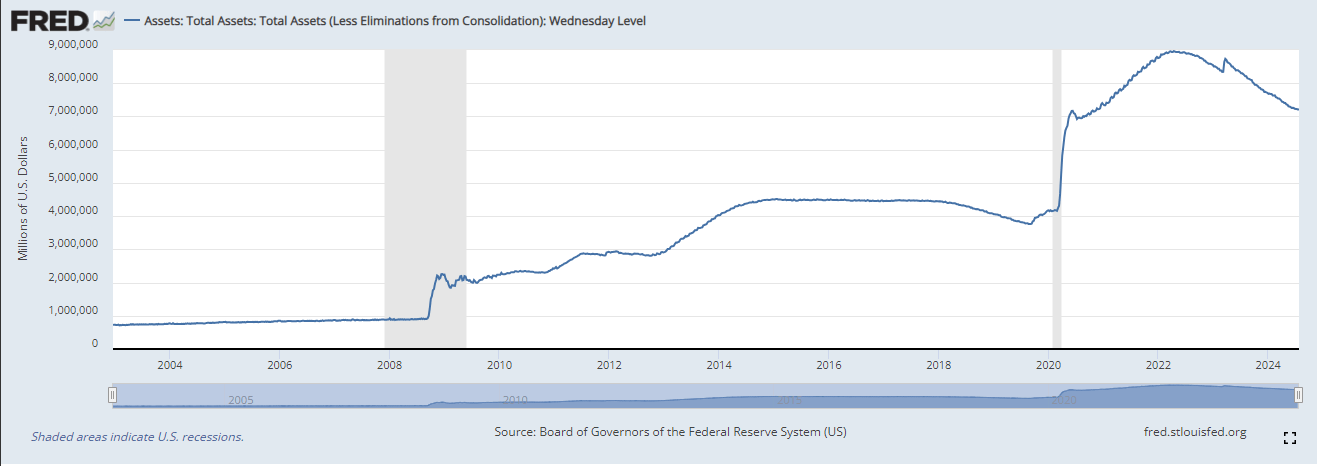

According to data from FRED, the Federal Reserve’s balance sheet has expanded significantly since 2002, growing from $720 billion to $7.2 trillion. This represents a Compound Annual Growth Rate (CAGR) of 11% over 22 years. Interestingly, a recent insight from CryptoSlate indicates that the S&P 500 has also experienced a similar CAGR of 11%, suggesting that the S&P 500 grows at the same rate as the Fed’s balance sheet expansion. Meanwhile, the SPX has risen approximately 16% year-to-date. In contrast, Bitcoin (BTC) has shown a remarkable CAGR of approximately 63% and has increased by roughly 50% year-to-date (YTD).

Examining the percentage increases during the Quantitative Easing (QE) events in 2008 and 2020 provides additional context. During the 2008 financial crisis, the Fed’s balance sheet increased by 144%; during the COVID-19 pandemic in 2020, it grew by 137%. If a similar crisis were to occur and the Fed were to respond with another aggressive QE, the balance sheet could potentially reach around $17 trillion.

The post Potential for Fed balance sheet to hit $17 trillion in future crises examined appeared first on CryptoSlate.