Quick Take

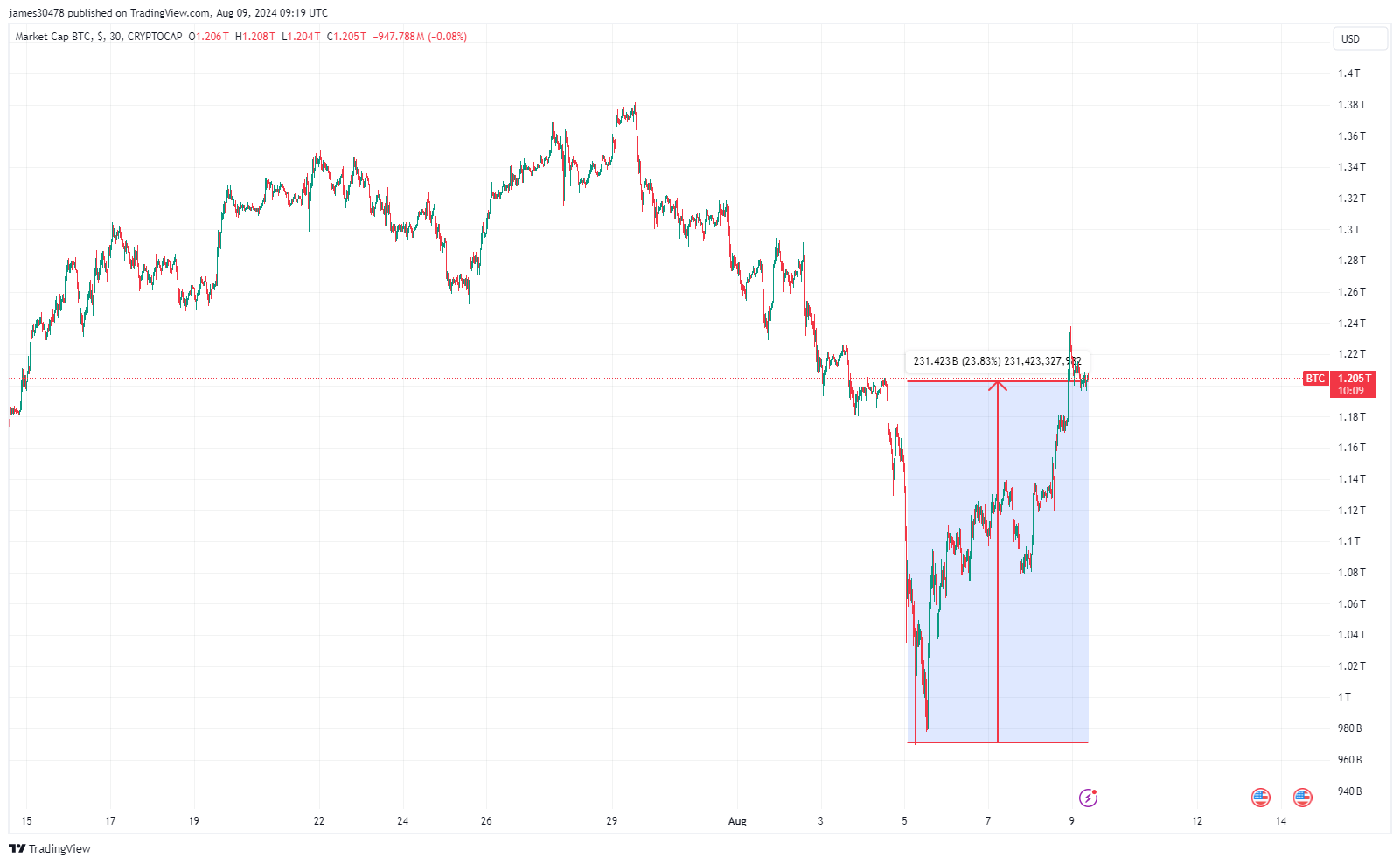

Bitcoin has experienced a significant resurgence, surging approximately 25% from its recent lows of $49,000. The digital asset’s market capitalization has also rebounded, now standing around $1.2 trillion after dipping as low as $980 billion. Once again, this recovery firmly established Bitcoin as a $1 trillion asset class.

