Polymarket is a prediction market that enables users to speculate on various events by trading on their outcomes. It has positioned itself as one of the most successful DeFi products this year, capitalizing on the ever-growing demand for real-world applications of decentralized platforms.

Polymarket users can trade on predictions about anything from political elections to financial markets or even more niche topics. The platform operates on the principle that market prices reflect the collective knowledge and sentiment of its users, with the outcome of each market determined through a decentralized and transparent process.

The platform supports two types of markets — CFT and negative risk (NegRisk) markets. Both serve different purposes and cater to distinct types of events or outcomes. CTF markets are based on the Conditional Tokens Framework, which allows users to create and trade tokens representing the outcome of specific events. For example, in a CTF market predicting the outcome of a political election, users can buy or sell tokens that represent the likelihood of a particular candidate winning. These tokens gain or lose value as the perceived probability of the outcome changes, and once the event concludes, the tokens are settled based on the actual result.

On the other hand, NegRisk markets are designed for scenarios where users can hedge against specific risks by betting on the occurrence or non-occurrence of an event. For instance, a user might participate in a NegRisk market to hedge against the risk of a financial downturn by betting on an economic indicator declining. If the indicator falls, the user profits, effectively offsetting losses elsewhere. The key difference between these markets is their focus: CTF markets generally predict outcomes with varying probabilities, while NegRisk markets are more about managing or hedging against specific risks.

