The market is facing severe volatility as the two main assets, Bitcoin (BTC) and Ethereum (ETH), are in crucial accumulation phases. However, Bitcoin has performed better over the past ten days, standing out amid the fluctuations.

The ETH/BTC chart reveals this shift. At the time of writing, Ethereum’s price in Bitcoin terms was 0.043, its lowest since April 2021. This highlights Bitcoin’s dominance in the current market environment.

As prices move and investors seek an edge, critical data reveals a clear preference for Bitcoin over Ethereum in the past months. While the market may appear calm, history shows things can turn on a dime. Therefore, examining on-chain data and fundamentals is vital to anticipate potential shifts.

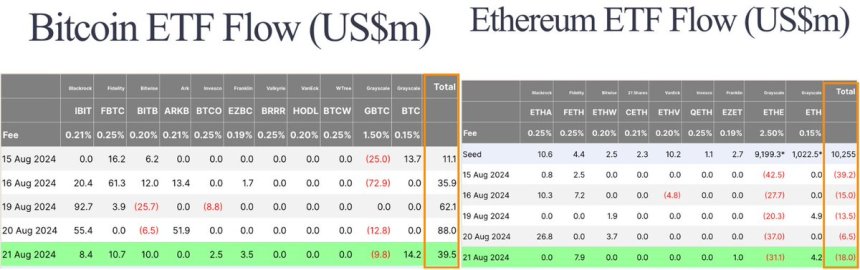

ETF Flows Showing Bitcoin Dominance

Traditional investors are showing an increasing preference for Bitcoin over Ethereum, as evidenced by crucial data from Farside Investors, a London-based investment management firm. According to their reports, Spot Bitcoin ETFs have experienced five consecutive inflows, while Ethereum ETFs have seen five straight days of outflows.

While some market participants believe that the outflows from Ethereum ETFs are due to selling pressure from Grayscale, analyst and investor Lark Davis has countered this argument. He points out that “about 30% of ETH is already out of Grayscale’s $ETHE ETF,” implying that the outflows are driven by broader market sentiment rather than Grayscale’s influence.

BLACKROCK NOW HAS MORE CRYPTO THAN GRAYSCALE

Blackrock has now overtaken Grayscale in total on-chain holdings. This makes Blackrock the largest ETF-related entity on Arkham.

Blackrock: $22,143,715,559

Grayscale: $21,996,062,828 pic.twitter.com/YrPZdrMObk— Arkham (@ArkhamIntel) August 22, 2024

This trend underscores Bitcoin’s undeniable dominance in the market, as traditional investors continue to favor BTC over ETH during times of uncertainty and volatility.

BTC Technical Levels To Watch

Bitcoin’s price is currently at $61,280 at the time of writing. It has been in a consolidation phase since August 8, oscillating between the local resistance at $62,729 and the local support at $56,138 in the 4-hour timeframe. This period of sideways trading has kept the market in suspense as investors watch closely for the next significant move.

For a bullish confirmation, BTC needs to break above the $63,000 level and close above the daily 200 Moving Average (MA), a crucial indicator that typically acts as support during bull markets and as resistance in periods of deep corrections. The daily 200 MA has been a critical level for determining the overall trend, and reclaiming it would signal a potential continuation of the bull market.

While Bitcoin’s current dominance in the market is evident, it’s important to note that this dominance may not last forever. The market remains dynamic, and shifts in sentiment or broader market conditions could alter the landscape at any time.