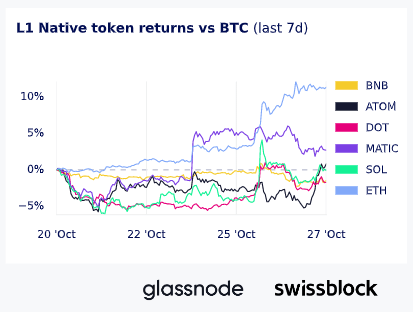

Ethereum’s (ETH) price performance has outperformed those of other leading layer1 networks in the last seven days, posting returns of over 10% against Bitcoin (BTC), according to data analyzed by CryptoSlate.

According to the Glassnode data, only Ethereum and Polygon’s MATIC posted positive returns against Bitcoin during the week. Meanwhile, Solana (SOL) briefly saw positive gains during the week before declining, while other layer1 like Binance (BNB), Polkadot (DOT), and Cosmos (ATOM) all saw negative returns throughout the week.

In the last seven days, CryptoSlate data shows that ETH recorded an impressive 18.73% gain, pushing its value above the $1,500 mark for the first time in the last 30 days on Oct. 25. This price performance also briefly made ETH the 50th most valuable asset in the world.

Compared to ETH’s last seven days’ performance, other layer1 networks like SOL, ATOM, and MATIC posted a positive return of 12.49%, 17.86%, and 15.35%, respectively. At the same time, BNB and DOT saw less than 10% gains.

Meanwhile, BTC only recorded gains of 7.53% in the last seven days.

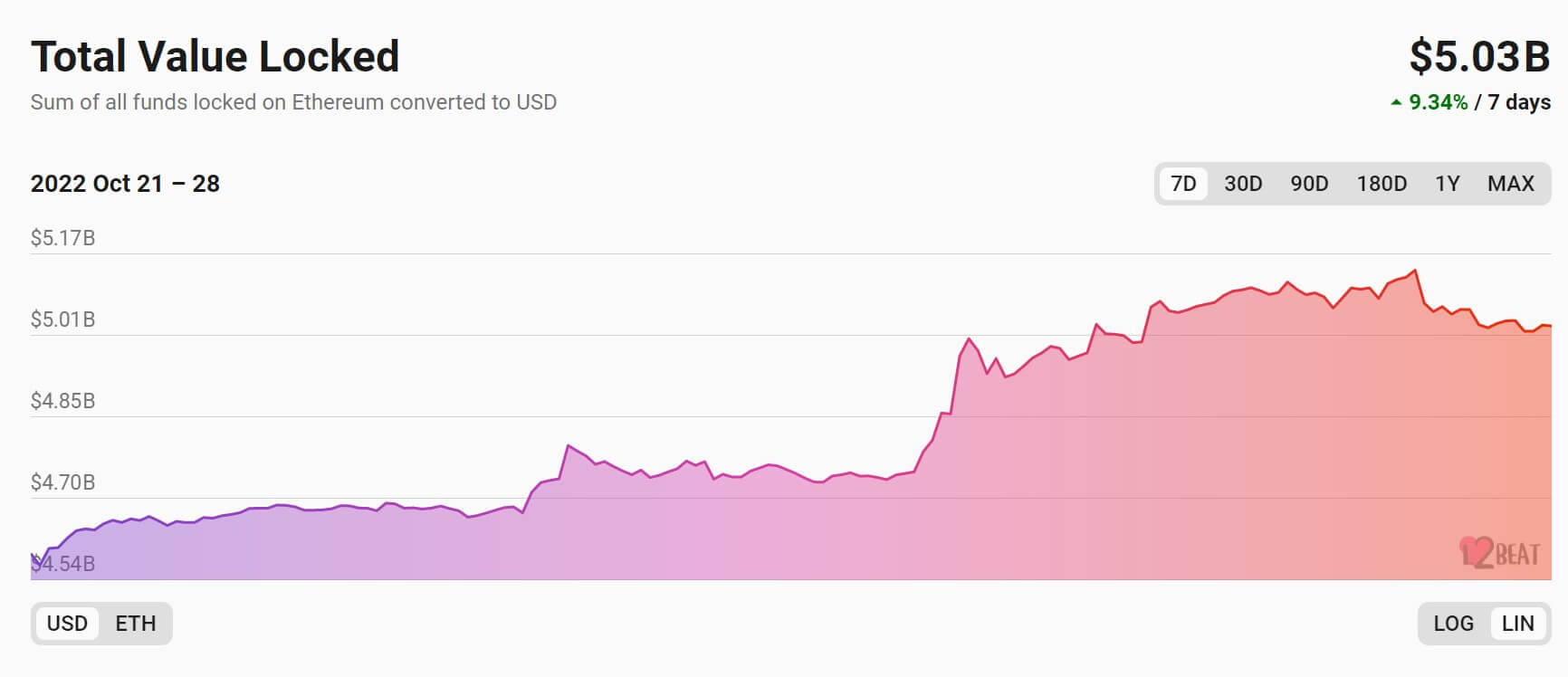

Ethereum layer2 TVL soars above $5B

Layer2 networks on Ethereum have seen the total value of assets locked in the ecosystem cross $5 billion due to the recent market rally, according to L2Beat data.

TVL rose by 9.34% in the last seven days to $5.03 billion. The ecosystem crossed $5 billion on Oct. 26, when ETH’s value was trading above $1,500.

This means the assets locked in Ethereum layer2 network are on par with that locked in other blockchain networks like Binance Smart Chain and Tron, which are around $5 billion.

Arbitrum One and Optimism account for over 80% of the TVL. The data showed that Arbitrum has over 50% of the TVL with $2.54 billion worth of assets locked in it, while Optimism has a $1.59 billion value.

Meanwhile, layer1 blockchain networks like Solana, Cardano, Algorand, etc., have a TVL that is less than $1 billion, respectively, according to DeFillama data.

The post Ethereum price outperforms other L1 networks appeared first on CryptoSlate.