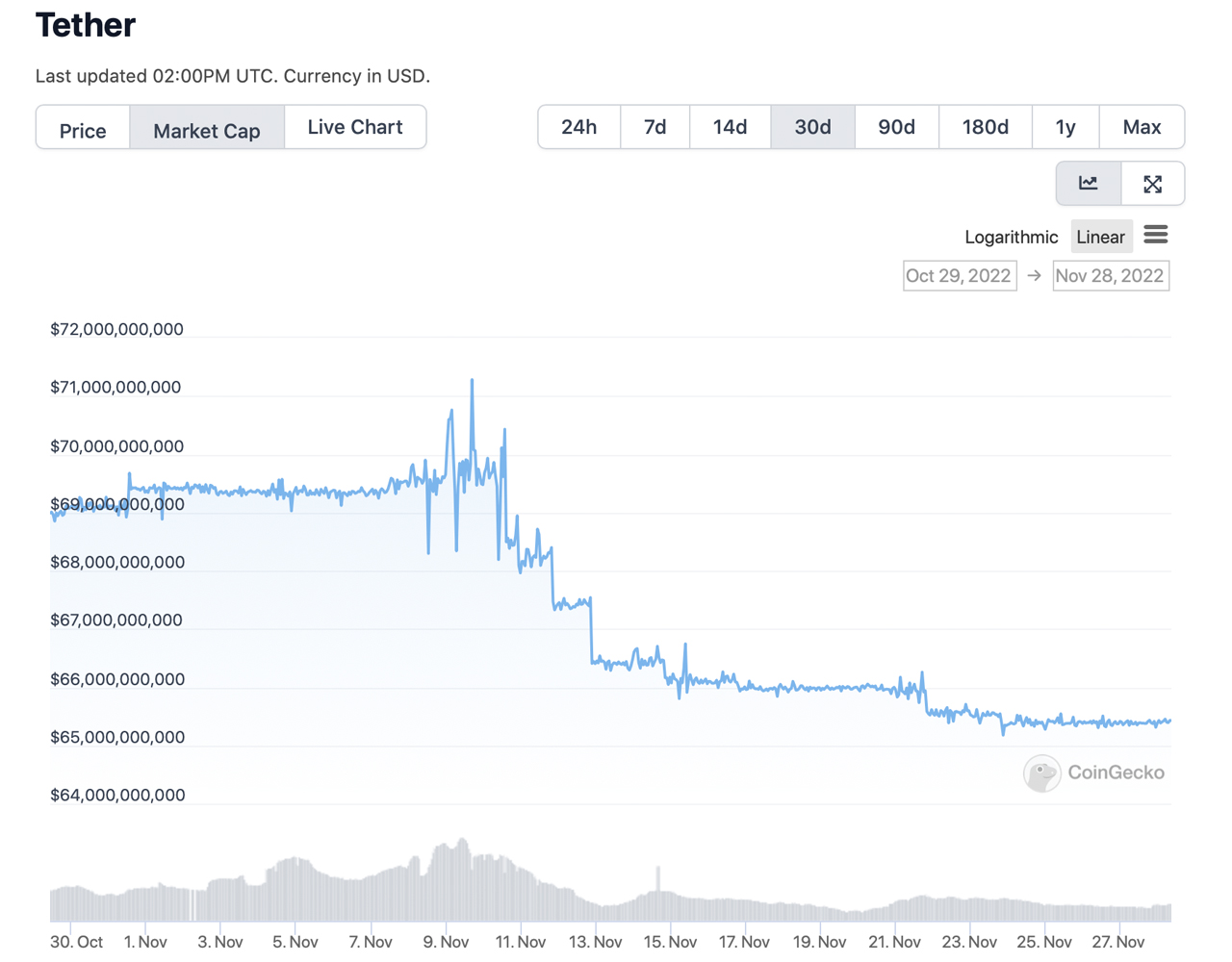

During the last month, the market capitalization of all the stablecoins in existence dropped by more than 2%, shedding roughly $2.98 billion since the end of October. Statistics show that tether, the largest stablecoin by market valuation, saw its market cap lose more than 5% during the last 30 days. Tether’s market cap slipped from last month’s $69.13 billion to today’s $65.48 billion.

