Onchain Highlights

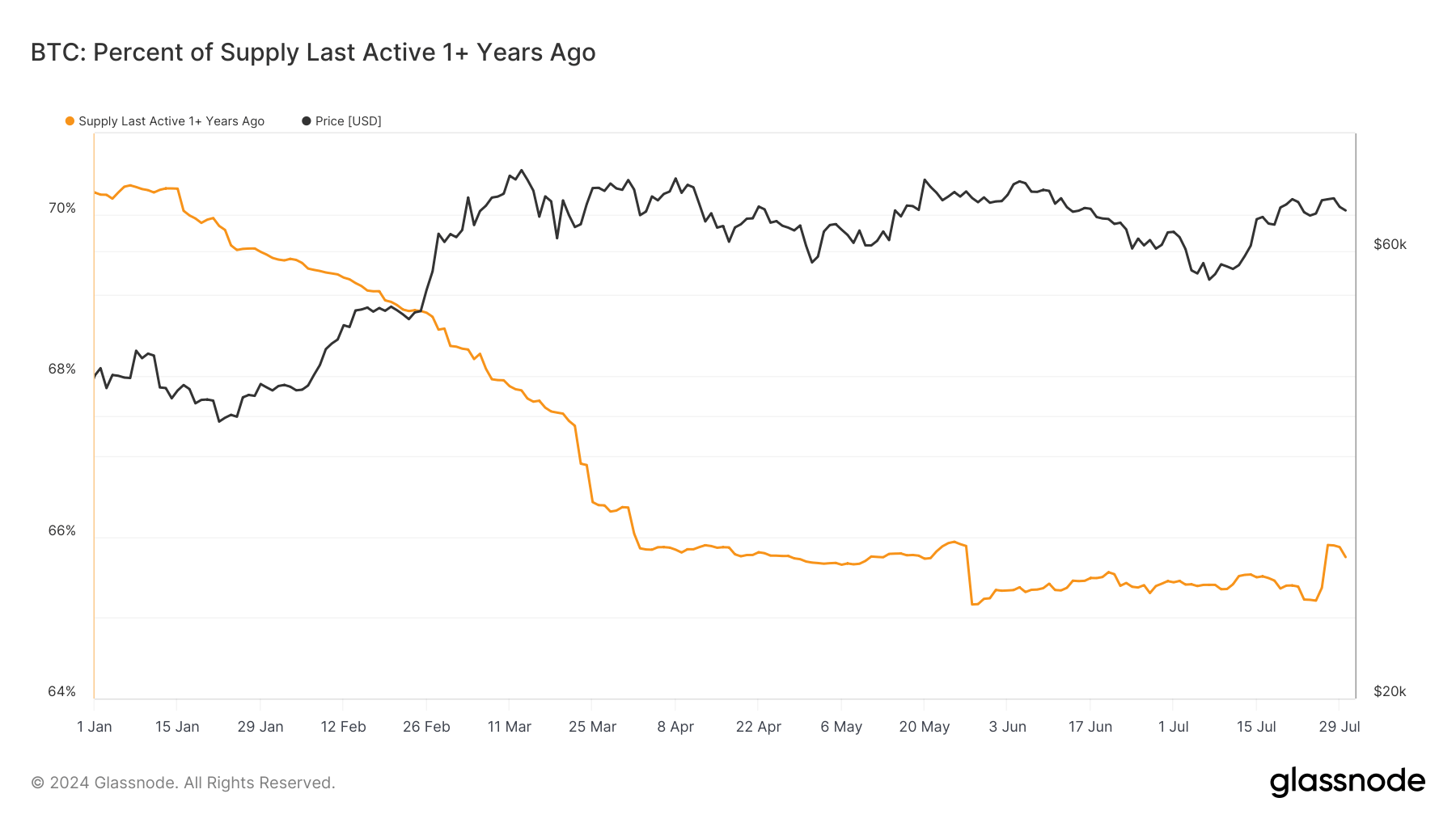

DEFINITION: The percent of circulating supply that has not moved in at least 1 year.

Bitcoin’s supply last active over a year ago has shown a recent decline, reflecting market conditions and holder behavior shifts. The percentage of dormant supply has decreased from approximately 70% at the start of 2024 to around 66% by late July.

This trend indicates that long-term holders are moving their assets, potentially in response to market conditions. In addition, Grayscale GBTC holders continue to distribute their coins in response to the ETF launch in January.

