Quick Take

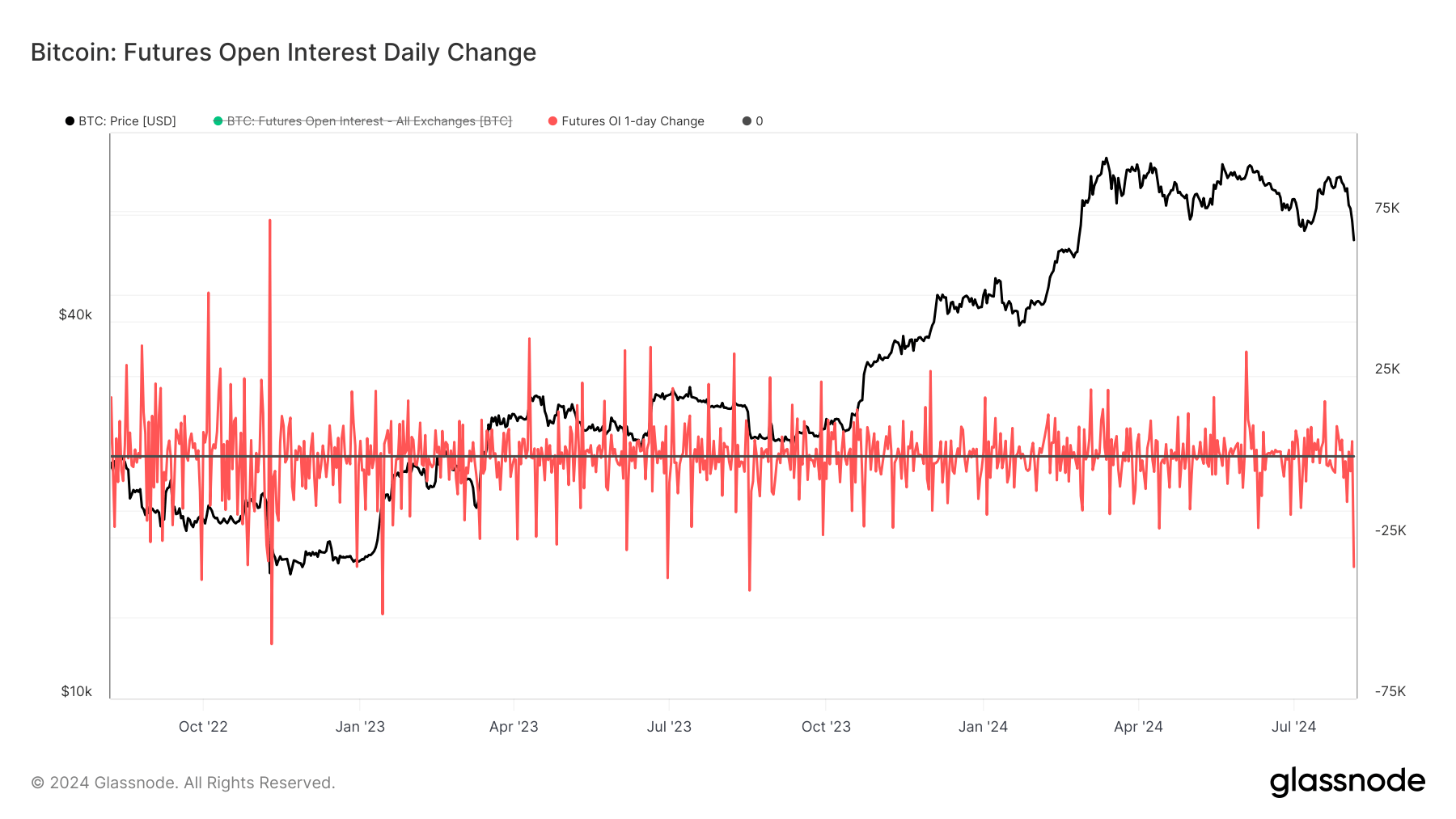

On Aug. 5, global markets experienced wild volatility, prompting a detailed assessment of trading volumes to gauge the impact. A key measure was futures open interest, representing the total USD value allocated in open futures contracts. During this period, Bitcoin (BTC) prices plummeted from approximately $58,000 to $49,000. To accurately measure this, open interest in BTC terms was examined to avoid price influence. It revealed a significant decline from 536,000 BTC to 492,000 BTC, marking one of the largest negative spikes in open interest in the past two years and the most substantial since August 2023, according to Glassnode.

