A case study on how Bitcoin could be utilized in a modern energy efficient, renewable-powered dwelling.

This is an opinion editorial by Makoto Shibuya, a licensed architect with an accomplished portfolio of personal and professional projects.

Introduction

I tend to believe that every challenge is also an opportunity. Cities developed over centuries, but the world is changing quickly. Though there is a healthy debate about what a future city may look like, if we were to design a city knowing what we know now, we can presume they would look quite different.

Architecture is difficult, complicated and rooted in a lot of history and tradition. Yet, it is one of our oldest practices — we needed a roof over our heads before we could sit and think about anything else. Unfortunately, this combination of complexity, tradition and permanence has historically kept the architecture, engineering and construction (AEC) industry at the mercy of changing technology rather than its forefront. Change is difficult, especially for something built on centuries of precedent.

Whether we like it or not, that will have to change as the world recognizes what some have been warning about for decades. Though the numbers are evolving, we know buildings collectively contribute about 40% of global CO2 emissions.

Thesis

Bitcoin introduces a market-based economic incentive for net-positive energy projects, which in addition to reducing CO2 emissions, could help offset the embodied carbon of our infrastructure over time.

A Case Study

In 1945, the “Case Study House Program” was commissioned to help reimagine housing after World War II. While some of the projects were never built, it was an important and influential contribution to the modern architecture movement. Today, we face a different challenge — we know buildings collectively contribute about 40% of global CO2 emissions.

Zero is a case study to explore new opportunities around renewable energy infrastructure and Bitcoin. The ultimate goal is to accelerate net-zero carbon projects through renewable energy technology, material selection and carbon removal strategies. I understand there are many nuances around environmental concerns, and I am merely flexing some design ideas to see where I land.

On its face, the energy consumption of a “proof-of-work” system like Bitcoin may seem like an inherent problem, but complex issues require looking at the entire system. When thinking about this, it is important to decouple energy from carbon emissions. Energy use is not intrinsically a bad thing. Everything requires energy — it is part of the first law of thermodynamics.

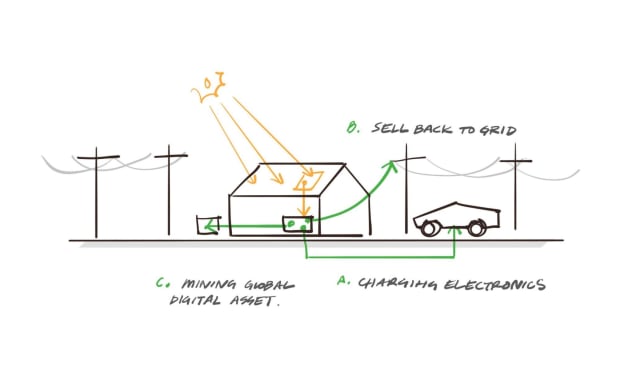

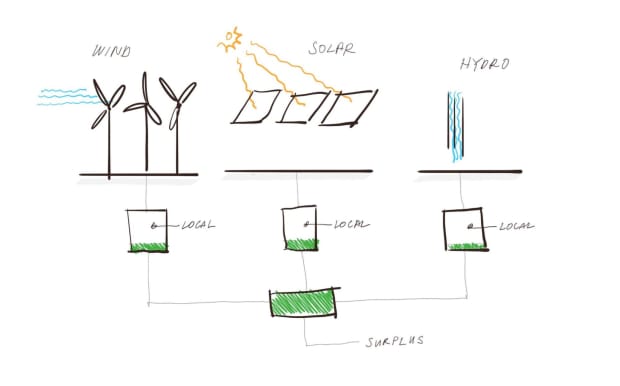

In summary, the problem with energy has never been about scarcity but rather intermittency, storage and distribution. For the first time in history, energy has a buyer of last resort — bitcoin miners — that can take stranded or surplus energy from anywhere and convert it into a global digital asset. Mining bitcoin introduces a perpetual appetite for stranded, or surplus, energy which can augment traditional net metering and energy storage. Mining makes it possible to monetize the buildout and operation of a solar system from day one rather than waiting for permits to sell back to the grid, which can often take months. It is another valuable tool that is geographically independent. This new demand acts as a continuous inducement for renewable energy and further innovation in energy infrastructure.

Combining renewable energy sources with batteries enables people to be their own utility. Mining could add another tool to help balance their renewable energy economics. This additional utility lets households, campuses and cities design a renewable energy system that will meet all of their power needs without the risk of overbuilding. Traditionally, this has been uneconomical because the system needed to be designed for peak loads. This new ability to economically design for these extended loads, in turn, continues to improve the economics of renewable energy infrastructure.

