Bitcoin’s mining difficulty fell 3.6% at 3:49 a.m. UTC on Jan. 3.

The difficulty change suggests that a fraction of Bitcoin (BTC) miners withdrew from the network — most likely due to reduced mining profitability, according to the latest data from Bitrawr.

Fluctuations in the price of BTC are unlikely to be the reason behind this most recent adjustment. Despite this year’s market crash, BTC price remained steady since the blockchain’s last difficulty adjustment two weeks ago. The price of BTC is down 0.7% over the last seven days and 3.64% over the past 30 days.

Last week a number of U.S. BTC mining firms — most notably the bankrupt Core Scientific — complied with recent local energy curtailments which involved higher winter electricity prices and power outages. As a result, miners faced increased electrical costs and, in some cases, restricted access to energy.

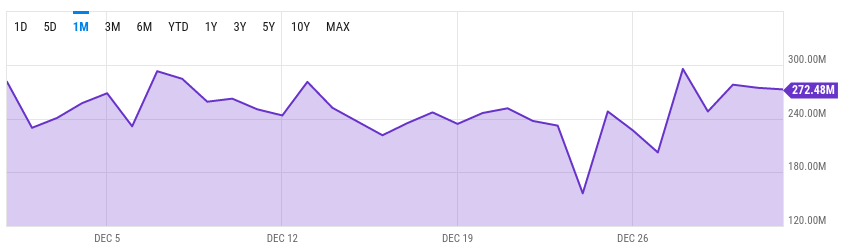

Bitcoin Network Hashrate

In light of the aforementioned energy curtailments, BTC overall mining hash rate fell temporarily to 156.46M on Dec. 24, 2022, from 232.05M on Dec. 23, 2022, according to YCharts.

Though BTC has since recovered much of its hash rate, restricted access to energy is still impacting participation in BTC mining.

Bitcoin’s mining difficulty is adjusted on a regular basis every 2,016 blocks (or approximately every two weeks). Bitcoin’s previous difficulty adjustment on Dec. 19 increased the blockchain’s difficulty by about 3%.

The reduced profitability of mining extends beyond the latest adjustment as data shows that mining revenue was down 37.5% year-over-year in 2022.

The post Bitcoin mining difficulty falls 3.6% following winter freeze appeared first on CryptoSlate.