Investors expect the Fed’s aggressive program of rate hikes to level off once inflation shows signs of being reigned in. However, forecasts suggest the U.S. economy is far from cooling.

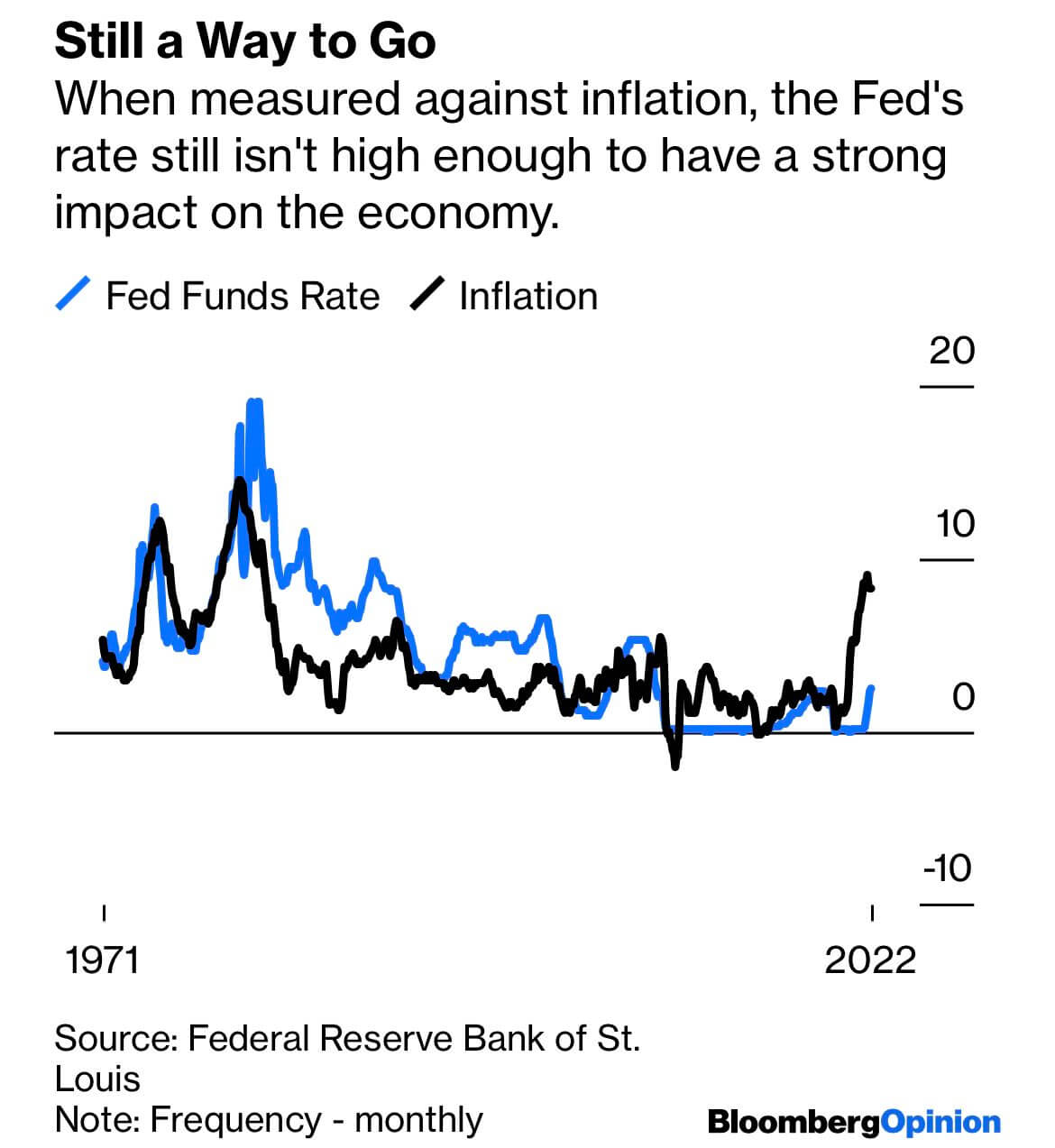

Last month, famed hedge fund manager Stanley Druckenmiller pointed out the uncomfortable truth that historically, once inflation hits 5%, it has never reverted course without Fed funds rising above CPI.

With September’s CPI inflation running at 8.2% year-over-year, rate increases may have a long and painful way to go before the Fed eases off – piling on sell pressure in risk-on markets, including crypto.

