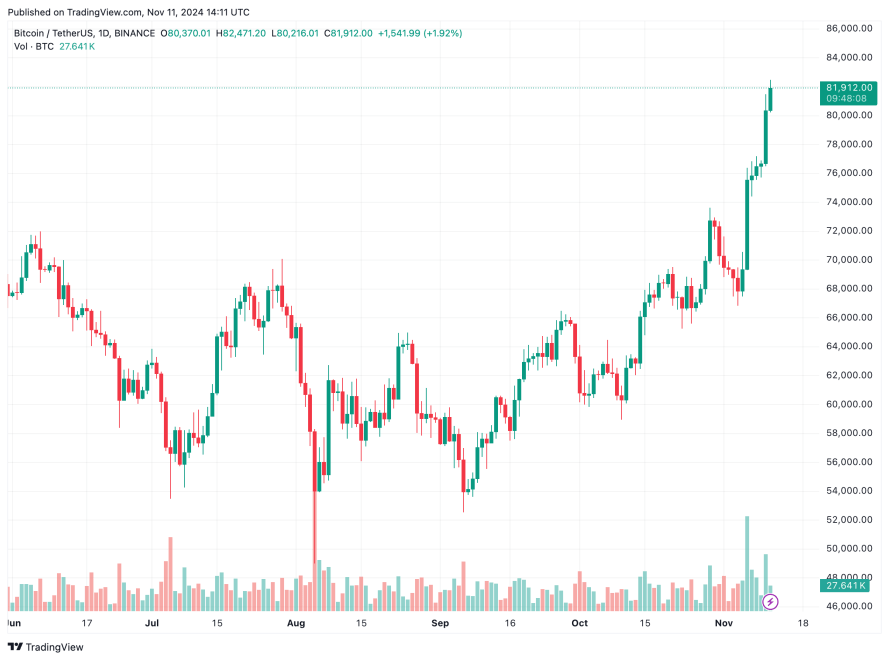

Bitcoin (BTC) has been on an all-time-high (ATH) run following the election victory of the Republican US presidential candidate Donald Trump.

Add Crypto Exposure At The Earliest, Bernstein Tells Clients

Despite Bitcoin’s strong gains after the election, analysts at trading firm Bernstein remain confident that the broader crypto market still has substantial room for growth.

In a client note published on November 11, analysts at trading firm Bernstein have urged clients to add digital assets exposure “as soon as possible.”

The digital assets team at Bernstein, led by Gautam Chhugani, endorsed the crypto market’s prospects, stating, “Don’t fight this. Welcome to the crypto bull market – buy everything you can.”

The timing of Bernstein’s bullish recommendation aligns with a 20% surge in the overall crypto market cap since Trump’s victory, from roughly $2.41 trillion to $2.92 trillion at the time of writing.

Alluding to Trump’s pro-crypto stance, Chhugani urged crypto-skeptic investors not to shy away from digital assets due to regulatory concerns. He encouraged clients to “invert their mental modal” in light of Trump’s resounding win.

To recall, Trump has repeatedly emphasized that he will dismiss the current US Securities and Exchange Commission (SEC) chair Gary Gensler soon after he assumes the US president’s office.

For the uninitiated, Gensler has been a controversial figure in the crypto industry due to the financial regulator’s perceived hostile approach toward the crypto industry.

Replacing Gensler with a pro-crypto SEC chair could open the door for more favorable regulations for crypto businesses in the US.

Reports suggest that Trump might nominate seasoned Wall Street lawyer Richard Farley as the new SEC chair, though this has yet to be confirmed.

It is worth noting that besides Trump, other Republican party leaders, including the new US Vice President JD Vance, RFK Jr., and Vivek Ramaswamy, have disclosed holding Bitcoin and promised support for the emerging industry under Trump’s administration.

No Reason To Not Hold Bitcoin Following Trump’s Win

In addition to Bernstein’s endorsement, Greg Cipolaro, head of research at New York Digital Investment Group said earlier today that there is no longer any risk to avoid holding BTC following Trump’s victory. Cipolaro remarked:

As Republicans assume control of the White House and Congress, the leadership of major government agencies such as the SEC, OCC, FDIC, and Treasury, are expected to shift toward a more pro-crypto stance. The new administration is likely to appoint leaders who view digital assets as an opportunity for economic growth and innovation, rather than primarily as regulatory challenges.

Recent trading patterns in crypto exchange-traded-funds (ETF) suggest that institutional investors might already be positioning themselves for a possible parabolic rally in digital assets, especially Bitcoin.

Asset manager BlackRock’s IBIT spot BTC ETF recently reported net assets of $33.2 billion, eclipsing the value of assets in the firm’s gold-based ETF, worth $32.9 billion.

In October, Bernstein predicted that $200,000 BTC by the end of next year might be a “conservative target.” VanEck CEO offered an even more ambitious forecast, suggesting that BTC could reach $300,000 by the end of April 2025.

Bitcoin price can also benefit from further adoption. In a recent filing with the US SEC, Tech juggernaut Microsoft revealed that it is currently assessing the option of investing in BTC.

BTC trades at $81,912 at press time, up 2.8% in the past 24 hours. On a similar note, BTC dominance sits at 59.36%.