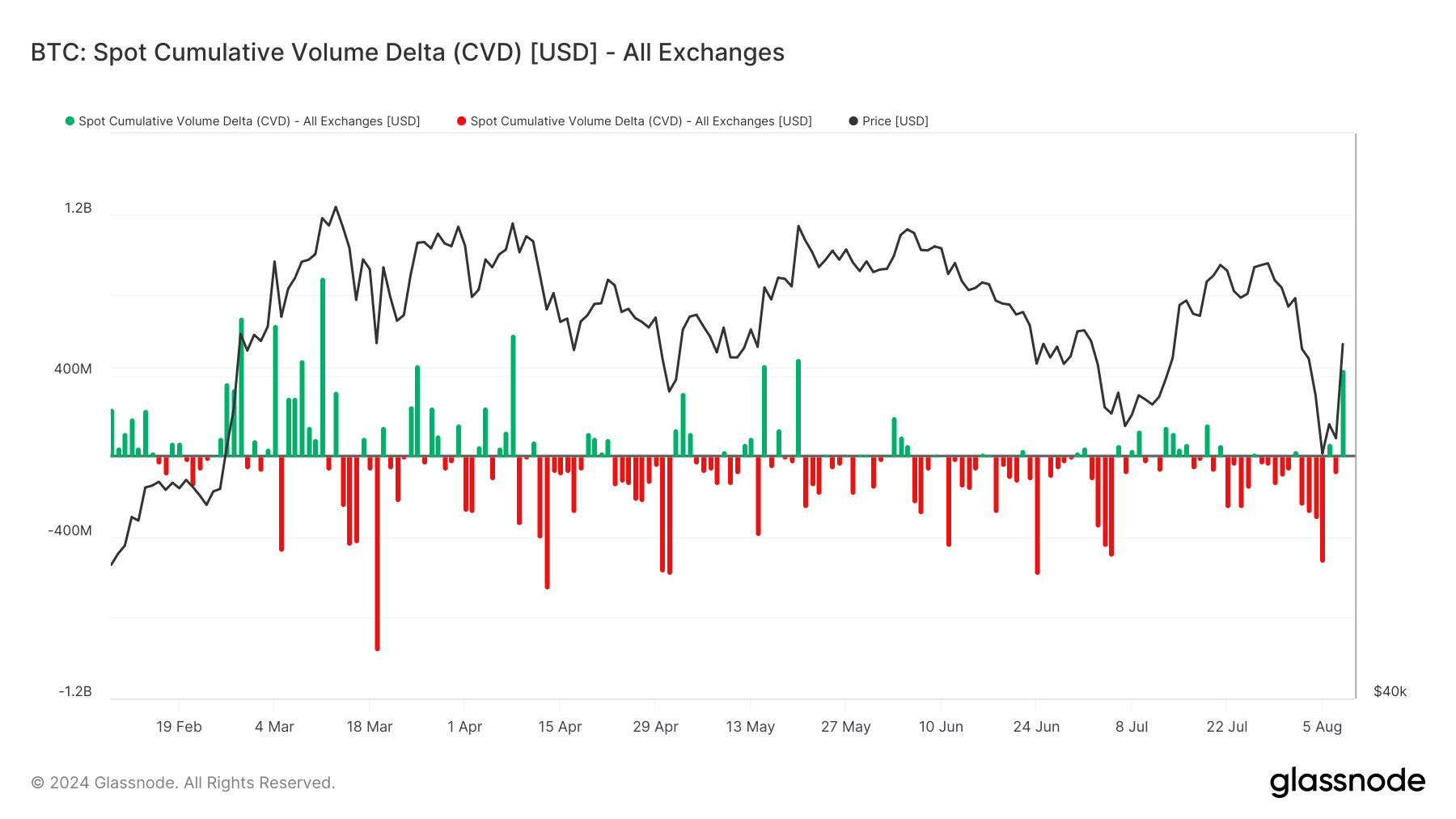

On Aug. 8, the market witnessed a substantial influx of buying activity, with $430 million in spot buying delta recorded. The Spot Cumulative Volume Delta (CVD), which tracks the net difference between buying and selling volumes, indicated the largest spot buying day since May 20, when Bitcoin reached $70,000.

