It is the election season in the United States, and Bitcoin and the broad cryptocurrency industry have never been more involved in the political landscape. From the openly friendly stance of former President Donald Trump to the relatively reserved position of Vice President Kamala Harris, there has been quite some drama in the interplay between the crypto market and United States politics.

There have been numerous discussions concerning the outcome of the elections and its potential impact on the crypto landscape. QCP Capital, a prominent trading firm, is amongst the latest to weigh in on the results of the polls and the effect on crypto, especially Bitcoin.

QCP Thinks Bitcoin Price Will Drop Following Election Result — Here’s Why

In a November 2 report, QCP Capital revealed that it expects the US elections to be another “sell-the-news” action irrespective of the outcome. Like the Nashville Bitcoin conference, the trading firm expects many investors to close their BTC positions following the election on Tuesday, November 5.

According to QCP, there has been a sustained level of short-term implied volatility above 72 vols for both Bitcoin and Ethereum in the upcoming elections. As the name suggests, short-term implied volatility tracks the market’s expectations of price movements in the near future.

With this metric as high as 72 vols at the moment, there is a sense that investors are anticipating major price swings in the Bitcoin and Ethereum markets following the elections. However, an increase in put skews that most traders foresee downward price movements.

QCP highlighted that the rise in put skews suggests that traders are taking “downside protection,” with the expectation of a market correction. Ultimately, this aligns with the “sell-the-news” projection, mirroring the aftermath of the Nashville Bitcoin conference.

After almost reaching its all-time high price in the previous week, BTC has experienced a notable pullback below $70,000. As of this writing, the premier cryptocurrency stands at around $68,150, reflecting a 2.2% decline in the past 24 hours.

Binance Traders Go Long On BTC Futures

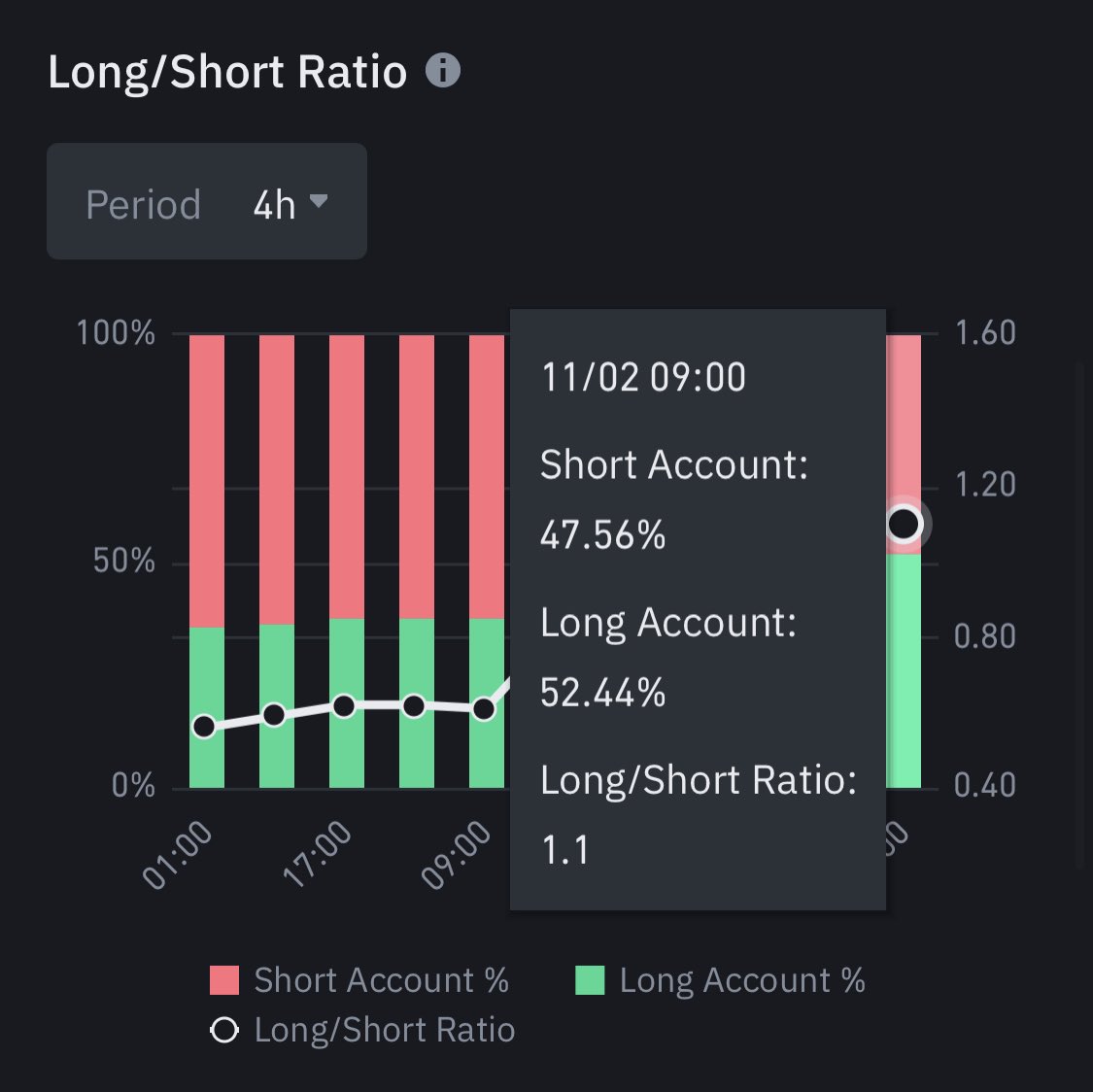

In a recent post on X, Ali Martinez revealed Bitcoin futures traders on Binance have begun to close their short position. According to the on-chain analyst, 52.44% of the Binance futures traders have now gone long on the flagship cryptocurrency.

A surge in long positions suggests that more investors are backing the Bitcoin price to rise in the near future. Hence, this latest observation signals a significant shift in sentiment, with the market seemingly leaning towards a more bullish outlook a few days before the US elections.

It is worth mentioning that this change in Binance traders’ positions may be a reaction to the recent dips in Bitcoin price. It is possible that investors are “buying the dip,” viewing the current price as the perfect entry point.