The Royal Government of Bhutan is still making strategic use of its Bitcoin assets. On December 10 the government dispatched 502 Bitcoin, or around $49.42 million, to two platforms, Binance and QCP Capital. Blockchain tracking service Arkham Intelligence says that this is the most current of a scheduled sell-off meant to maximize earnings by leveraging changes in the market.

Bhutan sent 402 Bitcoin, which is worth $39.56 million, to Singapore-based QCP Capital in four separate transfers. A short time later, Binance got an extra 100 coins, which were worth $9.81 million. This is the latest in a series of deals like this that started in October. In that time, Bhutan sold a total of 1,696 BTC and made $139 million, with each crypto unit selling for an average of $81,999.

A Record November Bitcoin Sale

On November 14, 2024, Bhutan made a big sell through Binance, offloading 367 BTC for about $33.5 million. At the same time, the alpha coin hit an intraday high of more than $90,000. This transaction was one of the Bhutanese government’s more lucrative decisions, according to Arkham Intelligence, demonstrating its skill at market timing.

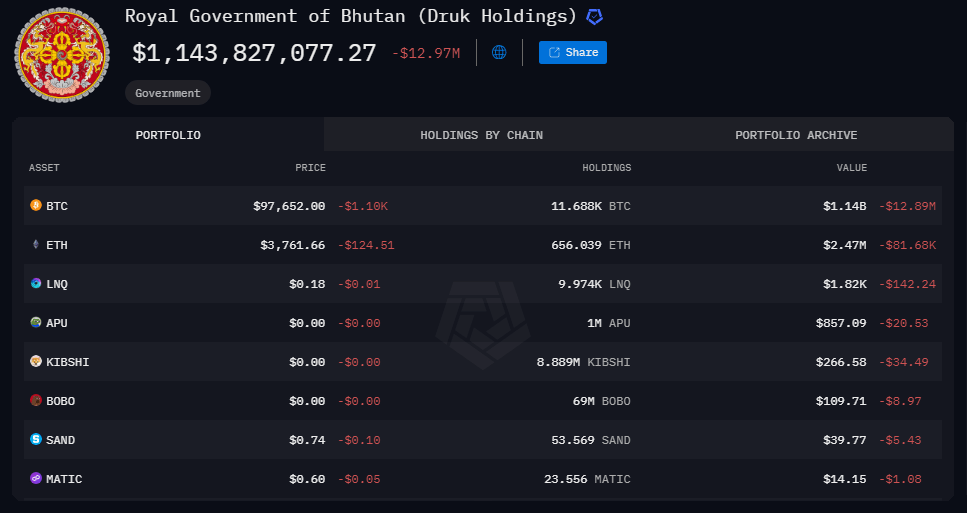

Bhutan still holds a sizable amount of Bitcoin—11,688 BTC, or over $1.15 billion—despite these recent sell-offs. Along with the US, China, UK, and Ukraine, the Himalayan monarchy is now one among the top five countries in the world in terms of crypto ownership.

Leveraging The Bull Market

The current bull market has made it possible for countries like Bhutan and El Salvador to use cryptocurrency for business. El Salvador, for example, has taken advantage of the rise in Bitcoin price to pay for building projects like its ambitious Bitcoin City and to get rid of its debt. Even though it’s not as well known, Bhutan’s approach also focuses on using cryptocurrency as part of bigger economic plans.

Market Dynamics And Future Outlook

Bhutan’s trades coincide with a more general market downturn in terms of timing. Bitcoin just dropped below the psychological $100,000 mark, falling as low as $94,350 before rising to about $97,000. Analysts believe that after Bitcoin’s significant gain, this decline is a normal correction.

The way Bhutan approaches the management of reserves emphasizes how governments may deliberately leverage market developments. Bhutan shows how nations may include digital assets into its economic plans by matching their sales with times of great demand and peak pricing.

This calculated use of bitcoin reserves not only generates significant income but also emphasizes the growing importance of digital assets in world financial institutions. Bhutan’s measures could be a model for other governments trying to negotiate this erratic yet profitable environment as the crypto market develops.

Featured image from Business 360, chart from TradingView