In periods of extreme price volatility leading to massive losses across the market, it’s important to understand where most of these losses come from. While previous CryptoSlate analysis focused on the difference between the behavior of long-term and short-term holders, there’s another layer of depth in on-chain data that can provide a better understanding of market sentiment.

One of these metrics is the volume spent in loss, which calculates the total volume of Bitcoin sold below the acquisition price. By categorizing this volume in loss by age cohorts and wallet sizes, we can better understand the distribution of loss-making movements across different investor classes and timeframes.

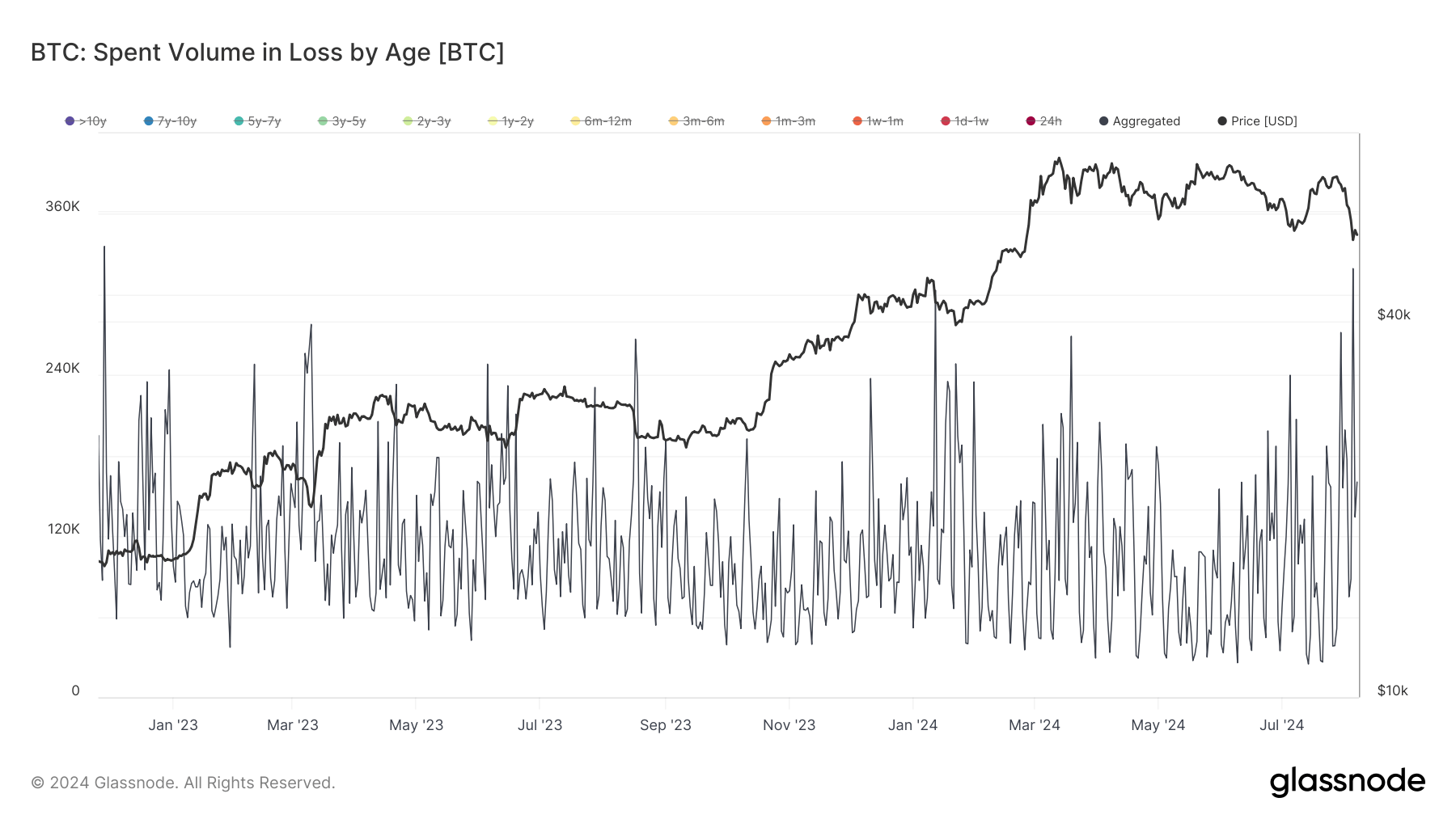

Bitcoin’s drop from $60,000 to $54,000 between Aug. 3 and Aug. 5 led to a significant spike in spent volume in loss for Bitcoin. The total spent volume in loss was just above 74,890 BTC on Aug. 3, spiking to 319,290 BTC on Aug. 5. This is the highest volume spent in loss since Nov. 28, 2022.