Stablecoin Economy Drops Lower, Tether Market Cap Sheds 5%

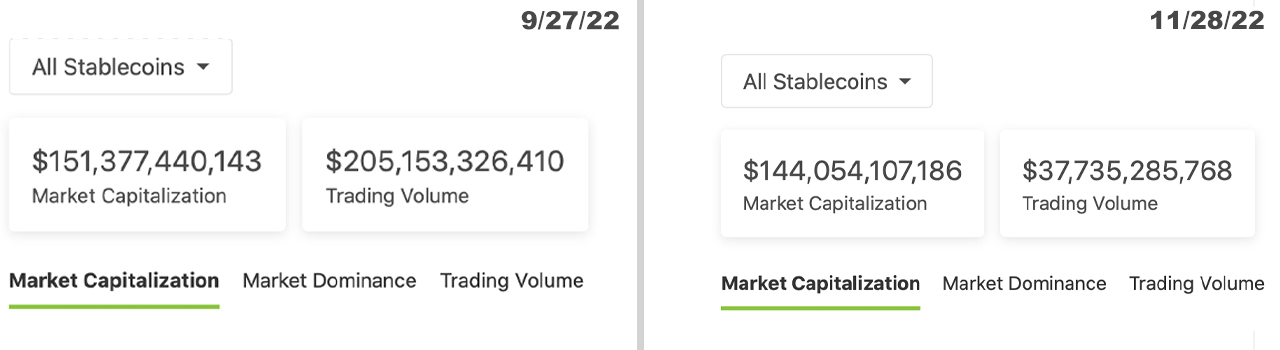

Statistics show that the stablecoin economy’s market valuation has reduced during the last 30 days by roughly 2.02%. On Oct. 31, 2022, the stablecoin economy was valued at $147.03 billion and today, it’s down to $144.05 billion.

Furthermore, the market capitalization of all the stablecoins in existence is much lower than it was two months ago, as the market cap dropped by 4.83% from $151.37 billion to today’s $144 billion total. Data indicates that this past month, tether (USDT) has seen its market capitalization drop more than 5% lower from $69.13 billion to the current $65.48 billion.

However, the second-largest stablecoin by market cap, usd coin (USDC) has seen its market valuation increase during the past 30 days, jumping roughly 1.5% higher. The stablecoin BUSD’s valuation continues to grow month after month, and over the last 30 days, it’s up 4.8%. Out of the top five stablecoins today, BUSD’s market cap grew the most over the last month.

Makerdao’s DAI stablecoin has shed 9.7% this past month and the stablecoin’s market capitalization was the biggest loser out of the top ten dollar-pegged crypto tokens. On Oct. 31, DAI’s market cap was around $5.77 billion and today, it’s coasting along at $5.20 billion. With tether and DAI leading the losses over the last month out of the top ten stablecoins, frax (FRAX) followed behind the two tokens shedding around 3.1% last month.

Stablecoin trade volume has dropped a great deal over the last two months but the tokens still represent a majority of today’s trades. For instance, on Sept. 27, 2022, stablecoins captured $205 billion out of the $225 billion in global trades. On Oct. 31, stablecoins recorded $55.91 billion in trades out of the total worldwide crypto trade volume ($71 billion).

During the past 24 hours stablecoins have captured $37.73 billion and the aggregate trade volume among all the crypto coins in existence today is roughly $46.56 billion. This means out of the $46 billion in trades among all the crypto assets, stablecoins equate to 81.04% of those trades.

What do you think about the state of the stablecoin market today? What do you think about the stablecoin economy’s valuation slipping by close to 5% during the past two months? Let us know what you think about this subject in the comments section below.