Institutional investment in Bitcoin ETFs is driven by a startling 27% rise in adoption that occurs within the second quarter of 2024. That increase reflects a growing confidence of institutional players in the digital currency market.

Data provided by K33 Research showed that over 260 new firms joined the US spot Bitcoin ETF space, skyrocketing the total number of professional firms holding these ETFs to 1,199 as of the end of June.

Retail Vs. Institutional Investors

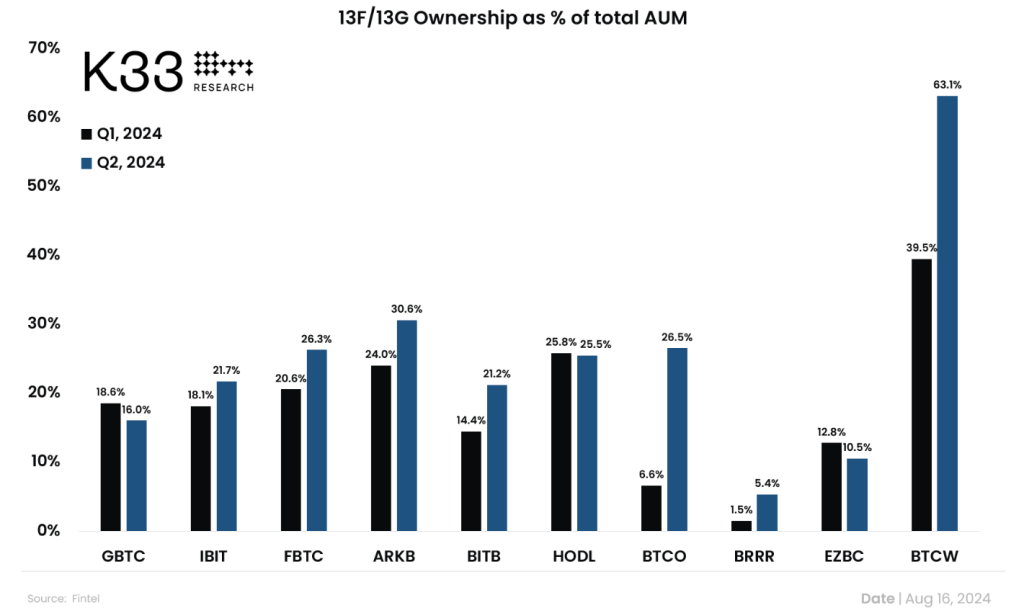

Although institutional interest is high, retail investors own most Bitcoin ETFs. Institutional investors increased to 21% of total AUM in June from 18% in Q1. This development shows that ordinary investors control the market even as institutions gain ground.

Institutional ownership of BTC ETFs grew solidly in Q2!

According to 13F filings, 1,199 professional firms held investments in U.S. spot ETFs as of June 30, marking an increase of 262 firms over the quarter.

While retail investors still hold the majority of the float,… pic.twitter.com/YanrZpfcCG

— Vetle Lunde (@VetleLunde) August 16, 2024

This trend is highlighted by the presence of famous firms, such as Goldman Sachs and Morgan Stanley, which have huge investments in Bitcoin ETFs. For instance, Goldman Sachs holds around 7 million shares worth nearly $418 million, while Morgan Stanley has acquired 5.5 million shares valued at $190 million.

Slumping Bitcoin Price Against Soaring Adoption

Despite increasing institutional acceptance, Bitcoin’s price has lagged. Bitcoin was trading at $59,190 as of August 17, battling to break $60,000.

Analysts say one of the reasons for this price stagnation could be due to ETF inflows, which are running lower than average. August 15th ETF inflows came in at just $11 million, a meager recovery from an $81 million outflow the day prior. Long-term holders start to accumulate once again and create price problems that alter the dynamics of the market.

The Road Ahead

Looking ahead, the secret to a fresh path forward for Bitcoin and the whole cryptocurrency sector could be this growing institutional acceptance. The fact that a combined $4.7 billion entered spot Bitcoin ETFs in Q2 could suggest that big financial firms are at last starting to see Bitcoin as an autonomous asset class instead of only a vehicle for speculation.

However, the real driver will be the momentum of Bitcoin above the $60,000 level. The analysts also watched the resistance closely with substantial hurdles near $61,700 and $59,000. If the price breaks above these two hurdles, this will trigger a wave of short liquidations that might drive prices higher.

Price Status

Bitcoin ETFs have been somewhat unstable even while their institutional acceptance is gathering steam. The future of Bitcoin hinges finally on this delicate equilibrium between institutional and ordinary investors. That scene might change drastically and set the path for wider acceptance and inclusion of cryptocurrencies into investment portfolios as conventional finance approaches digital assets.

Featured image from Pexels, chart from TradingView