Onchain Highlights

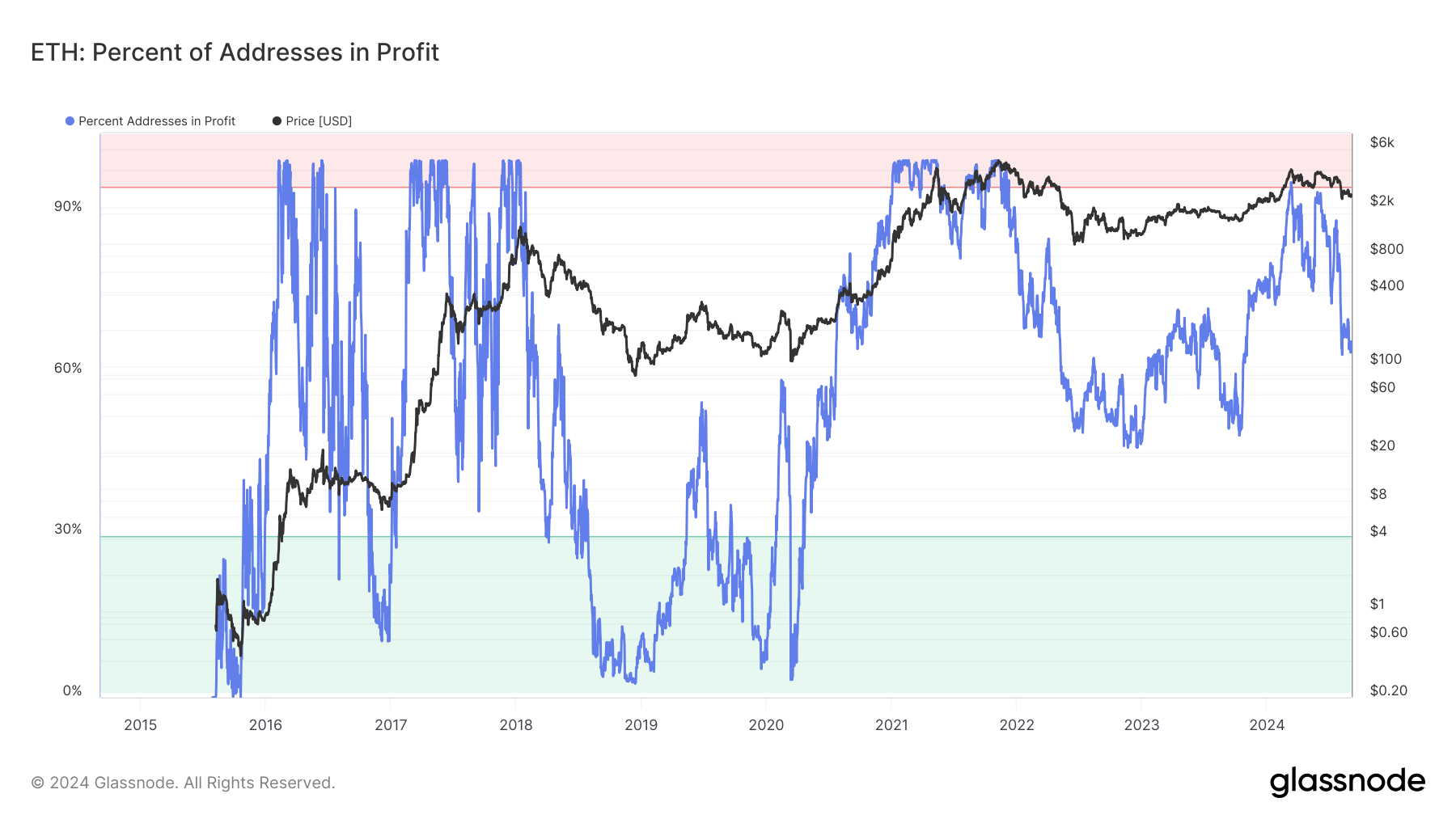

DEFINITION:The percentage of unique addresses whose funds have an average buy price that is lower than the current price. “Buy price” is here defined as the price at the time coins were transferred into an address.

