The US dollar has surged as Donald Trump secured a return to the White House – but there are fears the British and world economies will suffer from the president-elect’s promises of new tariffs.

Investors have returned to making “Trump trades” – when they bet on lower taxes and higher interest rates – on the belief he will increase tariffs on foreign imports to protect domestic industries.

This will push up prices of imported goods and inflation – and increase borrowing and government debt in the US.

A leading British thinktank said the UK’s already slow economic growth rate is likely to be more than halved if Mr Trump imposes sweeping import tariffs.

US election latest – world congratulates Trump

The National Institute Of Economic And Social Research said growth in the British economy would reach 1.2% in 2025 without US tariffs – but would be just 0.4% if they are implemented as promised by the incoming president.

Firms will mostly pass import costs to customers, with tariffs likely to be particularly inflationary for US buyers.

Analysts also said the pledges by Mr Trump are a “threat” to global financial security.

Please use Chrome browser for a more accessible video player

Erik Nielsen, of banking group UniCredit, said: “Trump’s fiscal pledges are seriously troublesome – for the US economy and for global financial markets – as they promise to vastly expand an already excessive deficit at the same time as he threatens to undermine key institutions.

“One must conclude that Trump poses a serious – and so far vastly under-appreciated – threat to the US Treasury market and thereby to global financial stability.”

US Treasury yields – essentially the rate of interest the American government pays on its debt – have also risen with investors betting the US Federal Reserve will take a more cautious approach to cutting rates in the months ahead.

Be the first to get Breaking News

Install the Sky News app for free

Read more:

Donald Trump wins US election

Republicans gain control of Senate

America’s night of historic firsts

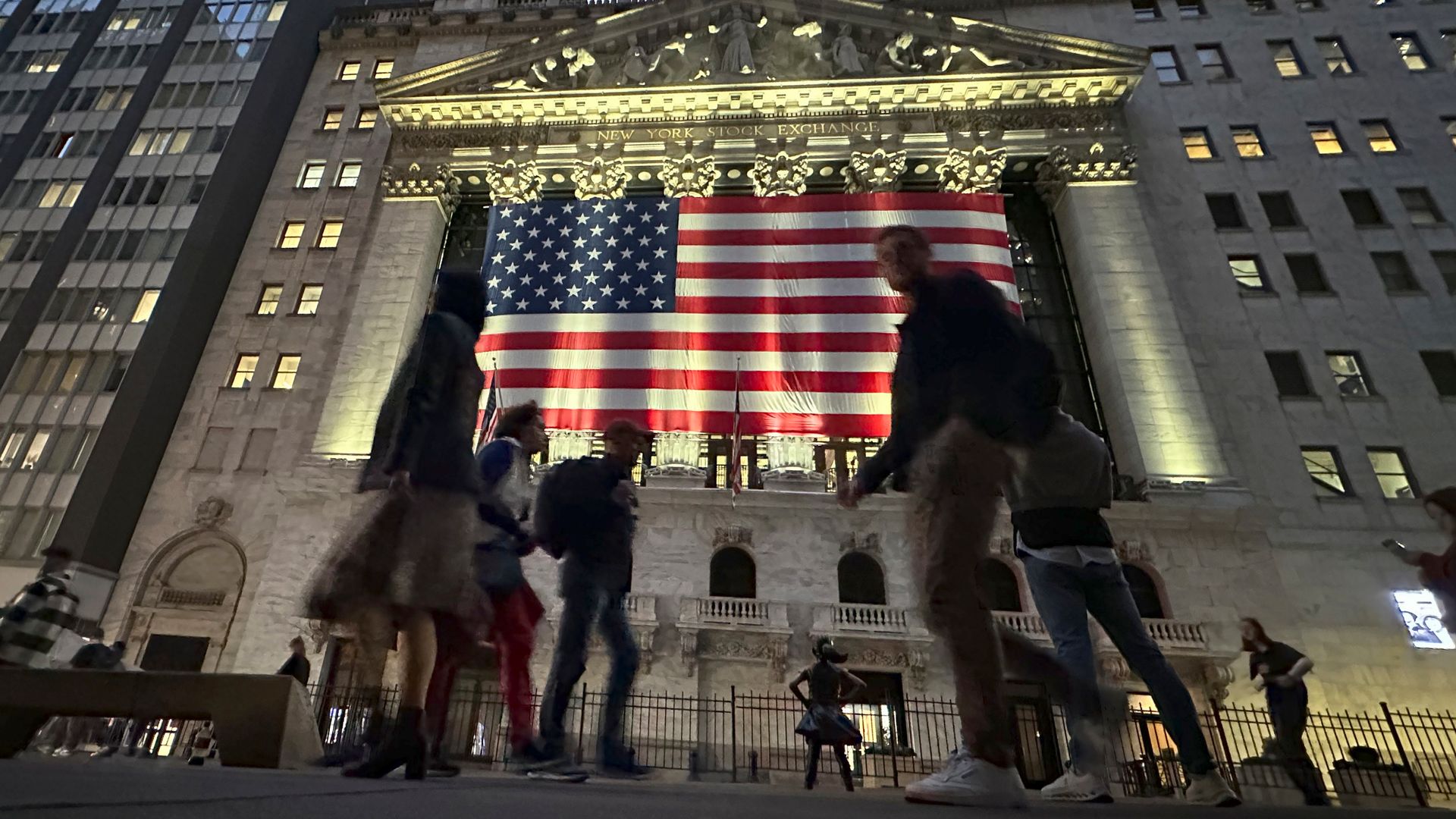

US stock markets are expected to be higher when they open on Wednesday – while in Asia, stocks on the Hang Seng were lower over fears Mr Trump could put 60% tariffs on Chinese goods.

Meanwhile, Bitcoin jumped nearly 8% to a record $75,345 as investors bet on a victory for Mr Trump.

The oil price has also eased to less than $75 a barrel over expectations a Trump administration will increase drilling and encourage more crude flows in the US.