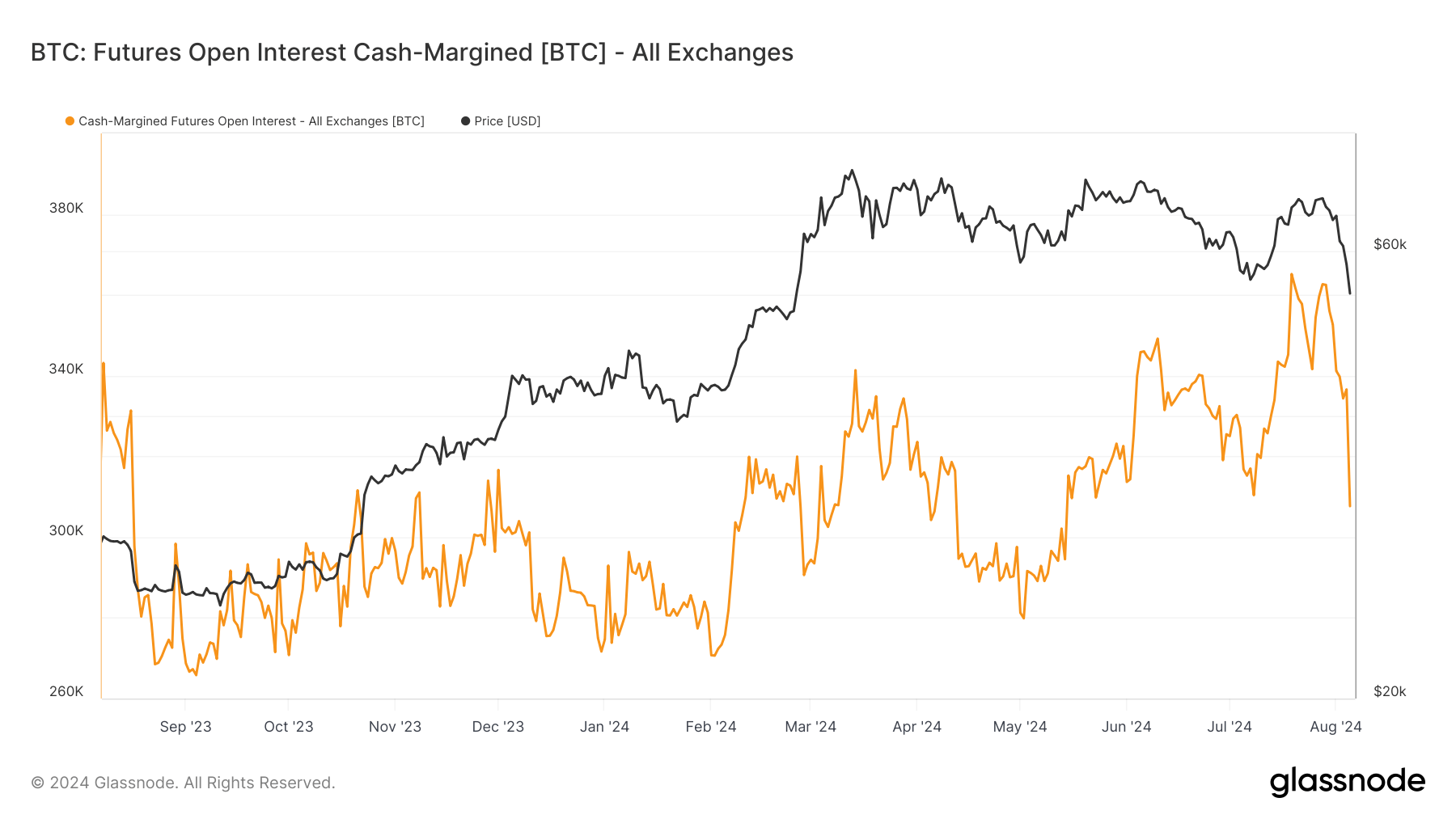

Additionally, the total open interest in futures contracts margined in USD dropped dramatically. At the start of the month, this figure was around 350,000 BTC but plunged to 308,000 BTC on Aug. 5, indicating a substantial leverage wipeout. This massive reduction in leveraged positions highlights the market’s reaction to the sharp price decline.

