The crypto industry in the US may see more support under Kamala Harris’ leadership compared to the current Joe Biden administration.

Harris More Supportive Than Biden, Trump ‘Undoubtedly’ More Favorable

Alex Thorn, Head of Research at Galaxy Research, recently shared a detailed policy scorecard on X, juxtaposing the Biden administration’s crypto and blockchain policy stances, the potential Kamala Harris-Tim Walz administration, and the Donald Trump-JD Vance administration.

Thorn noted that while a Trump victory would undoubtedly be more favorable for the broader crypto industry, a Harris win could still offer better support than the current Biden regime. He described the downside risk of a Harris presidency as ‘limited.’

For instance, regarding classifying digital assets as securities, the Biden administration has maintained an ambiguous regulatory stance, leaving the U.S. Securities and Exchange Commission (SEC) to handle issues case by case.

In contrast, the Harris/Walz administration is expected to be ‘slightly positive,’ based on Harris’ recent statements supporting innovative technologies like AI and digital assets. On the other hand, Trump has pledged to fire SEC Chair Gary Gensler and appoint a more pro-crypto replacement.

Another parameter is the difference in stance toward Bitcoin (BTC) mining. While the Biden administration has proposed a 30% tax on mining, Harris is expected to be ‘slightly better’ than Biden due to her connections in Silicon Valley.

Notably, Trump highly supports Bitcoin mining, viewing it as domestic manufacturing and pledging that Bitcoin will be “made in America.”

While neither the Biden nor Harris administrations are expected to take a covert stance against crypto self-custody, the US Treasury under Biden has attempted to label non-custodial wallet providers as money transmitters. In contrast, Trump has explicitly vowed to protect self-custody rights, as highlighted in a speech in Nashville in July 2024.

The Biden administration has shown interest in formalizing rules regarding stablecoins regulation, proposing that banks hold exclusive authority to issue stablecoins.

Harris is likely to follow Maxine Waters’ approach, advocating for stablecoins to be backed by safe reserves like short-term T-bills, with the Federal Reserve and big banks playing a role in issuance. Trump, however, favors allowing non-bank entities to issue stablecoins.

Harris Leaving No Stones Unturned To Woo Crypto Voters

Although the consensus seems that a Trump victory would vastly benefit digital asset prices and the broader industry, Harris has tried to attract crypto voters.

She recently shared her economic proposal, promising to support crypto regulation and digital assets. Additionally, Harris has received $1 million worth of XRP in political donations from Ripple co-founder Chris Larsen.

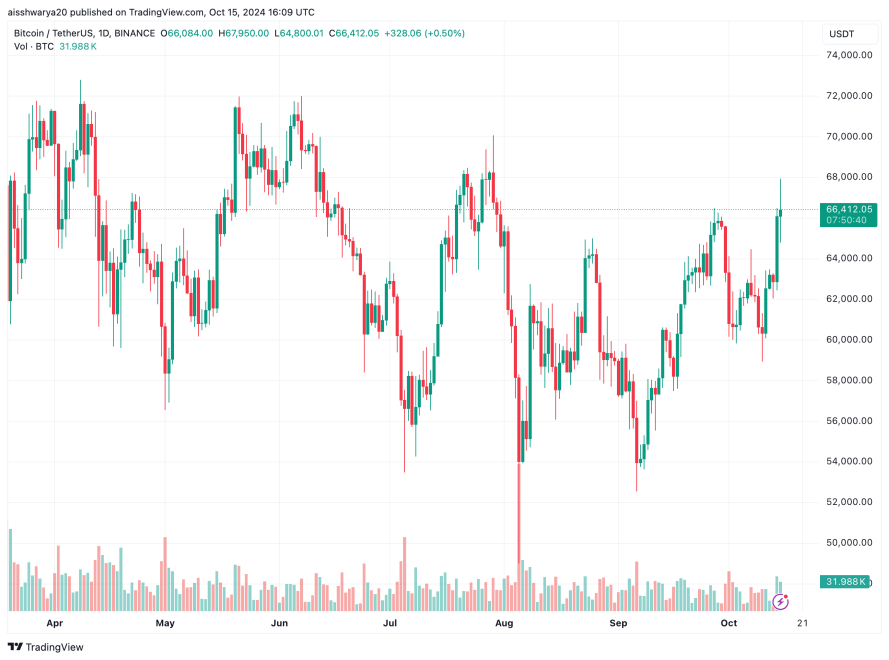

Echoing Thorn’s analysis, trading firm QCP Capital stated that a Harris victory may not be as bearish for crypto investors as some may think. BTC trades at $66,412 at press time, up 0.8% in the past 24 hours.