Energy Management

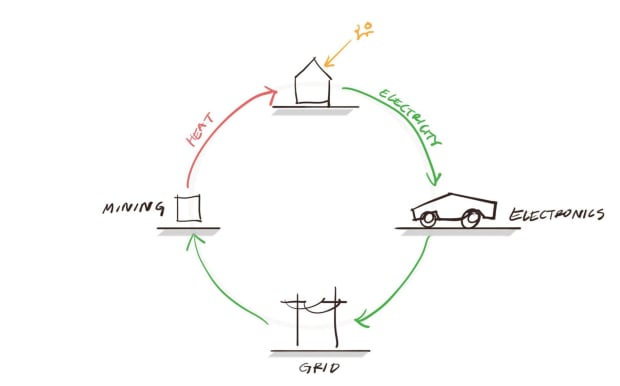

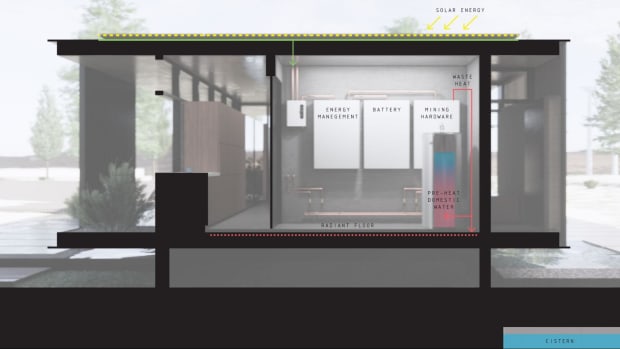

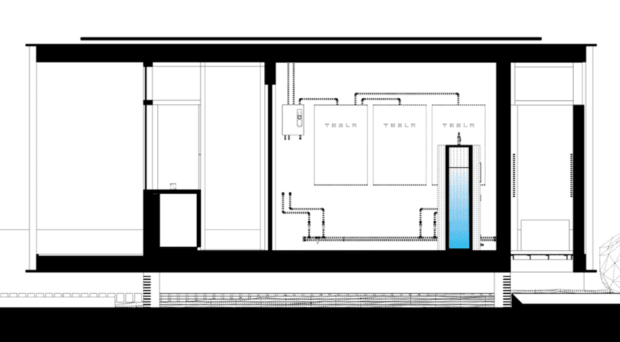

Below is a diagram showing how mining bitcoin could complement energy storage and net metering. The heat generated by the mining hardware is then used to pre-heat domestic water used around the house.

Waste Heat

The waste heat (a by-product of mining bitcoin) is used to pre-heat domestic water around the house. In the winter, it is also used as radiant heat for the floor.

Solar Energy

“Capturing just one hour of the sunshine that hits our planet would enable us to meet the world's food and energy needs for an entire year, and each year the sun radiates more energy onto the earth than has been used in the whole of human history.”— The Solar Revolution

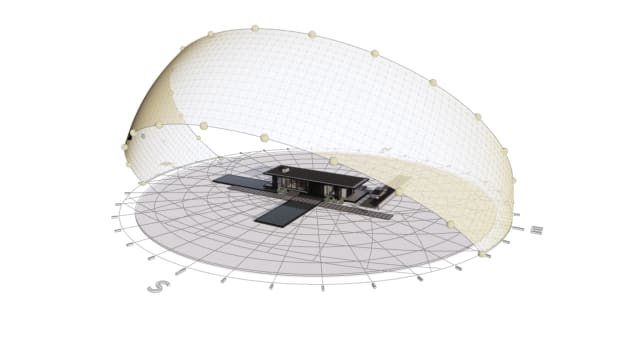

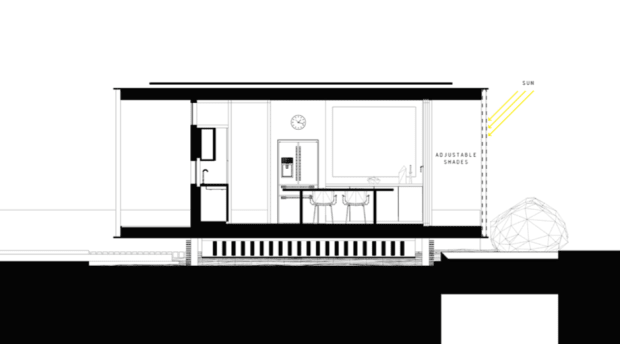

Sun Angle

The roof could be designed to cut off the sun angle in the summer and allow it to seep in during the winter. In the summer, this helps control the temperature from overheating. In the winter, the sun is allowed to heat the floor and radiate heat throughout the space over the course of the night. Adjustable sliding shades provide another level of local sun control.

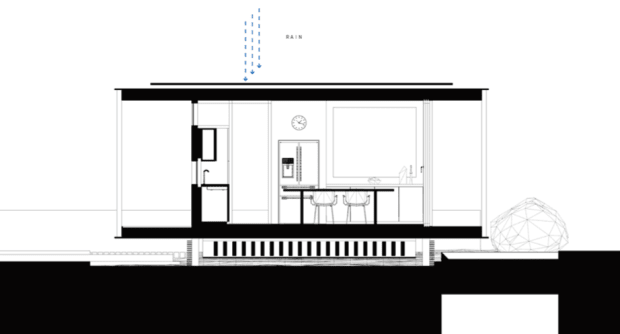

Rain

Rainwater is collected into a water feature and stored in an underground water cistern. In the summer, as this water evaporates, it pre-cools the air before entering the building. Combining this with strategically located operable windows allows cool air to cross-ventilate through the residence, saving energy on air conditioning.

The Power Of An Image

After World War II, the original “Case Study Houses” appeared in the “Arts & Architecture” magazine in iconic black and white photographs. These photographs spread California's mid-century architecture around the world and were influential to the modern architecture movement. In a similar spirit, I have created several images capturing project Zero to help paint a vision. It is not yet a complete picture — it is merely a case study to test ideas. Admittedly, there are details to work out and improvements to be made. However, the intention is to have an ongoing process to test ideas in hopes of a sustainable future.

This is a guest post by Makoto Shibuya. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.