Quick Take

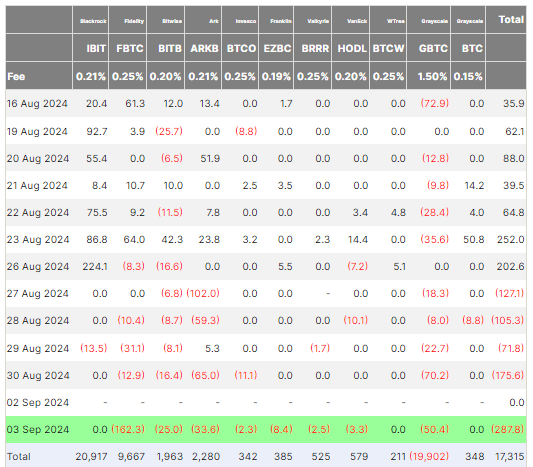

Farside data shows that Bitcoin ETFs experienced a significant outflow of $287.8 million on Sept. 3, marking the largest outflow since May 1, when $563.7 million exited the market.

Eight ETF issuers recorded outflows, highlighting a broad retreat from Bitcoin ETF investments. Among the hardest hit was Fidelity’s FBTC, which saw a $162.3 million outflow, and Grayscale’s GBTC, with $50.4 million leaving the fund. Bitwise’s BITB ETF lost $25.0 million, while ARK’s ARKB ETF experienced a $33.6 million outflow.

Notably, BlackRock’s IBIT ETF saw neither inflows nor outflows. Over the last five trading days, Bitcoin ETFs have experienced a cumulative outflow of $767.6 million, equivalent to around 4% of total net flows, now at $17.3 billion.

Ethereum ETFs also faced outflows, amounting to $47.4 million. Grayscale’s ETHE fund saw an outflow of $52.3 million, though this was slightly offset by Fidelity’s FETH ETF, which recorded a $4.9 million inflow. Overall, total outflows for Ethereum ETFs have now reached $524.8 million, according to Farside data.

Bitcoin is down 4% in the past five days, trading around $56,500.

The post Bitcoin ETFs see $287.8 million outflow, largest since May 1 appeared first on CryptoSlate.