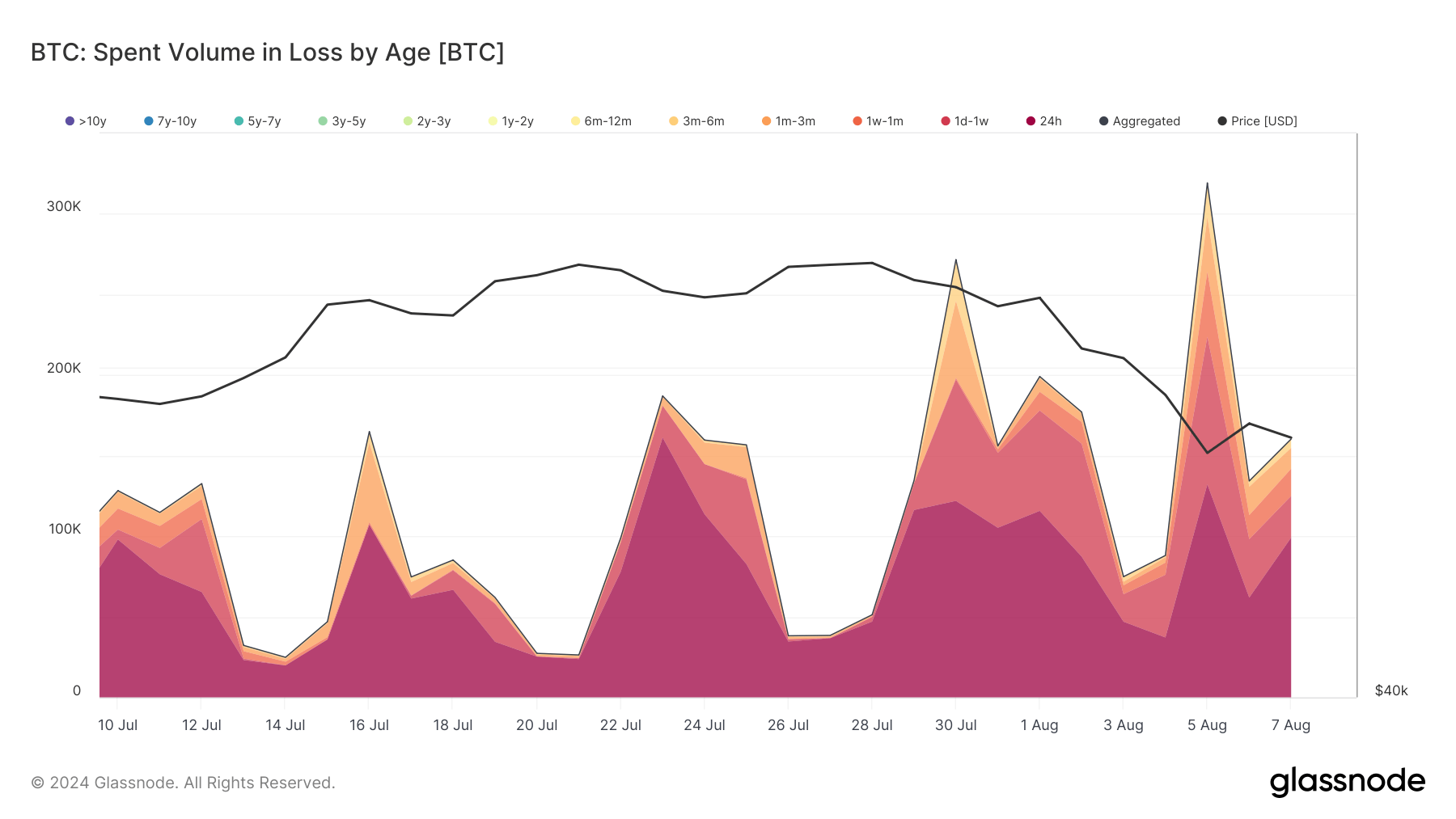

Looking at age cohorts, we can see that the majority of the volume spent in loss was spent by wallets that held onto BTC for less than 24 hours — 132,180 BTC. The second highest volume came from the 1-day and 1-week cohorts — amounting to 91,685 BTC.

The 1-week to 1-month cohort spent 40,235 BTC, the 1-month to 3-month cohort spent 34,088 BTC, and the 3-month to 6-month cohort spent 18,869 BTC in loss. Meanwhile, the 6-month to 12-month cohort spent 1,077 BTC, while cohorts older than one year spent less than 1,300 BTC in total.

This significant volume can be attributed to several factors. Investors who acquire Bitcoin with the intention of short-term gains often react quickly to market movements. Additionally, many traders use stop-loss orders to automatically sell their assets when the price drops to a certain level. The sharp price decline could have triggered a cascade of stop-loss orders, resulting in a substantial volume of Bitcoin being sold at a loss within a short time frame.

Moreover, automated trading bots that execute high-frequency trades may have contributed to the high volume of Bitcoin spent in loss. These bots are programmed to react to market movements within seconds or minutes, leading to a significant number of transactions from newly acquired coins.

