Quick Take

Bitcoin, often dubbed “digital gold,” shares some characteristics with the precious metal, though the two are perceived differently in investment circles. While Bitcoin (BTC) is considered a “risk-on” asset, favored during periods of market optimism, gold is viewed as a “risk-off” asset, preferred during uncertainty.

The Aug. 5 sell-off, driven by the unwinding of the yen carry trade, led to declines in both Bitcoin and gold. This indicates that during broad market sell-offs, most assets tend to move in tandem, challenging the notion of certain assets, like gold, being classified as “risk-off.”

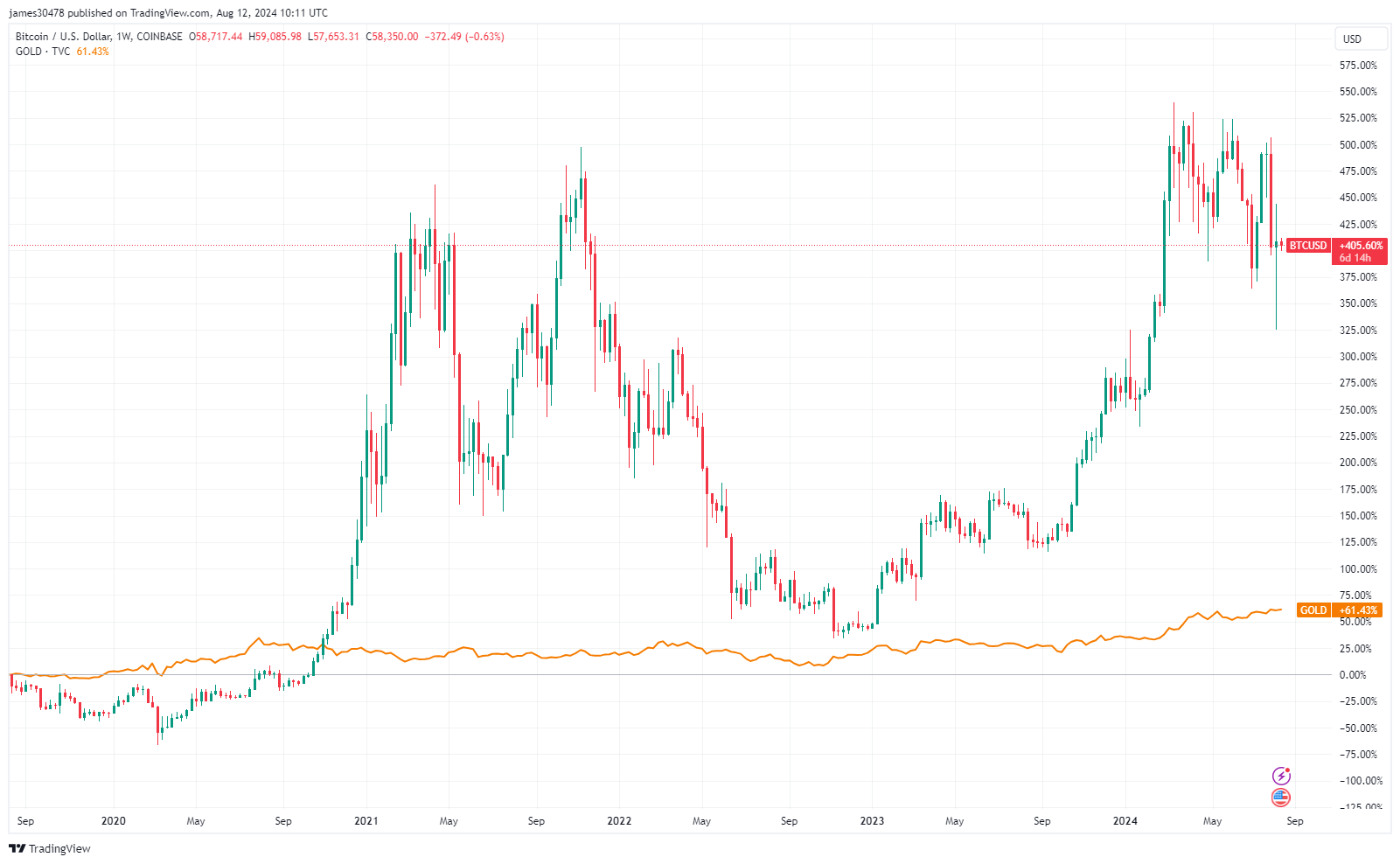

Over the past five years, Bitcoin has delivered impressive returns of over 400%, compared to gold’s 61%. However, Bitcoin’s volatility makes it challenging to hold, with significant fluctuations both on an absolute and relative basis.

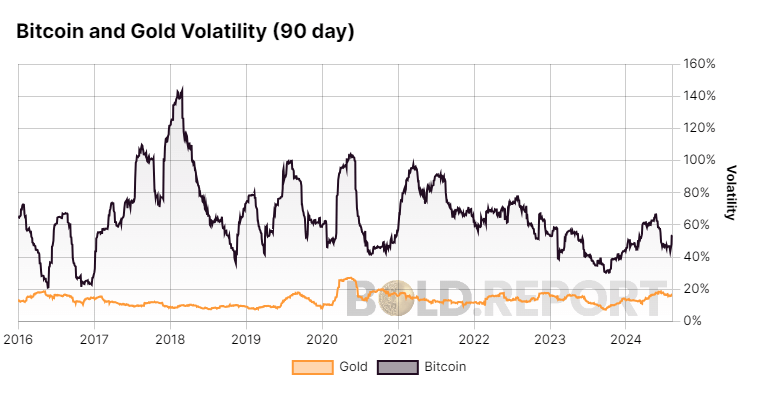

Absolute Volatility

Absolute volatility refers to the magnitude of price swings over time, and in Bitcoin’s case, it has historically been much higher than gold’s. For example, in 2017 and 2018, Bitcoin’s volatility exceeded 100%, though it has since trended downward as the asset matures. Gold’s volatility, by contrast, has remained below 20%, according to the Bold Report.

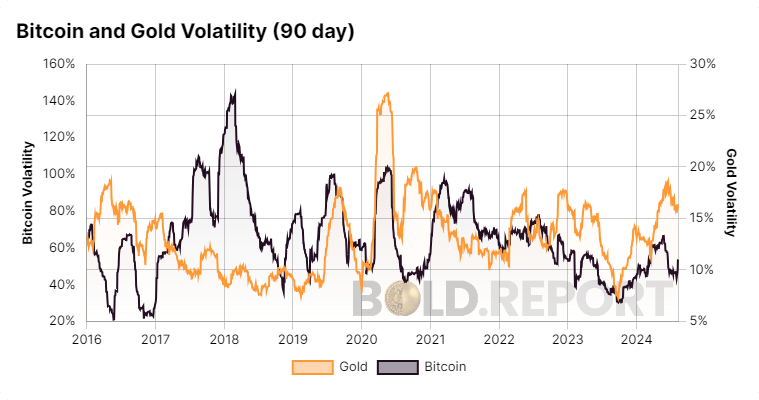

Relative Volatility

Data from the Bold Report also shows relative volatility, which compares the volatility of one asset to another. It also indicates Bitcoin’s higher fluctuations, though these have decreased over time.

The Bold Report tracks the Bold ratio weightings by ByteTree, an index weighted at 25% Bitcoin and 75% gold. This ratio has increased from 19% in June 2021, reflecting Bitcoin’s growing stability and maturity as a financial asset. As Bitcoin continues to mature, this ratio may rise further.

The post Bitcoin’s maturity reflected in declining volatility trends appeared first on CryptoSlate.