After the first sales day, the Trump-backed World Liberty Financial (WLFI) contract wallet at 0x5be9a495 holds assets totaling $11,589,118. Most of these assets are in Ethereum (ETH), accounting for 71.72% of the portfolio and valued at over $8.3 million. Other holdings include Tether USD (USDT) and USDC, making up 20.60% and 7.20% of the portfolio, respectively.

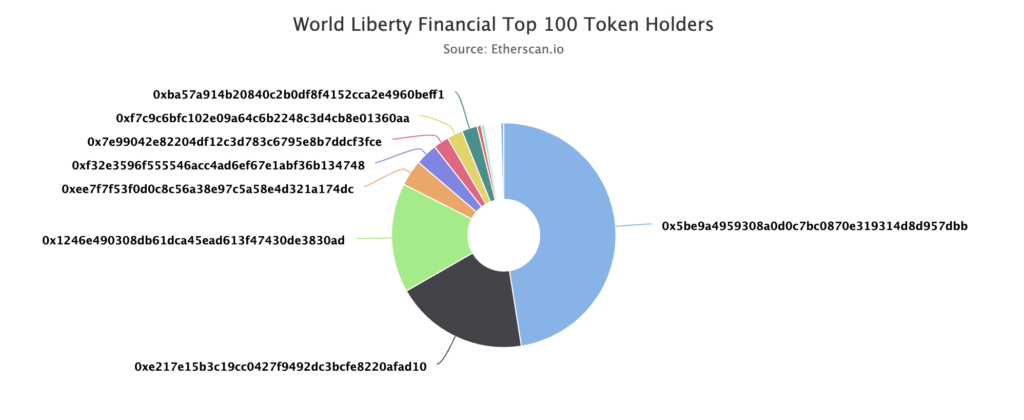

The top 100 token holders own 99.56% of the total supply. The token has a maximum supply of 100 billion WLFI, with 8,755 holders accounting for 23.292%. The top holder is a project gnosis safe contract wallet, holding 47.5% of the tokens. Another significant portion, 19.2382%, is held in a distribution wallet at address 0xe217E.

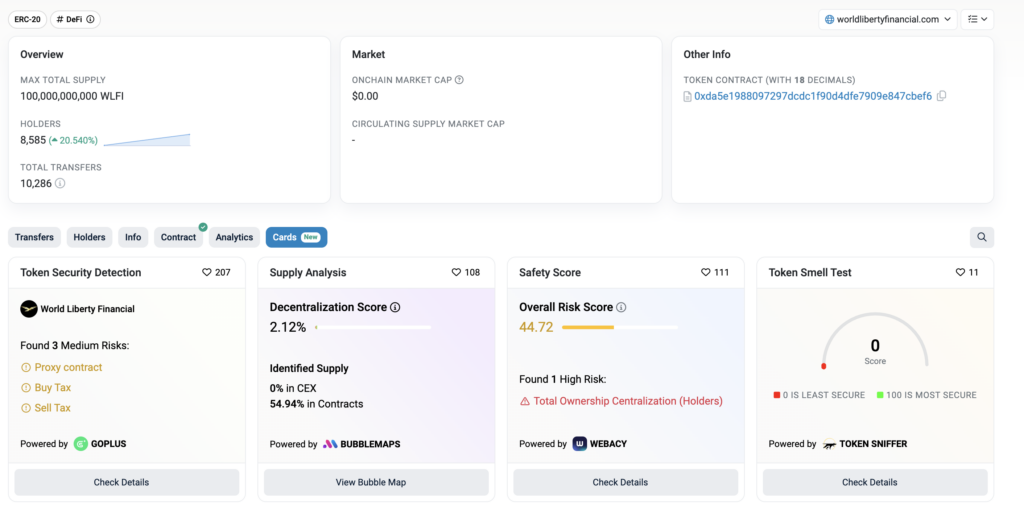

According to Etherscan, the token’s decentralization score currently stands at 2.12%, indicating an unsurprisingly high level of ownership concentration for a new token. Based on this data, safety assessments reveal an overall risk score of 44.72, highlighting possible concerns about total ownership centralization among holders. No tokens are identified in centralized exchanges, and 54.94% are held in contracts.

If this concentration of token ownership among a small number of wallets does not improve, it may have implications for governance, as the ability to sell tokens is tied to a future governance vote.

The project aims to raise $300 million through token sales. After day one, it is 3.8% of the way to this goal.

The post Trump’s World Liberty Finance attracts $11.5 million inflow across 8,500 holders appeared first on CryptoSlate.