CoinShares, a leading crypto asset management firm, released its latest “Digital Asset Fund Flows Weekly Report,” highlighting a notable surge in investment inflows following the US elections.

$116 Billion Record High Crypto Fund Flows

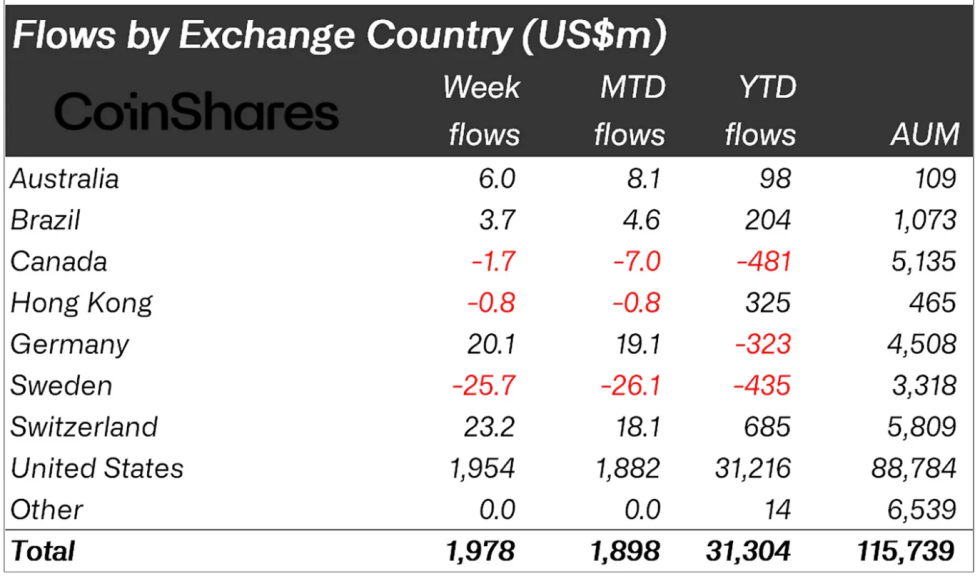

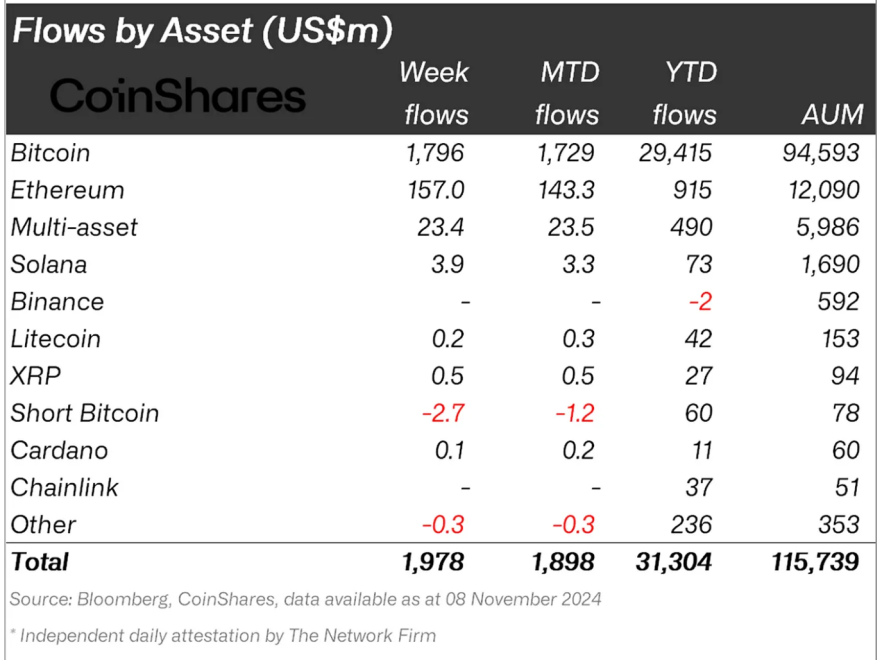

The report revealed that digital asset investment products attracted $1.98 billion in inflows, bringing global assets under management (AuM) to a record high of $116 billion. This marks the fifth consecutive week of inflows, pushing year-to-date figures to $31.3 billion.

The surge in inflows was primarily concentrated in the United States, which accounted for $1.95 billion of the total, driven by favorable macroeconomic conditions and political shifts, specifically the triumph of Donald Trump emerging as the 47th president of the United States.

Europe also saw moderate inflows, with Switzerland and Germany recording $23 million and $20 million, respectively. Notably, Bitcoin led the charge with $1.8 billion in inflows, supported by factors such as the US Federal Reserve’s decision to cut interest rates earlier this cycle.

James Butterfill, Head of Research at CoinShares, particularly attributed the strong investor sentiment to macroeconomic support and significant changes in the US political landscape. Butterfill wrote in the report:

A combination of a supportive macro environment and seismic shifts in the US political system being the likely reason for such supportive investor sentiment.

Ethereum And Altcoins See Renewed Investor Interest

The report also highlighted a marked improvement in sentiment for Ethereum. The leading altcoin saw inflows totaling $157 million, marking its largest weekly inflow since the Ethereum-based exchange-traded funds (ETFs) launch in July 2024.

This reversal of fortune for Ethereum, which had been experiencing lackluster performance, signals renewed investor confidence in the asset’s prospects.

Altcoins were not left out of the influx. Solana attracted $3.9 million in inflows, while Uniswap and Tron garnered $1 million and $500,000 respectively. Blockchain equities also saw significant interest, with inflows totaling $61 million.

The uptick in inflows across various digital assets and related equities suggests a broad-based recovery in investor sentiment, potentially fueled by macroeconomic tailwinds and optimism surrounding regulatory clarity in the market as Donald Trump emerges winner of the 2024 US election.

Notably, the victory of Trump hasn’t only led to these reported surges in inflows but also appears to have kickstarted a major bull run in the overall crypto market.

So far, Bitcoin and other crypto assets in the market have seen double-digit gains in the past week. Particularly, over the past three days alone, Bitcoin has consistently hit new all-time highs. With the asset now up by more than 20% in the past 7 days, its latest ATH as of today stands at $82,379.

Other top crypto assets such as Ethereum, Solana, and Dogecoin haven’t recorded a new all-time high yet, however, they have all seen significant rises in price with DOGE’s past week’s performance increasing by 84%.

Featured image created with DALL-E, Chart from TradingView