Quick Take

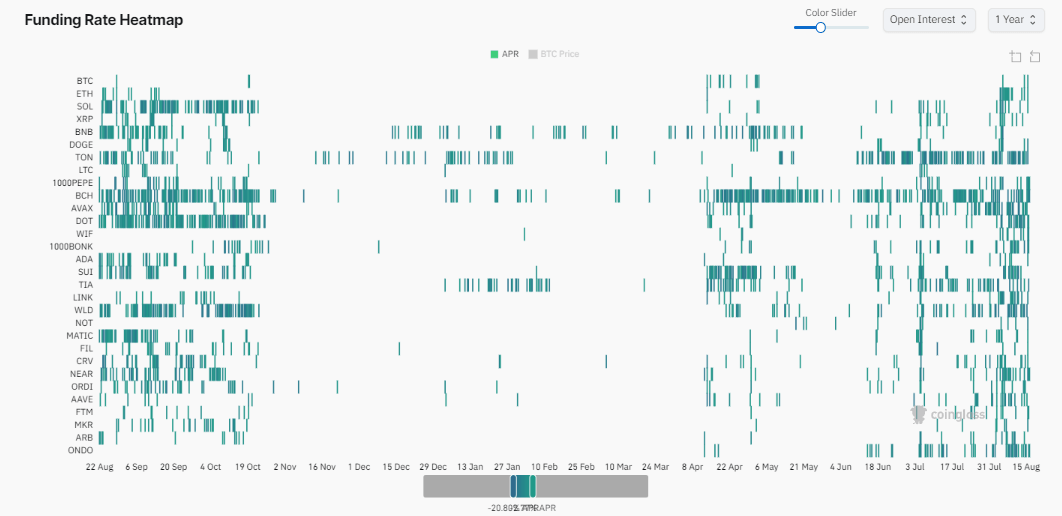

This past week, Bitcoin experienced significant price fluctuations around the $60,000 mark, briefly moving above and below this level before stabilizing. On Aug. 15, funding rates for Bitcoin dropped as low as 7%, according to Coinglass, a stark contrast to the typical positive rates that result in long positions paying short positions.

With this negative funding rate, short positions instead paid long positions, contributing to a sharp price drop from just under $60,000 to $56,000. This was one of the most extreme negative funding rates observed in the past year, surpassed only by the negative rates seen in April and May 2024 when Bitcoin made local bottoms.

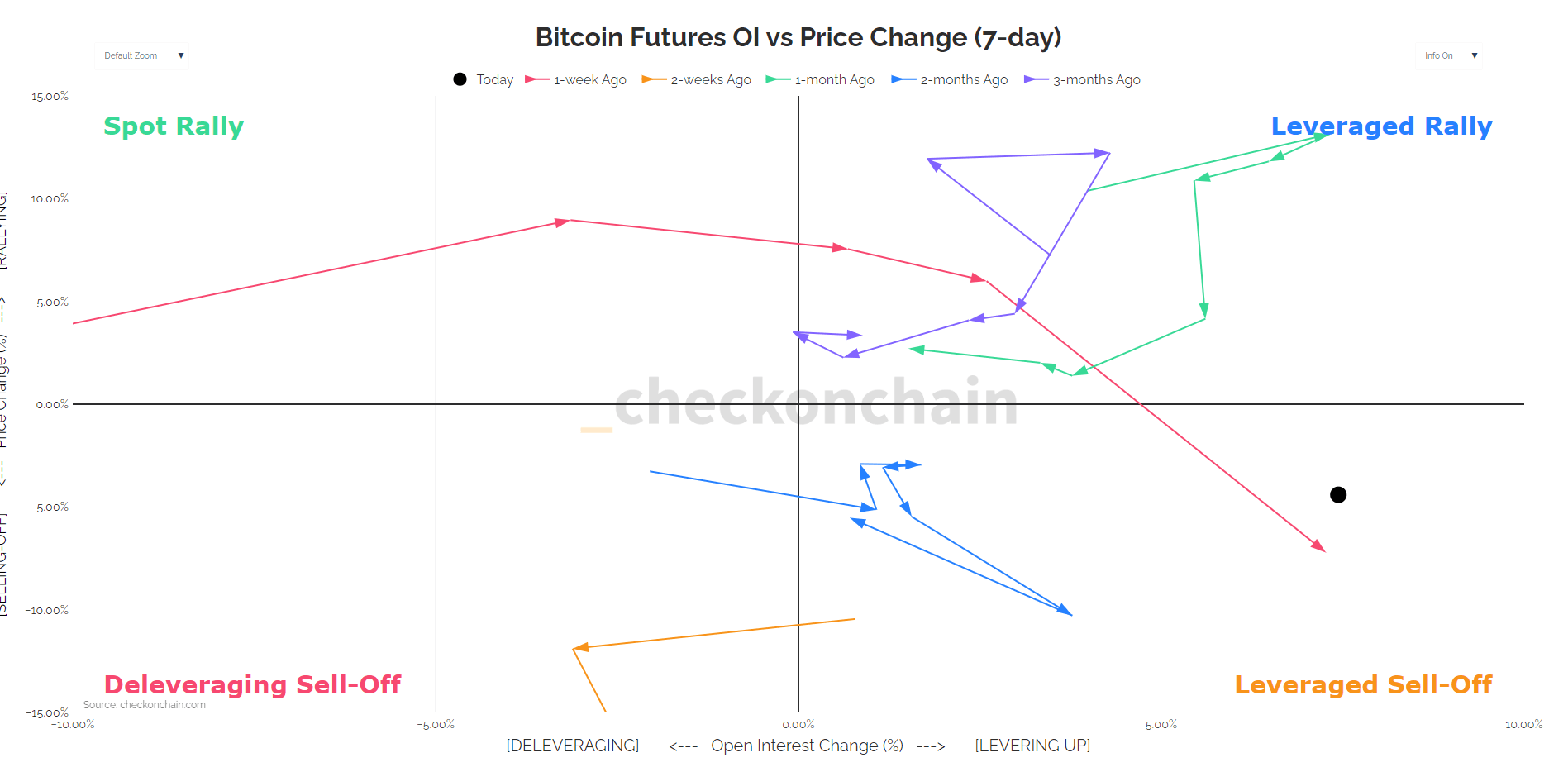

The sell-off was identified as a leveraged sell-off according to a chart by Checkonchain, where open interest increased while the price decreased, indicating that traders were heavily using leverage. Earlier in the week, the market saw a healthy spot rally characterized by declining open interest and spot buying. Moving forward, market observers hope for a continuation of spot buying, which would signal a healthier and more sustainable price trend for Bitcoin.

The post Leveraged sell-off drives Bitcoin down to $56K during negative funding rate spike appeared first on CryptoSlate.