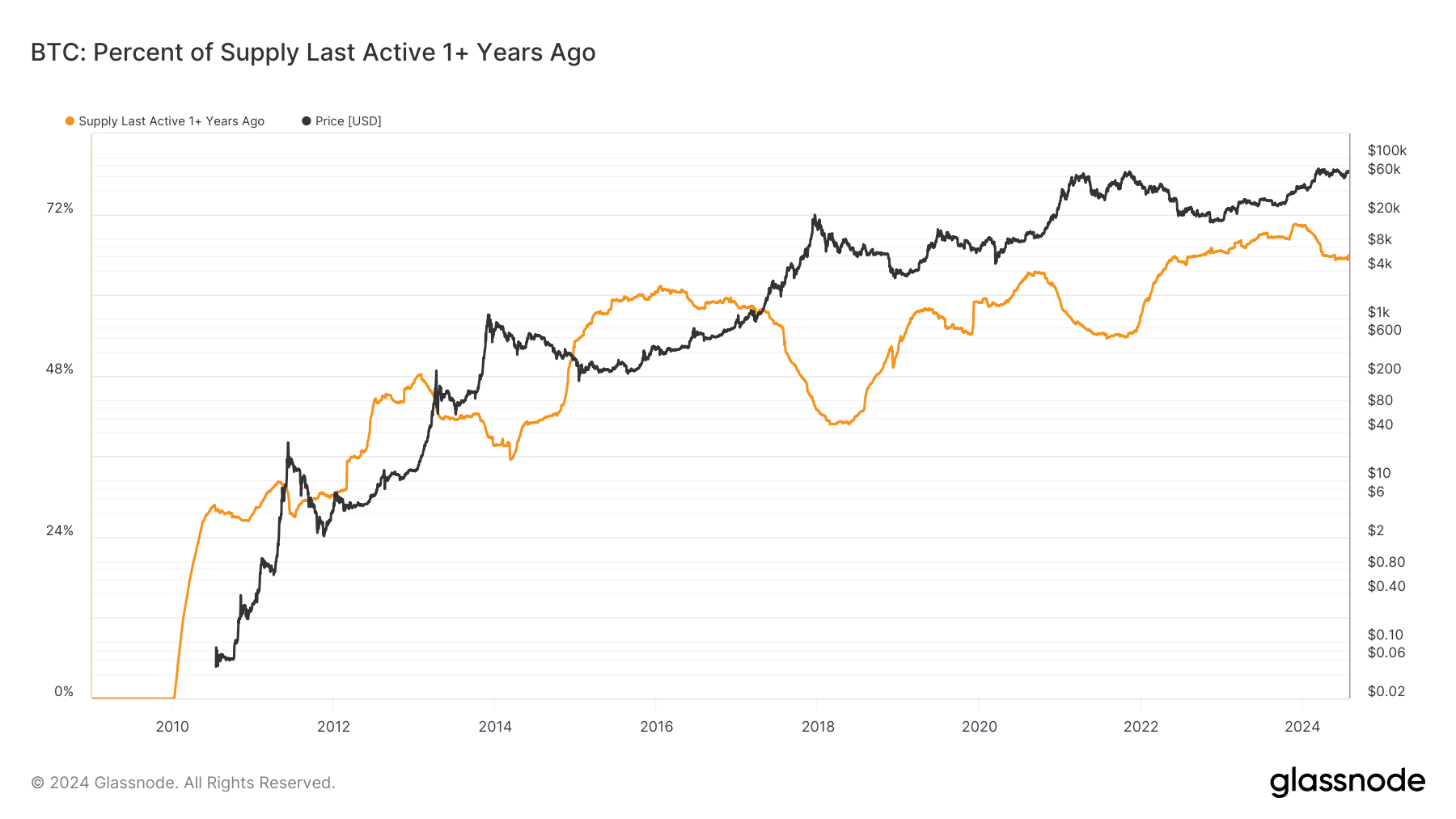

Historically, changes in the dormant supply percentage have correlated with significant price movements. The long-term trend, as seen in the broader historical chart, shows periods of accumulation and distribution, with the current decline suggesting increased liquidity and trading activity.

While the price of Bitcoin has fluctuated significantly during periods of volatility, it has mostly remained between $60,000 and $70,000 since February — indicating a balanced market despite the increased movement of previously dormant coins.

This shift in holder behavior highlights the market’s adaptive nature following major events such as the recent halving, which often prompts strategic reallocations among investors.

The post Bitcoin’s 12-month dormant supply has fallen to 66% from 70% at the start of 2024 appeared first on CryptoSlate.