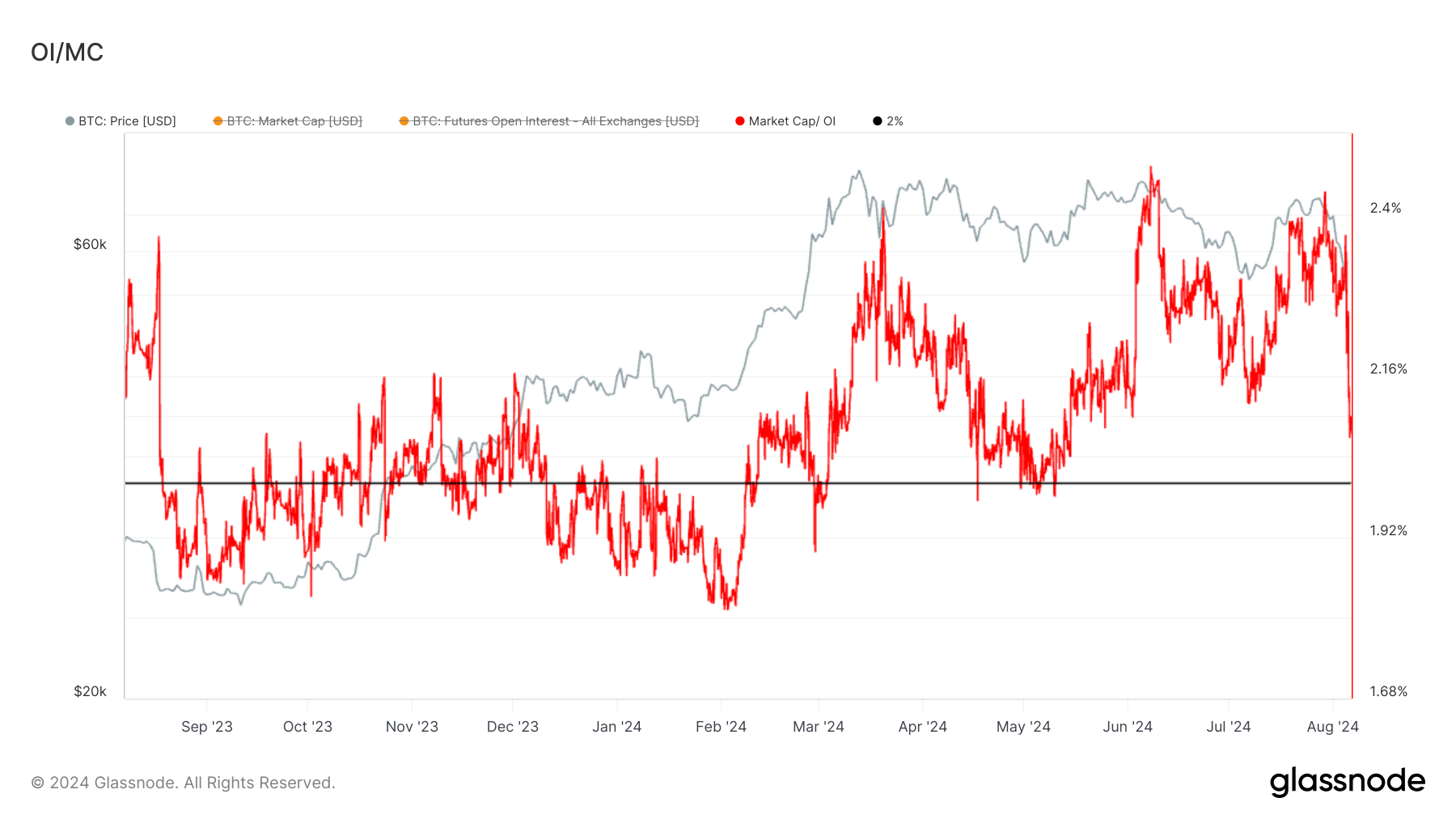

Another crucial metric, open interest divided by market cap, has now settled closer to 2%. Historically, this level is considered healthy, suggesting the market is not overleveraged, a stark contrast to the previous few months. This metric indicates a return to stability, implying that the recent volatility might have helped cool down the market, making it more balanced and less prone to extreme fluctuations in the near term.

The post Bitcoin futures open interest sees largest drop in two years amid market volatility appeared first on CryptoSlate.