Trading desk QCP Capital recently published its 2023 crypto forecast on their latest edition of “Just Crypto.” The firm highlighted this past year’s key moments, their potential impact going into a new year, and possible future digital assets and the global market.

The report points out 2022’s year-to-date return for global assets. The market has experienced its worst-performing year for benchmark assets, such as Bitcoin, the S&P 500, the Nasdaq 100, and others.

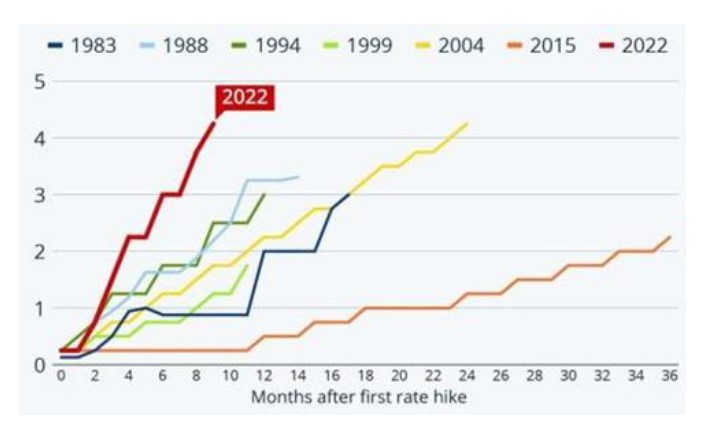

Except for Natural Gas, other assets saw their worst losses since the 1970s. Bitcoin (BTC) alone crashed over 70% from its all-time high, while Ethereum (ETH) saw a 72% loss. This negative performance “was a by-product of the sharpest rate hike cycle in recent history” by the U.S. Federal Reserve (Fed).

Crypto Forecast: What You Need To Pay Attention To

According to QCP Capital’s crypto forecast, the Fed will likely continue to pressure the markets. The financial institution is trying to bring down inflation from a 9% high to its target of about 2%. Thus, the Fed hikes interest rates and unwinds its balance sheet.

While inflation probably peaked at those levels, QCP Capital believes the market will see “sticky” or persistent inflation. In order words, the financial institution will have difficulty lowering inflation to its target.

This scenario could worsen if commodities prices, such as oil prices, push back above $100. Per the trading desk’s report, this is not the first time the Fed would face a similar scenario.

In the 1970s, the financial institution hiked interest rates and brought down inflation, but the metric rebounded when oil prices trended to the upside. The war between Ukraine and Russia could have similar consequences to the 1970s and operate as fuel for inflation.

As a result, the upside potential for Bitcoin and risk-on assets might be capped as long as inflation remains “sticky.” Furthermore, QCP Capital believes the Fed’s Federal Open Market Committee (FOMC) is unaware of the dangers of an uptick in inflation.

Therefore, the financial institution will embrace a crash in risk-on assets, such as crypto, and ignore investors’ pain. QCP Capital said the following on what could be one of the essential items for their crypto forecast:

This will lead them to accept a recession rather than risk a rebound in inflation, even if the inflation spike is again due to supply side shocks. In terms of recession probabilities, we are now above the 2020 Covid highs, and fast approaching 2008 GFC and 2001 Dot.com levels.

Crypto’s Hope At The End Of The Tunnel

There is potential for an upside if the Fed rushes to ease its monetary policy. In the past months, some financial institution representatives hinted at this possibility.

If this faction succeeds, the global market might see a sharp rebound, including Bitcoin and other cryptocurrencies. The U.S. Dollar, represented by the DXY Index, will continue to operate as a direct obstacle for digital assets.

Regarding technical analysis, the DXY Index has seen some losses in the past six weeks but is likely to bounce off its current levels. This upside price action might take the dollar back to 120, punishing global currencies, equities, and risk on assets. A break below these levels might trigger an opposite scenario.

As of this writing, Bitcoin (BTC) trades at $16,600 with sideways movement on the daily chart. BTC/USDT chart from Tradingview.