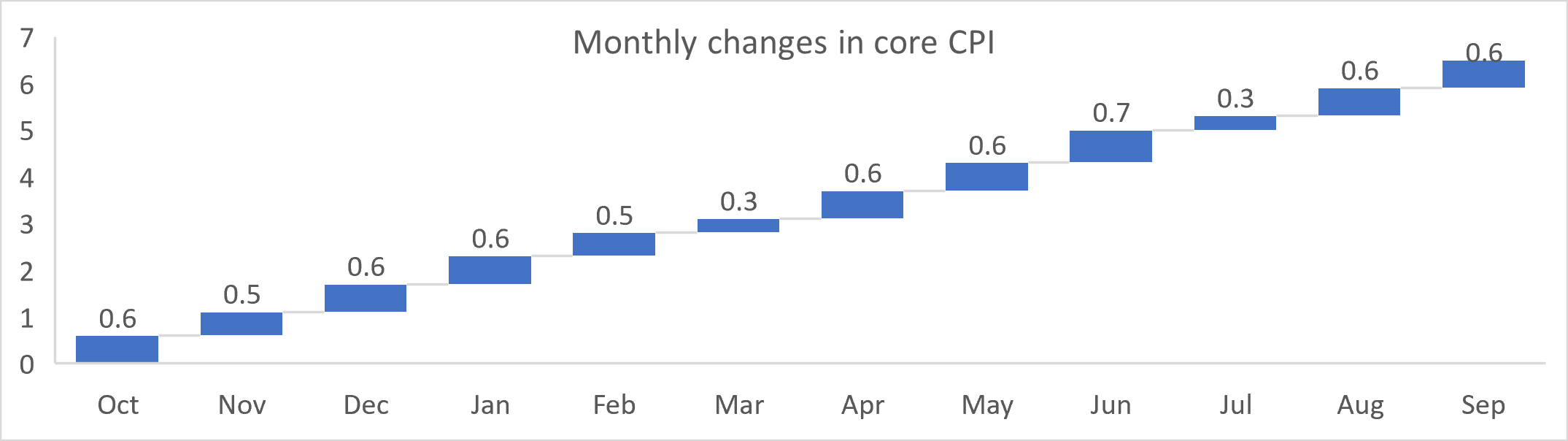

CPI forecast

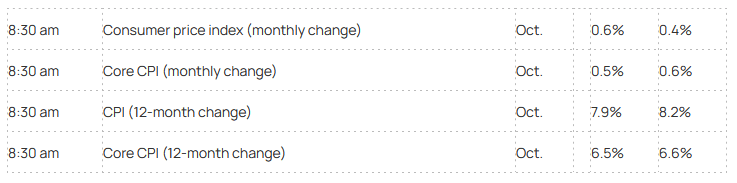

According to MarketWatch, overall CPI is expected to increase by 0.6% for October, to a year-over-year change of 7.9%.

Currently, markets are at a pivotal point. Either inflation cools, and central banks ease off rate hikes, or fixed-income yields continue making new highs, recession risk rises, and assets come under further pressure.

This week’s U.S. October CPI report carries considerable weight after the previous month saw little headway in reigning in core inflation, despite the past eight months of rate hiking.

Slowing price gains for core goods prices were more than offset by faster price increases for services. The trend for 0.6% monthly increases in core CPI over the past year was bucked by just two smaller increases of 0.3% in March and July.

Equities are vulnerable; what about crypto?

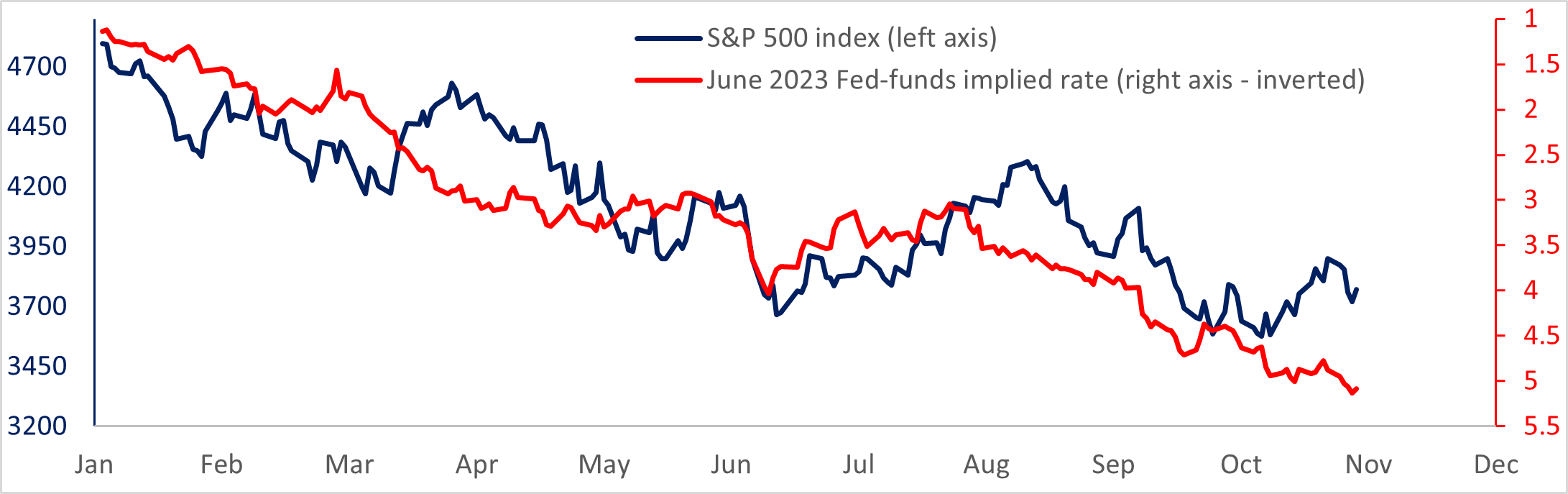

Following the FOMC meeting on November 2, in which the U.S. central bank implemented a fourth successive 75 basis point hike, Fed Chair Jerome Powell said peak rates will be higher than previously expected. Market expectations are for a peak rate of around 5% by next summer.

The chart below shows the S&P 500 and inverted implied Fed funds rate. Concerns are that equities are vulnerable to a further slide if the positive correlation reasserts itself.

In recent weeks, Bitcoin has shown a decoupling from stocks, leading to a return of the safe haven narrative. However, it remains to be seen whether this trend will continue to play out amid these unprecedented times.

The post Crypto, stocks brace for Thursday’s CPI announcement appeared first on CryptoSlate.