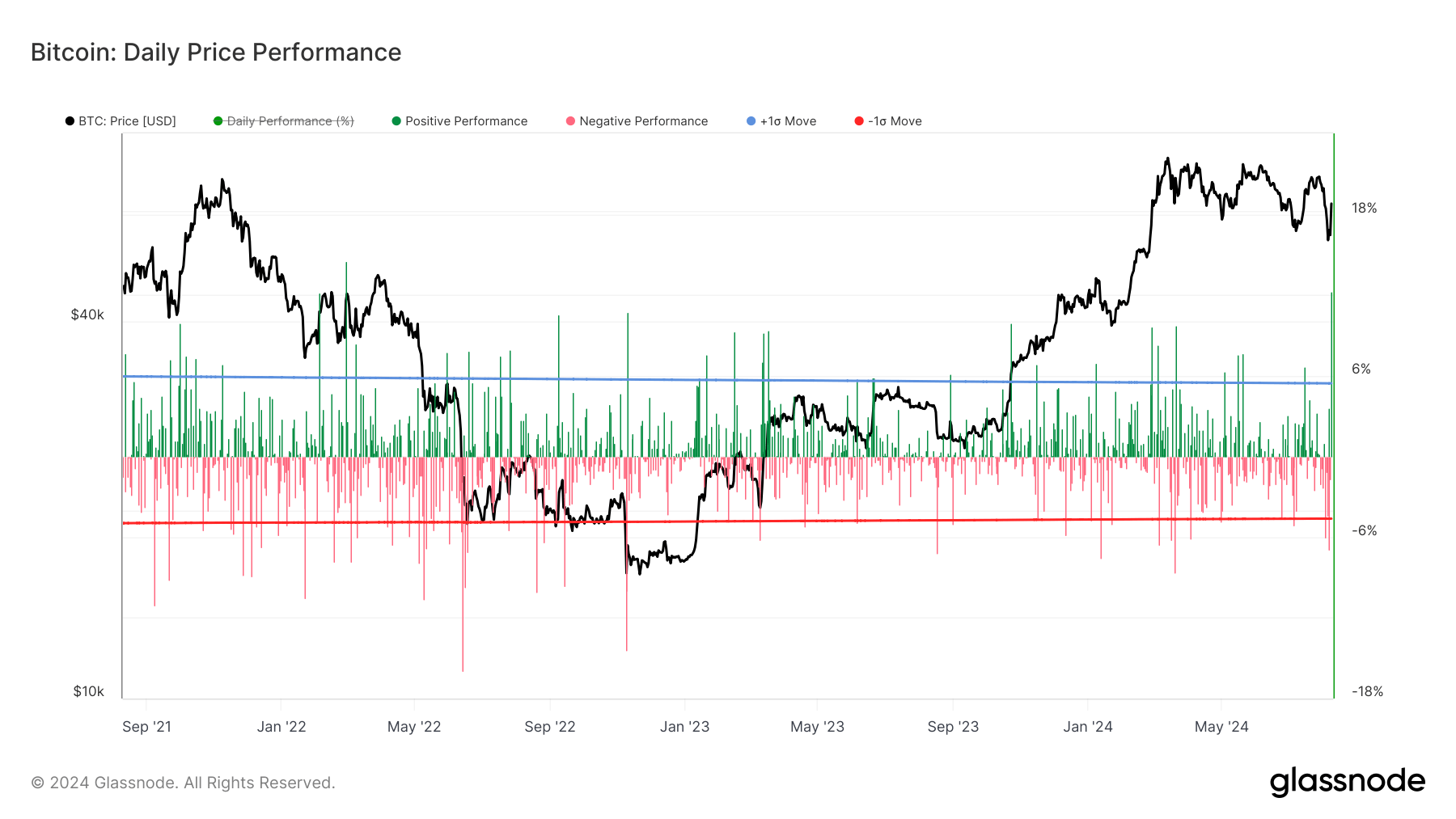

The day’s performance was particularly notable, with Bitcoin gaining over 12%, marking its best day since February 2022, according to Glassnode.

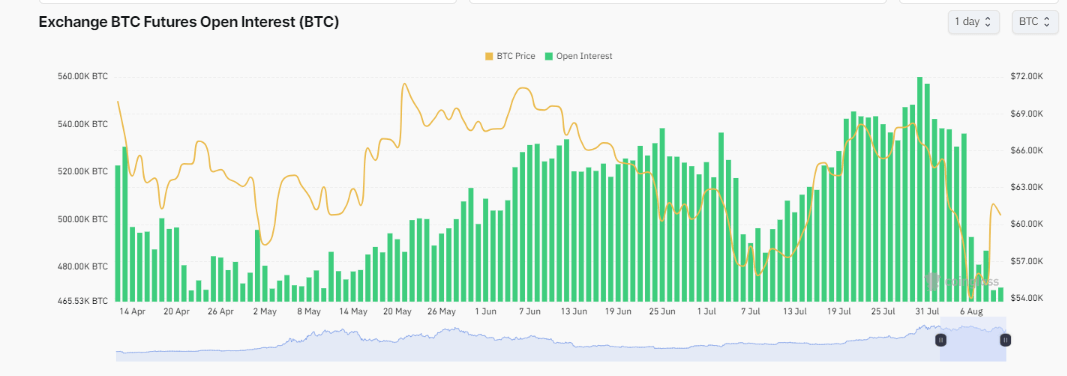

Interestingly, despite this price surge, open interest in Bitcoin barely increased. The last time Bitcoin was at $60,000, on Aug. 4, there were 530,000 BTC allocated in open interest contracts, according to Coinglass data. This figure has since decreased to 471,000 BTC, suggesting a spot-driven rally.

The post Spot-driven rally propels Bitcoin back to over $1 trillion market cap appeared first on CryptoSlate.