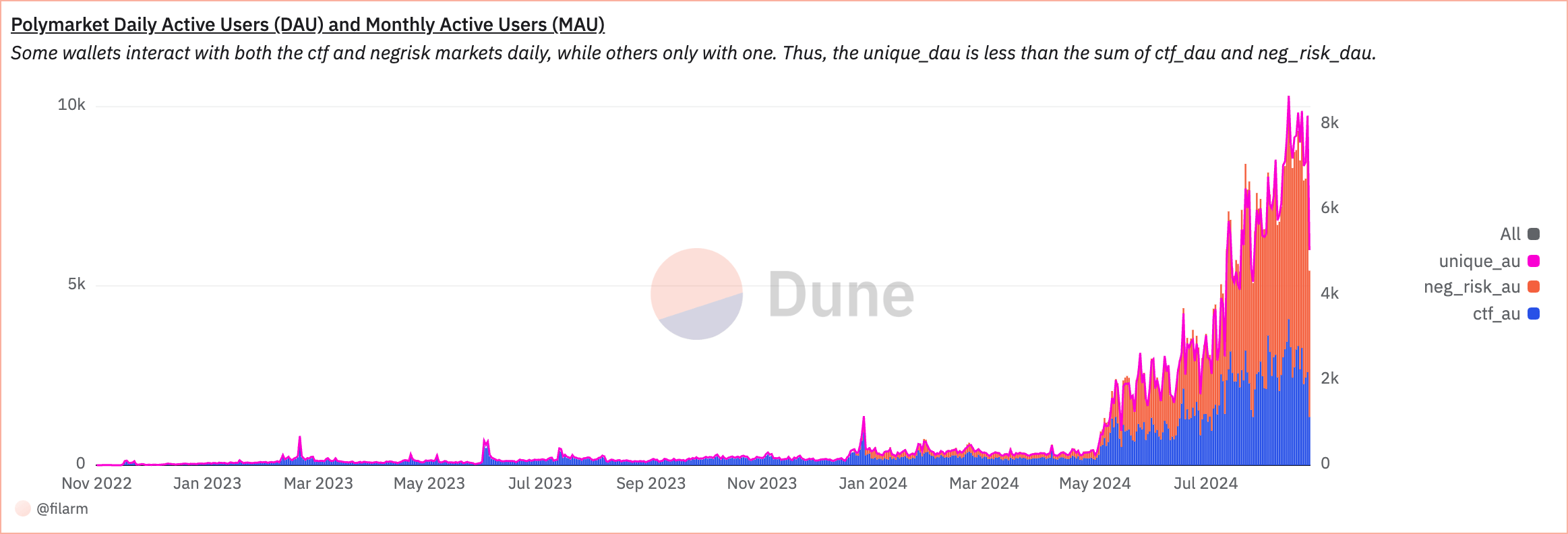

Polymarket’s unique active users peaked on Aug. 23, with over 8,600 users interacting with the platform that day. It represents a significant increase in user engagement, as the platform saw a consistent range of 7,000 to 8,000 unique active users daily throughout August. This surge in activity contrasts sharply with the first half of the year when the platform had only around 150 unique active users daily for most of May. The spike in user numbers illustrates a growing interest and participation in the platform, most likely driven by the hype surrounding the upcoming US presidential elections.

The distinction between wallets interacting with the Conditional Tokens Framework (CTF) and NegRisk markets is crucial in understanding user activity. Since some wallets engage with both market types daily, the total number of unique daily active users is less than the combined daily active users from the CTF and NegRisk markets.

Among these, NegRisk daily active users form the majority, with between 5,000 and 6,000 users engaging with NegRisk markets daily since the beginning of August. It suggests that the NegRisk markets are particularly appealing to users, perhaps due to the nature of the events they cover or the perceived risk/reward profile of these markets.

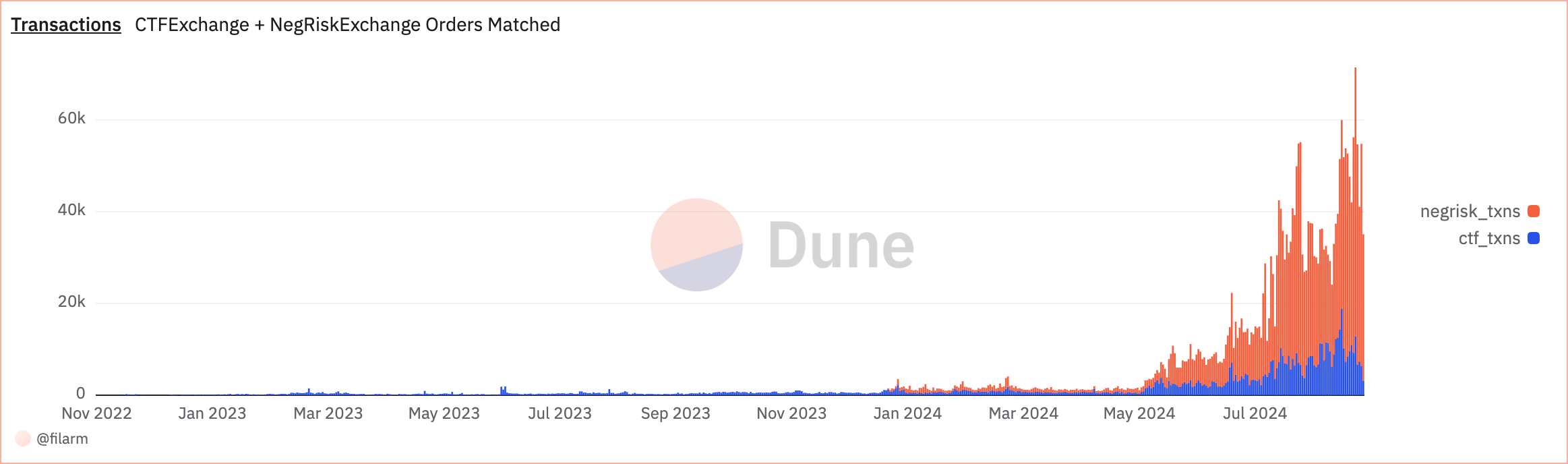

In terms of transaction activity, NegRisk transactions also dominate the platform. On Aug. 30, the platform peaked at over 58,000 transactions within NegRisk markets, compared to 12,700 transactions in CTF markets. This disparity highlights the popularity and activity levels within NegRisk markets.

However, it is also notable that the total number of transactions across the platform decreased by almost half in the first few days of September from the highs seen in August. Despite this decline, Polymarket still processes around 35,000 transactions daily, indicating sustained user engagement even as overall activity levels normalize.

