Former BitMEX CEO Arthur Hayes thinks the upcoming interest rate cuts by the US Federal Reserve (Fed) could ignite a short-term crypto market crash.

Fed Is Doing A Colossal Mistake, Hayes Says

Delivering a presentation titled ‘Thoughts on Macroeconomic Current Events’, at the Token2049 event in Singapore on September 18, Hayes indicated he is not too excited about the Fed’s decision to slash interest rates. Hayes said:

I think the Fed is making a colossal mistake cutting rates at a time when the US government is printing and spending as much money as they ever have at peace time. While I think a lot of people are looking forward to a rate cut, meaning that they think the stock market and other things are going to pump up the jam, I think the markets are going to collapse a few days after the Fed’s rates.

While delivering the presentation, the serial digital assets entrepreneur pointed to a chart showing that almost 50% of the central banks in the world today are in rate-cutting mode. Hayes opined that the Fed may cut rates by 50 or 75 basis points (bps), which might narrow the interest rate differential between the US dollar (USD) and the Japanese yen (JPY) and culminate in a wider market drawdown. He noted:

We saw what happened a few weeks ago when the yen went from 162 to about 142, over about 14 days of trading that caused almost a mini financial collapse,” the former BitMEX exec said, adding: “We’re going to see a revisit of that financial stress.

To add merit to his prediction, Hayes juxtaposed investing in digital currencies with holding 5%-yielding Treasury Bills (T-bills). He said that investors would much rather put their money into government-backed T-bills during market turmoil than riskier decentralized finance (DeFi) applications. Hayes stressed that income yields in many crypto assets are ‘either slightly above or below the rate of T-bills’.

However, Hayes was not entirely dismissive of holding cryptocurrencies in a declining interest rate environment. He analyzed returns generated by four cryptocurrencies, namely Ethereum (ETH), Ethena (ENA), Pendle (PENDLE), and Ondo (ONDO). Hayes emphasized that he has significant holdings in three cryptocurrencies except ONDO.

Hayes Confident In Ethereum Despite Weak Performance

Hayes said the existing high interest rate environment is having a severe impact on financial markets around the world, including crypto markets. Taking the example of Ethereum, Hayes said its staking yields of 3-4% are not attractive enough for investors to ignore T-bills yielding 5.5% without any risk whatsoever.

Hayes went as far as calling Ethereum an ‘internet bond’, which isn’t too surprising since throughout 2024 ETH has consistently underperformed against most other major cryptocurrencies like Bitcoin (BTC), Solana (SOL), Binance Coin (BNB), and others.

However, Hayes added that with a rapid fall in interest rates, the prospects of an Ethereum bull market would increase. However, the attractiveness of digital assets will depend a lot on T-bills yields falling at an even greater pace. Hayes added that despite the headwinds faced by Ethereum, he still invests in it.

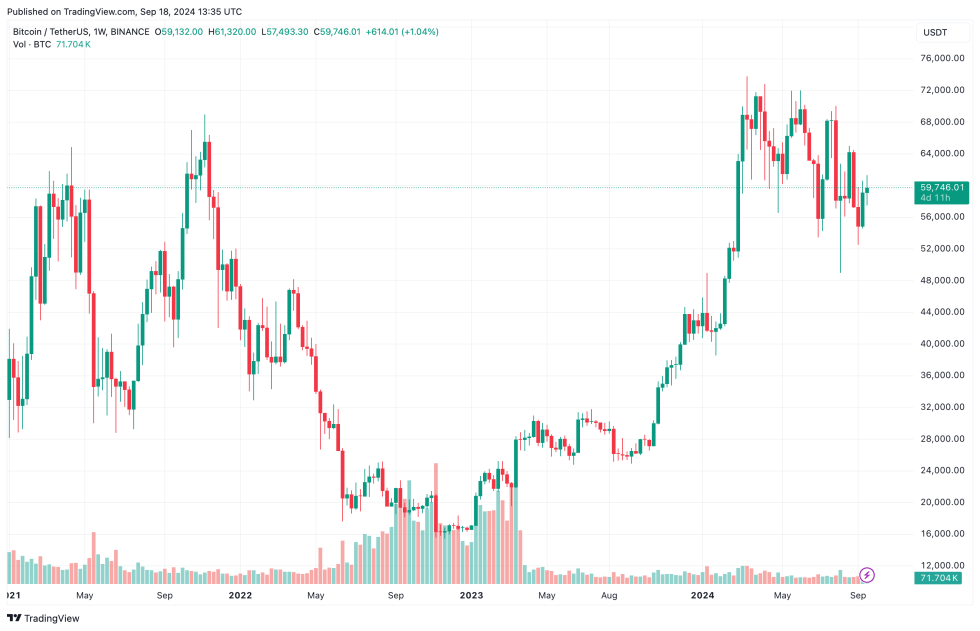

Hayes isn’t the only crypto enthusiast with skepticism toward interest rate cuts. Another crypto market expert recently asserted that the Fed’s decision to cut rates could lead to market sell-offs and corrections. Bitcoin trades at $59,746 at press time, up 1.2% in the last 24 hours.