The US central bank has announced an interest rate cut, just hours before the Bank of England is tipped to refrain from following suit.

The Federal Reserve cut its main funding rate by a quarter point to a new target range of 4.25%-4.5%, as markets had expected, but signalled that future reductions would happen more slowly.

A resurgence in the pace of inflation is a big worry, with the prospect of new trade tariffs under Donald Trump from 20 January also risking a leap in the pace of US price growth in the New Year as imported goods would cost more.

Money latest: Most pension credit claims made recently have been denied

Data on Tuesday showing resilient consumer spending among other reasons for Fed policymakers to be wary of inflation ahead.

The Federal Open Markets Committee expected two rate cuts in 2025. Market expectations had been for four just weeks ago, in line with the Fed’s September guidance.

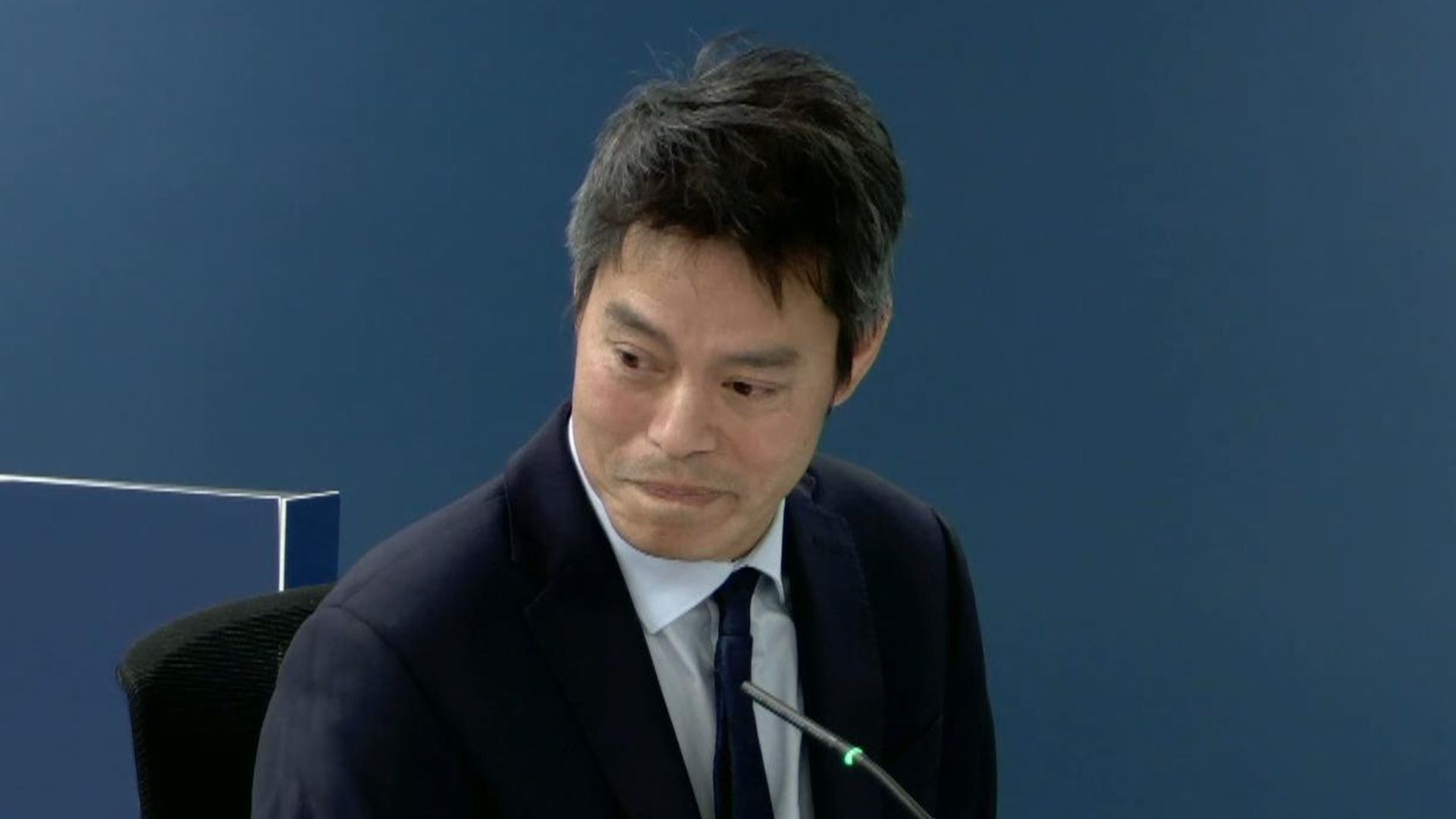

Fed chair Jay Powell told reporters that solid growth, improved employment and progress in the battle against inflation meant that the central bank was in a “good place”.

Rent prices reach record high in England

Inflation rises for second month in a row

Money blog: BrewDog millionaire raises eyebrows as he considers delaying marriage to Georgia Toffolo for tax relief

But he acknowledged that “policy uncertainty” relating to the incoming Trump administration was a concern for the inflation outlook among some of the committee’s membership.

“We just don’t know very much at all about the actual policies, so it’s very premature to try and make any conclusion”, he added.

Government bond yields, which reflect perceived future interest rate paths, ticked upwards.

The dollar found support, gaining 0.5% against both the pound and euro, while major US stock markets retreated.

The Fed’s rate decision was announced just hours before the Bank of England gives its own rate verdict.

No cut is expected while financial markets are expecting a similar message on the possible interest rate path ahead.

UK yields – the effective cost of servicing government debt – have moved sharply higher this month, with the gap between British and German 10-year bond yields rising to its highest level in 34 years earlier on Wednesday.

It reflects the diverging interest rate outlooks for the Bank of England and European Central Bank, which has been cutting rates consistently to boost the euro area’s economy.

The UK’s problem is that the paces for both wage and price growth have accelerated.

At the same time, economic growth has stalled.

Please use Chrome browser for a more accessible video player

The scenario presents the Bank with a particular challenge.

Its governor Andrew Bailey has admitted that the budget’s effect on businesses is casting the biggest question mark over the future rate path.

Worries include the extent to which firms seek to recover costs from tax hikes and minimum pay rises in the form of price rises.

On the other hand, the pressure on wage growth could be eased if firms carry out their threat to limit pay growth as a result of the budget burden.

As it stands, UK borrowing costs look set to be higher for longer, hampering the economy as they are designed to do but also driving up the government’s bill to service its debts.

Please use Chrome browser for a more accessible video player

Be the first to get Breaking News

Install the Sky News app for free

While the Bank is widely expected to hold off on a cut on Thursday, financial market forecasts for a reduction in February, seen as nailed on just weeks ago, are now running at just 50% in the wake of the latest wage and inflation data.

Just two rate cuts are priced in for 2025 currently.

What the Bank has to say about the price pressures it is currently seeing will be closely scrutinised.

Commenting on the US outlook Matthew Morgan, head of fixed iIncome at Jupiter Asset Management, said: “As it stands, the market expects only two further cuts in the whole of 2025. This is perhaps not surprising given consumer spending, policy uncertainty (particularly around tariffs) and jobs looking in decent health.

“However, we think we are likely to see [US] rate cut expectations increase next year as growth softens. The labour market is clearly cooling, inflation is softening, and Europe and China are a drag on global growth.

“Given the high inflation of the Biden presidency was very unpopular with the public, we think Trump will be wary of overdoing inflationary policies, like tariffs. Together with potential government spending cuts in the US, next year could well see positive conditions for the performance of government bonds.”