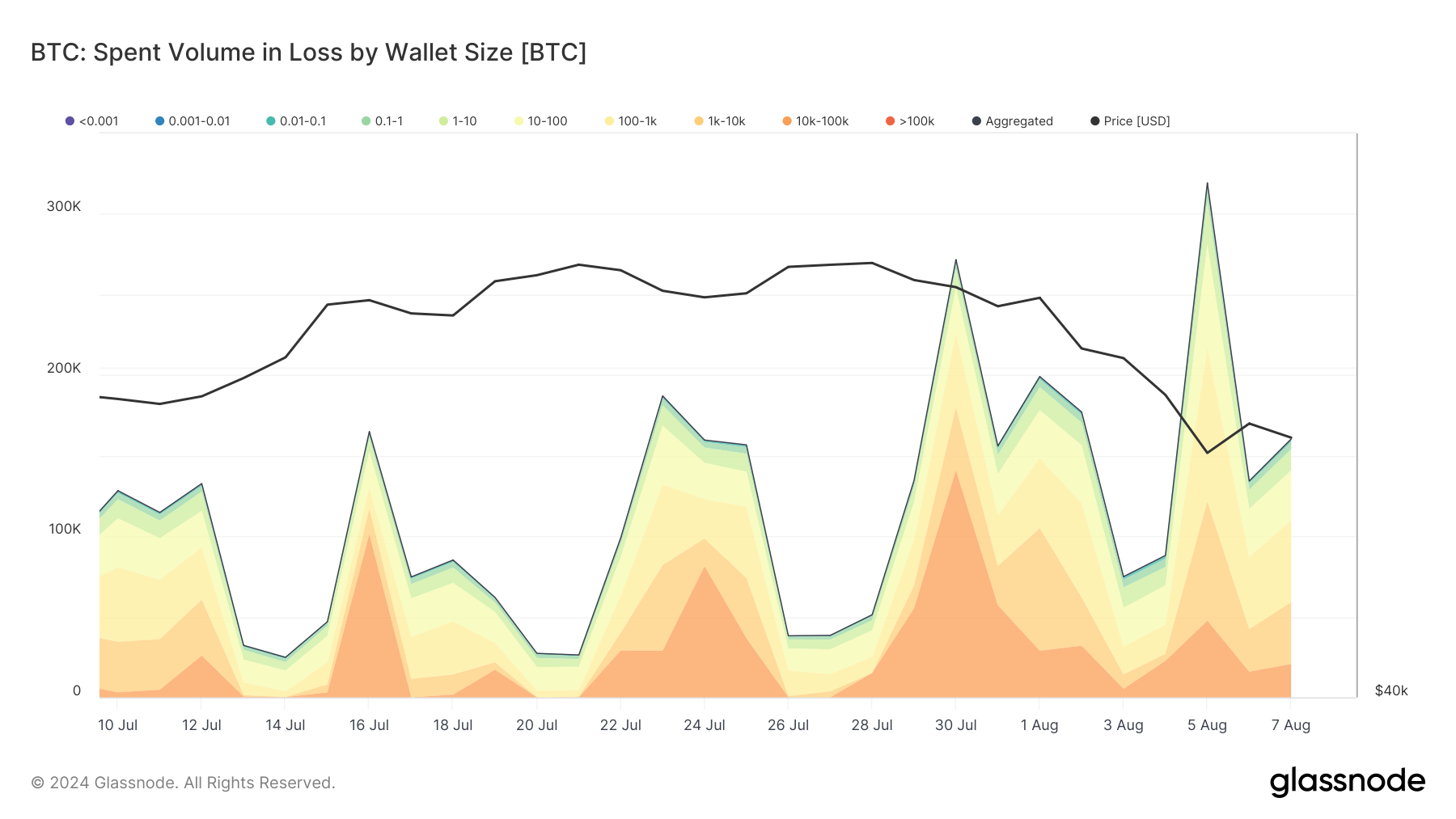

The spent volume in loss by wallet size shows that the highest volume came from wallets holding between 100 BTC and 1,000 BTC, totaling 95,590 BTC. Wallets holding 1000 to 10,000 BTC spent 73,990 BTC, while wallets holding 10 BTC to 100 BTC spent 63,869 BTC in loss.

Wallets holding between 100 BTC and 1,000 BTC often belong to institutional investors or large holders. The data suggests that large investors were actively selling their Bitcoin during the price drop. With the increasing prevalence of Bitcoin ETFs (Exchange-Traded Funds), significant sell-offs from these funds could contribute to the high volume of Bitcoin spent in loss.

ETFs that track Bitcoin prices need to adjust their holdings based on market movements and investor demand, leading to substantial transactions. Additionally, many exchanges hold large amounts of Bitcoin in hot wallets, which fall within the 100 BTC to 1,000 BTC range.

During periods of heightened trading activity, such as a rapid price decline, exchanges might move significant volumes of Bitcoin to manage liquidity or facilitate large sell orders from their users.

The post Bitcoin volume in loss hit highest level since FTX collapse appeared first on CryptoSlate.