The Ethereum layer-1 network has taken a massive hit, with revenue plummeting by 99% since March 2024. This drastic change comes on the heels of the Dencun upgrade, which significantly altered the fee structure for transactions.

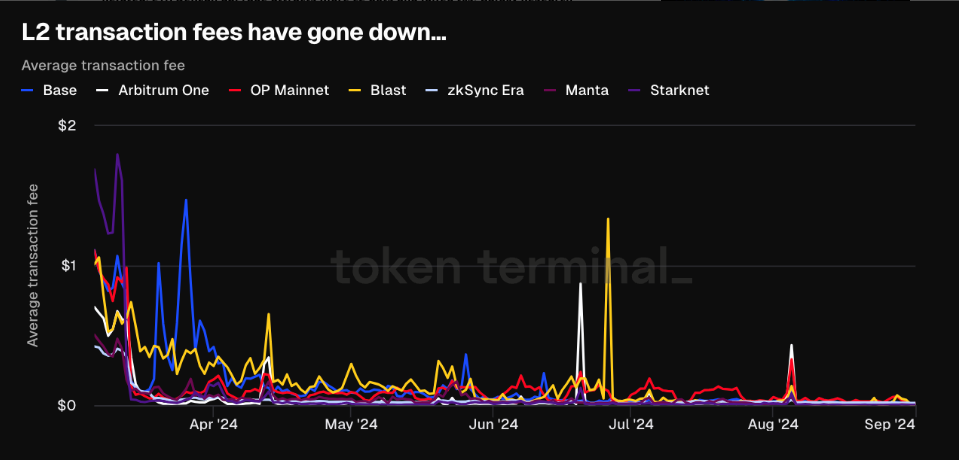

While layer-1 revenue has tanked, layer-2 solutions are thriving, attracting more users and offering lower fees, data from Token Terminal shows. This situation has sparked a mix of concerns and optimism within the Ethereum community.

Ripple Effect Of Dencun Upgrade

The Dencun upgrade went online on March 13, further optimizing the efficiency of layer-2 transactions. Just days before, Ethereum’s layer-1 revenue topped out above $35 million. However, once that upgrade took hold, fees began to sharply decline to finally land at close to $600,000 by the end of August.

A change of this sort underlines visibly altered behavior as to how users interact with the Ethereum ecosystem. Transactions have become much cheaper with the introduction of “blobs” that make it possible for layer-2 solutions to process transactions with much less reliance on the layer-1 network for data availability.

That has caused Ethereum’s base layer revenue to fall off a cliff. While that sounds terrifying, it also means the layer-2 solutions are taking off. The number of different active layer-2 projects has also increased-a total of 74 solutions now fight for space. In turn, there is a race to the bottom of the transaction fee prices, and the users win because they save money on the faster transactions.

Shifting Perspectives On Fees

Despite the revenue crash, some Ethereum validators argue that the focus on fees is misplaced. According to Ryan Berckmans, a prominent validator, the success of layer-2 solutions has made Ethereum’s base layer more approachable for larger entities. He said:

“Fees are a result of Ethereum being useful, not the goal in itself.”

However, the community is divided on the issue. Some point to one potential long-term consequence of falling revenues on the health of the network and the tokenomics. The reduced burn rate of ETH tokens has flipped the previously deflationary supply into an inflationary one.

That said, this development does raise some questions over the future value of ETH and whether changes in blob fees may be required to rebalance it.

Institutional Adoption and Future Growth

Amongst all these changes, the interest in Ethereum amongst institutions is growing. The fact that companies like Coinbase and Circle, and financial players like BlackRock, are supporting the network-developing infrastructure to indicate that adoption will be more permanent.

Hate to break it to the #Ethereum doubters, but $ETH is well on its way to securing solid institutional adoption, led by industry giants like Coinbase, Circle, BlackRock, and more recently, Sony. And it looks like Toyota and Robinhood might be jumping on board soon too.

Anon is… pic.twitter.com/2QdaC7sVJx

— AdrianoFeria.eth

(@AdrianoFeria) September 3, 2024

According to Ethereum believer Adriano Feria, this institutional support is key to what the future holds for Ethereum. He has said that while speculation may bring temporary interest to a project, actual progress is from the established players coming into the space.

Feria also believes that Layer-2 scaling solutions are not a fad but rather unlock new possibilities and enhance the user experience. Giant players, such as Coinbase’s Base, along with Arbitrum, have tapped into the leading liquidity of Ethereum to prove that Layer-2 scaling solutions can live alongside the base layer and thrive on it.

The rising use of layer-2 solutions is, to some extent, a big hit to Ethereum’s revenue on layer-1. It’s a whole new chapter for the network, especially with the reshaping the recent Dencun upgrade has brought about–cheaper and more reachable transactions. The looming institutional interest and influx of users already churning out huge volume on these layer-2 solutions might be just about the time Ethereum starts its evolution.

Featured image from PixelPlex, chart from TradingView