The drama surrounding FTX and Binance continues to unfold as new text messages emerge that show what went on behind the scenes as the exchange crumbled.

The New York Times obtained text messages from a group chat with Sam Bankman-Fried, Changpeng Zhao, and various other cryptocurrency executives that were exchanged on Nov. 10 — the day before FTX filed for bankruptcy.

The series of around a dozen texts showed that all of the crypto executives feared that the situation could worsen. The worried exchanges reportedly became increasingly tense as CZ accused SBF of trying to manipulate the price of Tether (USDT).

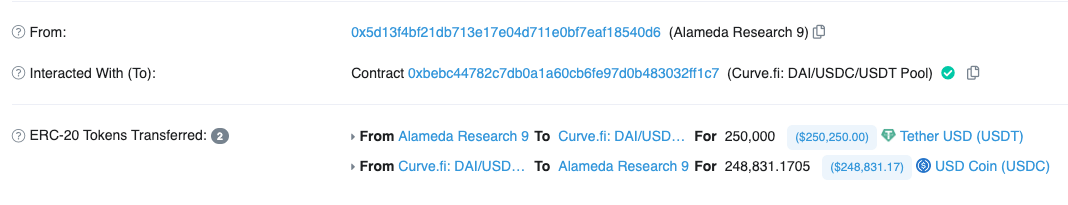

In the texts, CZ said that SBF used Alameda Research to depeg the stablecoin. Binance’s CEO pointed out a $250,000 trade and said Alameda specifically placed it to destabilize USDT.

According to the New York Times, SBF dismissed the accusations.

“Are you claiming that you think that $250k of USDT trading would depeg it?”

CZ responded that a trade of that size wouldn’t be able to destroy Tether but could still cause problems.

“My honest advice: stop doing everything. Put on a suit, and go back to DC, and start to answer questions.”

Other executives in the group chat reportedly shared the concern, with messages showing all of them were aware that any fluctuations in a single cryptocurrency could destabilize the whole industry.

Binance declined to comment on the matter. A spokesperson for Tether said that the company demonstrated resilience to attacks and that FTX’s actions “don’t reflect the ethos and commitment of an entire industry.”

SBF issued a statement calling CZ’s claims “absurd.”

“Trades of that size would not make a material impact on Tether’s pricing, and to my knowledge, neither myself nor Alameda has ever attempted to intentionally depeg Tether or any other stablecoins. I have made a number of mistakes over the past year but this is not one of them.”

The post CZ accused SBF of trying to depeg USDT though Alameda appeared first on CryptoSlate.