Bitcoin is currently experiencing volatile and uncertain price action, with the latest 10% correction raising concerns among investors. While this decline is smaller than the 30% retracements seen in recent months, it is causing significantly more damage to market sentiment as investors grow increasingly weary of the ongoing market dynamics.

The general mood is shifting, with many feeling the strain of this prolonged uncertainty. Prominent investors and analysts are expressing that BTC is now at a crucial level. Data from CryptoQuant’s head of research, Julio Moreno, suggests that if the price drops below $56,000, it could trigger a deeper correction, potentially leading to a more prolonged bearish phase.

This sentiment has fueled caution among market participants, who are closely watching the next moves in Bitcoin’s price to gauge whether this support level will hold or give way to further declines, which could exacerbate the current market strain.

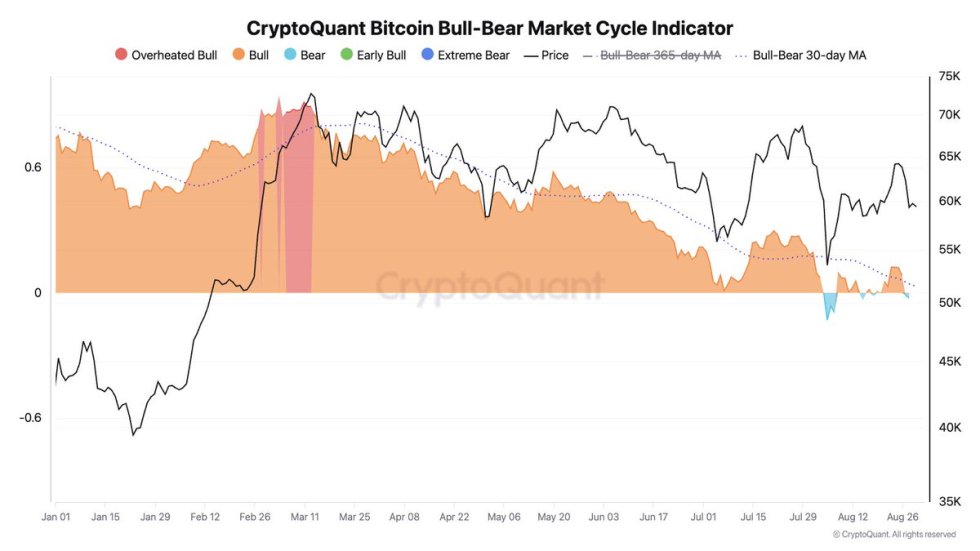

Bitcoin Market Cycle Indicator In Bear Phase

CryptoQuant’s head of research recently shared a detailed Bitcoin chart on X, highlighting a concerning trend: the BTC market cycle indicator has once again shifted into the Bear phase. This indicator is essential for traders and investors as it defines the market’s overall strength and direction, offering insights into potential price movements based on historical price action. According to the analysis, Moreno points out that $56,000 is a critical support level that the price must maintain to avoid a deeper and more damaging correction.

The current market conditions are increasingly confusing and risky, with investors struggling to keep pace with the rapidly shifting dynamics of Bitcoin’s price. The recent volatility, coupled with this critical support level, has led to heightened uncertainty among market participants. The unpredictable environment makes it challenging for traders to decide on their next moves, adding to the overall market volatility.

If Bitcoin fails to hold the $56,000 level, the possibility of a more significant downturn becomes increasingly likely. This potential drop would further strain investors already grappling with the turbulent price action seen in recent weeks.

As the market continues to navigate these uncertain waters, Bitcoin’s ability to hold this crucial level will be a key focus for both analysts and investors. The outcome at this level could determine the next major move for Bitcoin, either stabilizing the market or leading to a deeper correction that could extend the current bear phase.

BTC Price Action

Bitcoin is currently trading at $58,467, following a sharp 10% decline from its local high of $65,103. This drop has positioned BTC below the 4-hour 200 exponential moving average (EMA), which stands at $60,895. For bulls to regain control and push the price higher, it’s crucial for Bitcoin to break past and retake this EMA level. Failure to do so could signal continued weakness and further declines.

On the downside, the $56,138 level is a critical support that must be defended. Losing this level could trigger a capitulation event, not just for Bitcoin but for the entire cryptocurrency market. Such a move would likely lead to panic selling and a deeper correction across the board. Given the current market dynamics, investors are closely monitoring these key levels as they can define the next phase of Bitcoin’s price action.

Cover image from Dall-E, Charts from Tradingview.