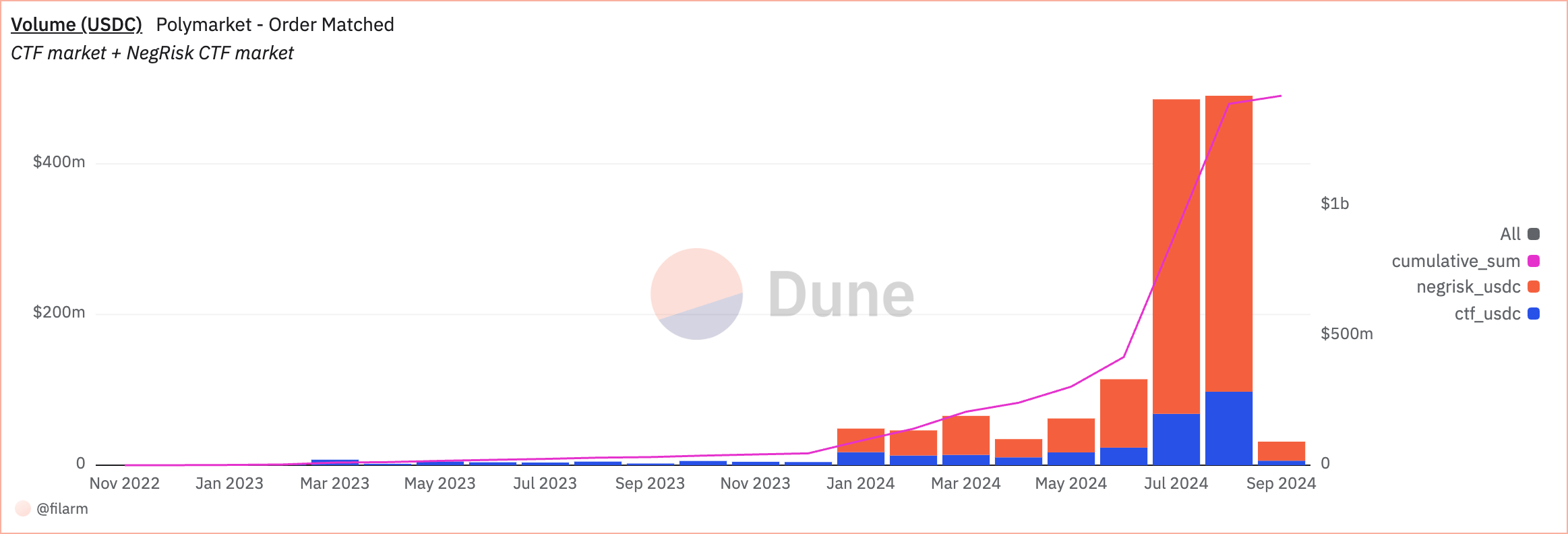

The volume shows that Polymarket has processed a cumulative total of $1.424 billion. On Aug. 1 alone, the platform recorded a total volume of $490.331 million, with a significant $392.762 million coming from NegRisk markets. The high volume in NegRisk markets shows their importance within Polymarket, possibly reflecting the larger stakes or higher frequency of bets placed within these markets.

The average bet amounts provide further insight into user behavior on the platform. The overall average bet amount in CTF markets across all users was 146 USDC, while in NegRisk markets, the average bet amount was notably higher at 301.49 USDC. The difference in average bet sizes between the two market types could suggest that users perceive NegRisk markets as either more lucrative or require larger bets to secure meaningful positions.

The correlation coefficient between the average amount bet in CTF markets and the average amount bet in NegRisk markets is 0.18, indicating a weak positive relationship between the bet sizes across the two types of markets. This low correlation suggests that the factors driving user behavior in these markets might differ, with users potentially adjusting their bet sizes based on the specific characteristics or risks of each market.

The post Polymarket processes $1.4B as NegRisk outshines CTF markets appeared first on CryptoSlate.