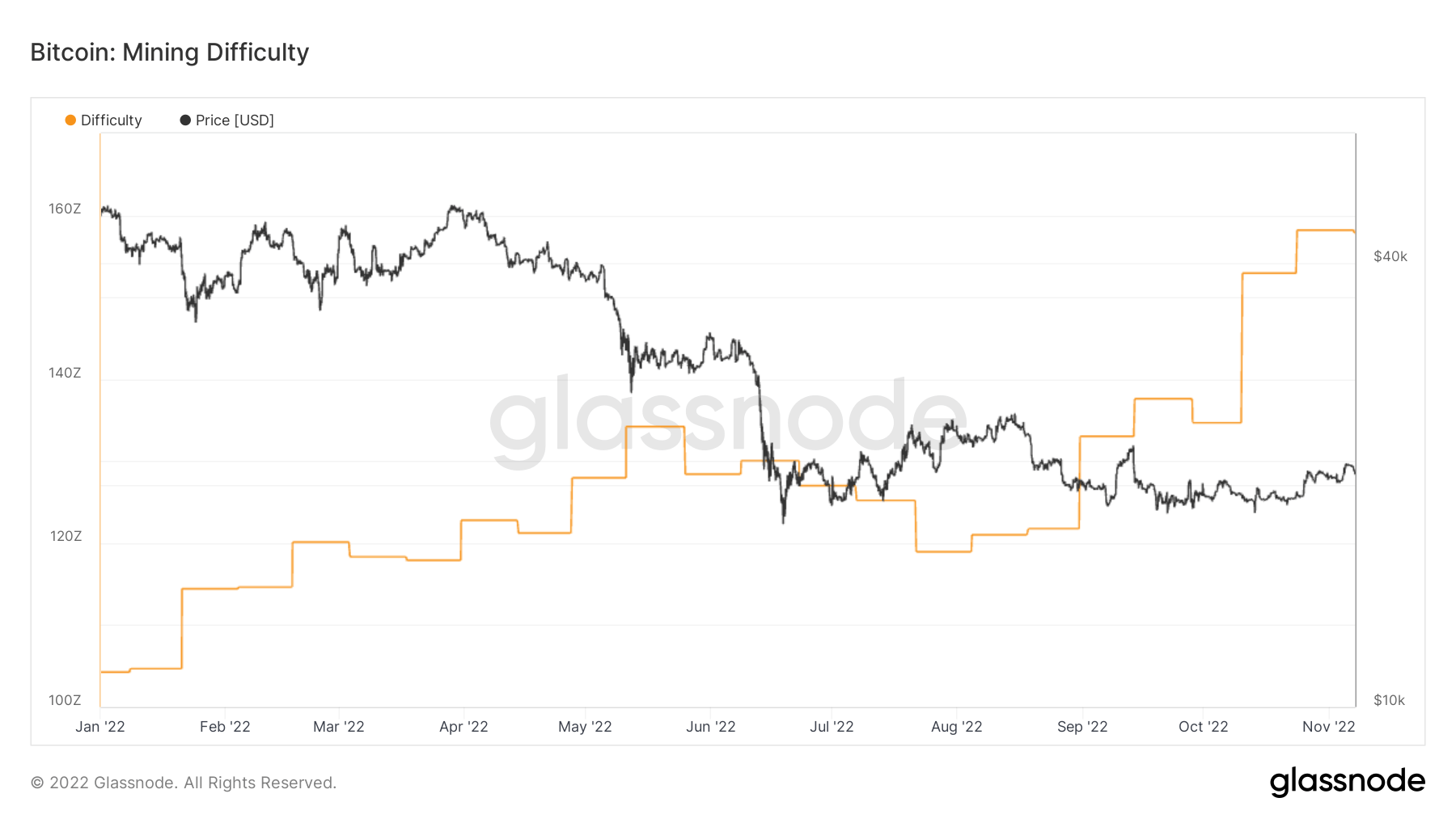

Bitcoin’s (BTC) mining difficulty has plateaued since the beginning of November and saw a 0.19 percent drop on Nov. 7 following its latest adjustment, according to CryptoSlate’s analysis of Glassnode data.

The chart above shows that mining difficulty has jumped significantly starting August all the way through November. The difficulty level reached a new high of 36.84 trillion, as of block height 760,032 in the last adjustment on Oct. 24.

However, mining difficulty dropped to 36.76 trillion as of block height 762,048 on Nov. 7.

Bitcoin miners struggle to survive

Mining Bitcoin is increasingly difficult as the market is in the midst of increasing energy prices, exacerbated by inflation, depressed crypto prices, and a looming global recession.

Several Bitcoin mining companies have been experiencing financial stressors, cases in point are Core Scientific’s halt in debt payments, Argo’s negative cash flows, and equity-infusion plan fallout, Compute North’s bankruptcy filing, and Iris Energy’s failure to produce cash to meet its financial obligations.

The network’s hash rate is expected to fall as Bitcoin miners are struggling to afford the maintenance of operations.

The post Bitcoin mining difficulty barely adjusts downward by 0.19% as miner pressure continues appeared first on CryptoSlate.