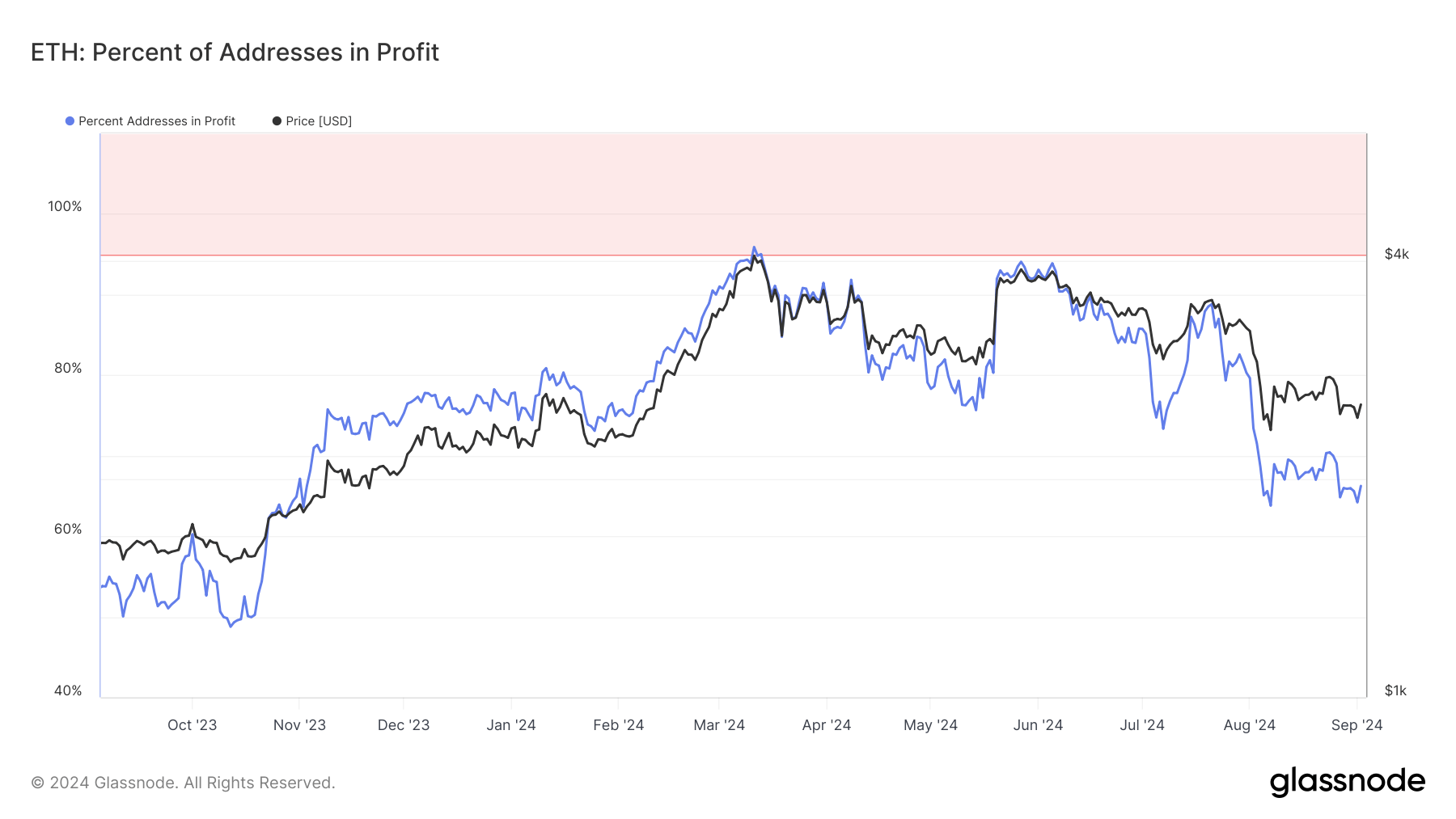

Ethereum addresses in profit have seen a notable decline in 2024. The percentage of addresses in profit has fallen to 65% as of Sept. 3 after reaching a peak near 90% in March. This decline is evident from the broader context of Ethereum’s price, which has also retraced from its earlier highs this year.

Historical data reflects a similar pattern during market downturns. In late 2018, Ethereum’s percentage of profitable addresses plunged below 10% as the asset’s price fell sharply, marking one of its most significant drops. A similar trend occurred in early 2020 when profitability dipped to nearly 0% during the broader market correction.

The current trend suggests Ethereum’s profitability is mirroring past bear markets, where a decrease in profitable addresses preceded extended periods of lower prices. As Ethereum’s price remains under pressure, the percentage of addresses in profit may continue to decline, potentially revisiting levels seen in previous market cycles, indicating cautious market sentiment.

The post Ethereum address profitability declines as bearish trend continues appeared first on CryptoSlate.