Quick Take

Bitcoin ETFs have garnered significant attention in 2024, amassing over $17 billion in net inflows.

Senior Bloomberg ETF analyst Eric Balchunas suggests that without the success of Bitcoin ETFs, the digital assets’s price would hover around $20,000 instead of the current $60,000. He argues that ETF activity has been a key driver in Bitcoin’s price surge.

“Take the ETFs away from picture and btc price is probably around $20k”.

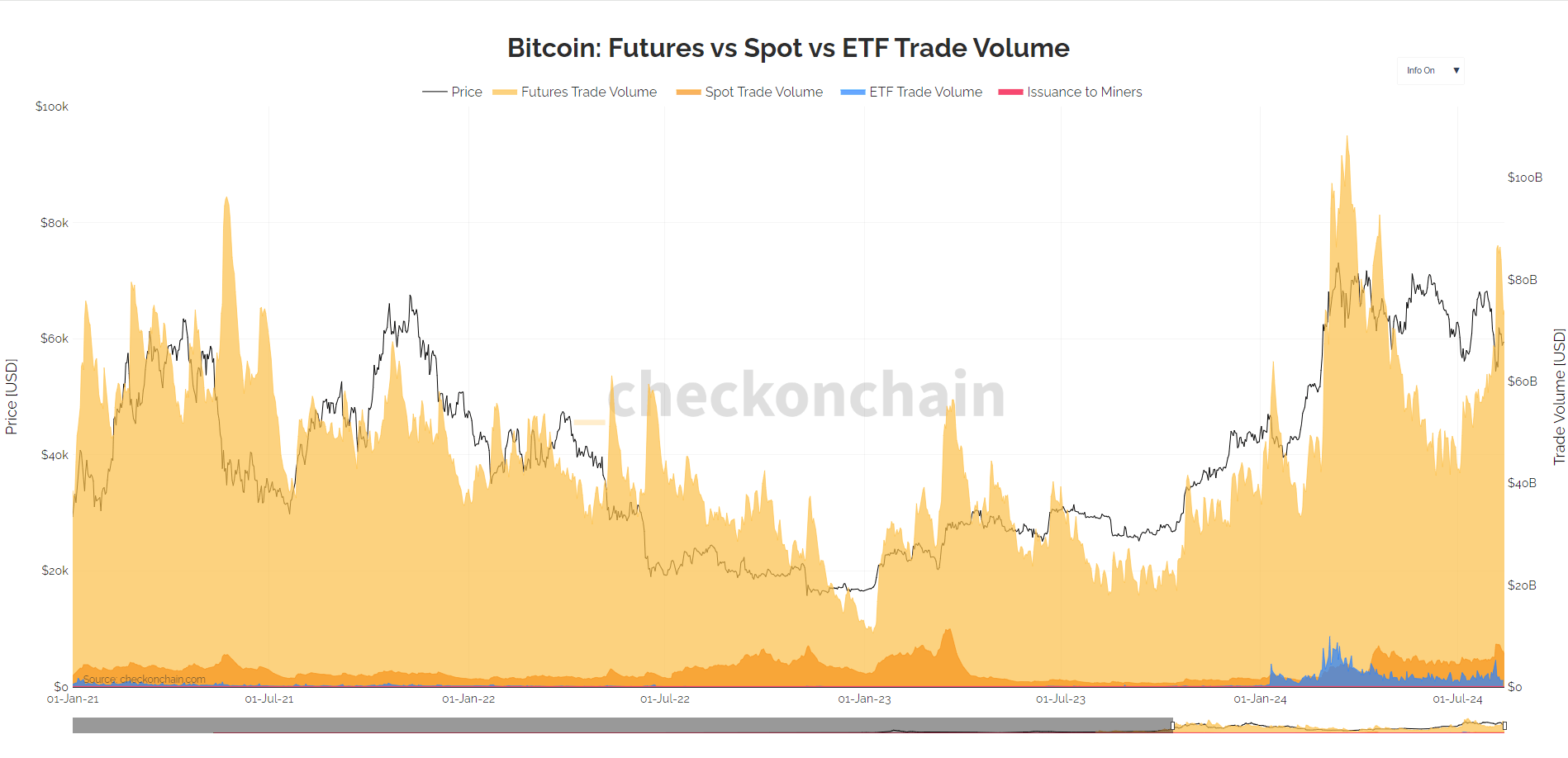

However, I disagree with Balchunas’s assessment. I’ve emphasized that the volume of Bitcoin ETFs is relatively minor compared to the futures market, which plays a more substantial role in influencing Bitcoin’s price.

As of Aug. 12, the futures trading volume has reached $74 billion, significantly surpassing the ETF trading volume, which stands at $1.3 billion, according to data from checkonchain.

I align more closely with the views of Checkmate, a well-respected analyst in the Bitcoin space. He highlights that net capital flows in the Bitcoin market amount to roughly $12 billion per month, with long-term holder supply changes around $1.6 billion, substantially larger than any given ETF inflow or outflow per month.

In essence, while ETFs are influential, they are not the primary force driving Bitcoin’s market. As Checkmate succinctly puts it,

“At best, the ETFs are 20% of the influence. They are important, but not the driver”.

The post Analysts debate ETF influence on Bitcoin suggesting $20k price without $17 billion inflows appeared first on CryptoSlate.