Quick Take

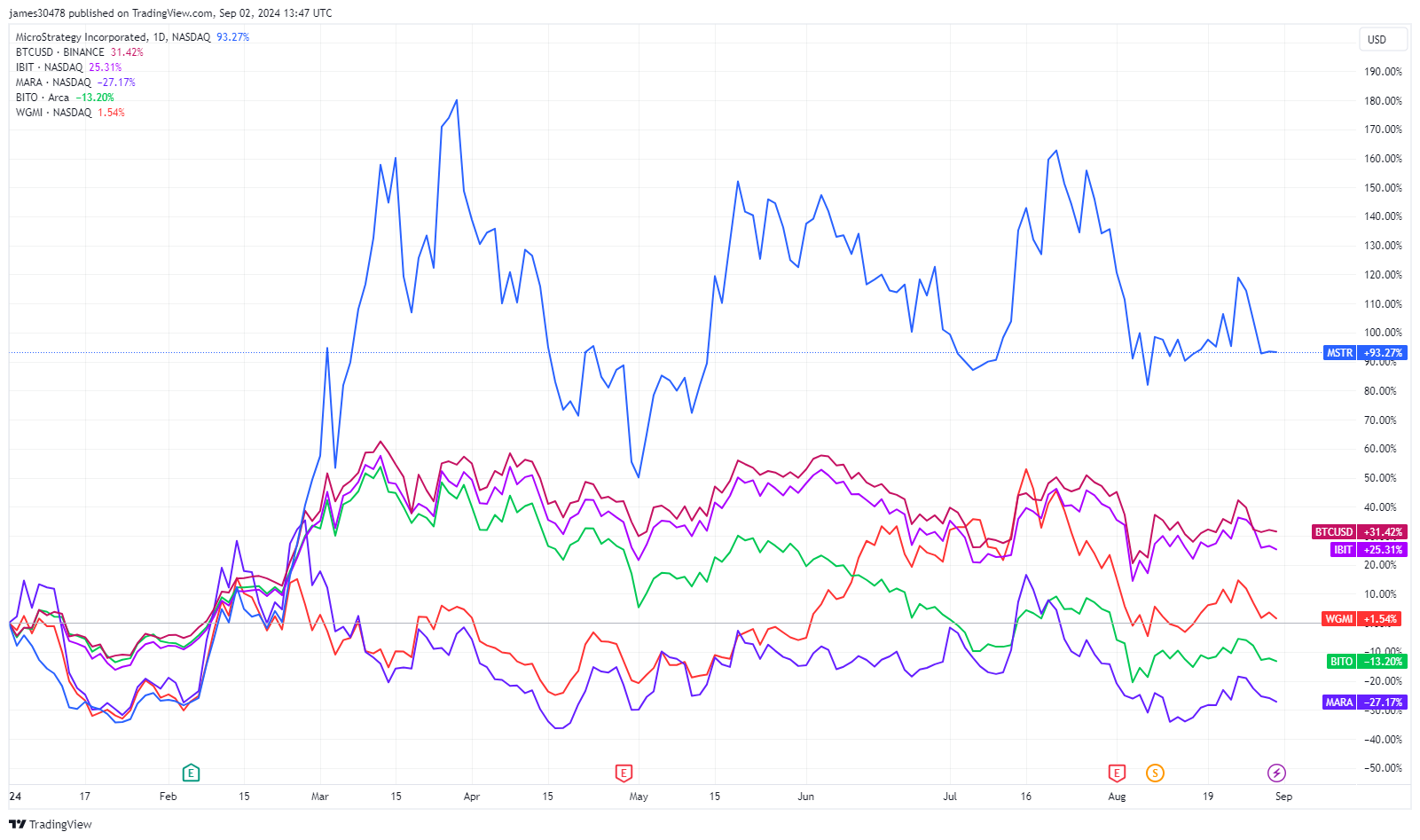

Year-to-date, MicroStrategy (MSTR) has been the best-performing Bitcoin-related equity, boasting a remarkable 93% return. In contrast, Bitcoin itself has returned 31%, ahead of US equities and gold. BlackRock’s IBIT has also shown strong performance with a 25% return. However, the broader Bitcoin equity landscape is mixed. The WGMI ETF saw a modest 1% increase, while BITO, which invests in Bitcoin futures, is down 13% YTD and 20% since its inception.

The mining sector, in particular, has faced significant challenges due to the Bitcoin halving, leading to some miners declaring bankruptcy. Marathon Digital Holdings (MARA), the largest miner by Bitcoin HODL, has dropped 27% YTD. Despite the struggles, there have been bright spots, such as some miners pivoting into AI, with Core Scientific striking notable deals in AI and high-performance computing with companies like CoreWeave.

The post MicroStrategy tops Bitcoin-related equities in 2024 appeared first on CryptoSlate.