The relationship between Ripple Labs and XRP tokens has been a controversial topic in the crypto community for quite some time. While there is evidence through older documents that XRP was also called Ripple in the past, since the XRP initiative in 2018, the company has placed great emphasis on the fact that the cryptocurrency is called XRP.

In particular, the company’s huge XRP holdings in escrow accounts have been the focus of controversy. As of December 2017, Ripple created 55 escrow accounts, each holding 1 billion XRP. More than five years later, as of January 2023, the company still owns 43.3 billion XRP of all 100 billion pre-mined XRP.

While Ripple created the escrow accounts to provide transparency and also publishes quarterly reports, a Twitter researcher named “Mr. Huber” has made a ‘finding‘ that sheds light on a different angle on Ripple’s impact on the XRP price.

Is Ripple Intentionally Influencing The XRP Price?

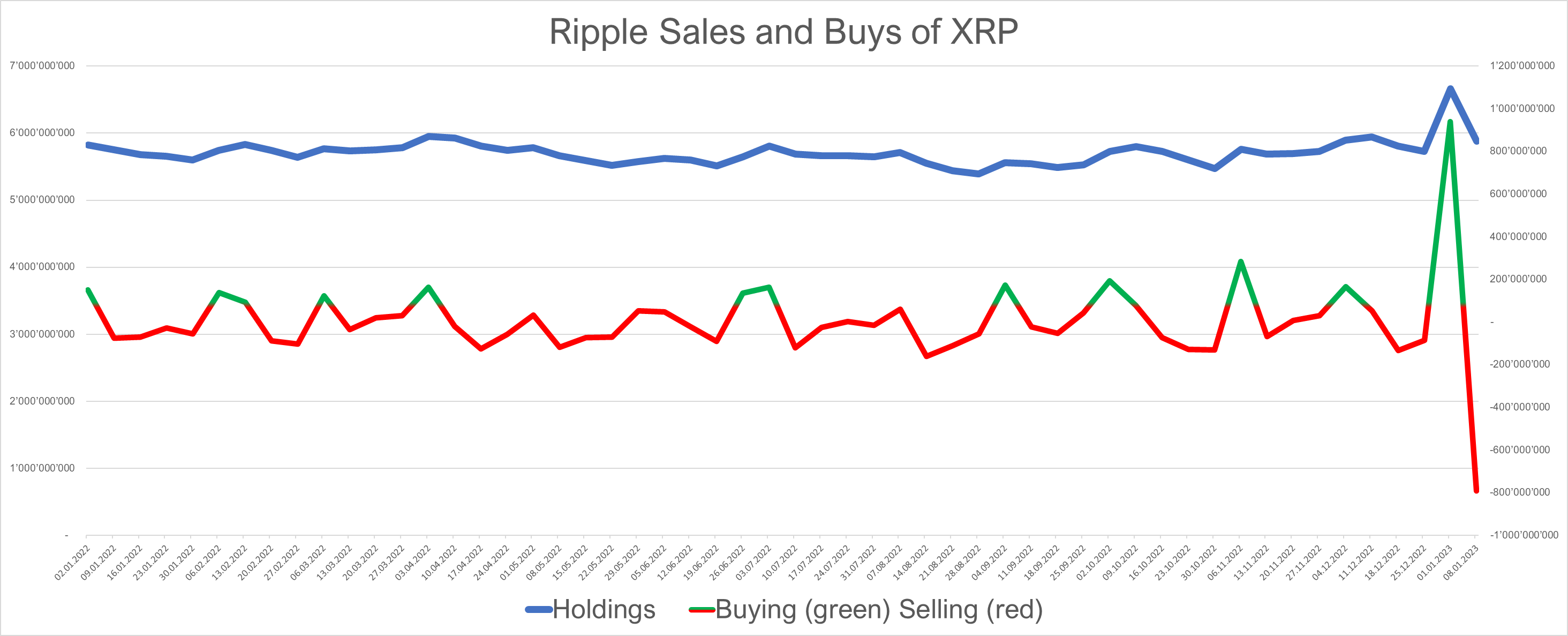

In an update on the company’s trading of XRP yesterday, the researcher wrote that the company bought the dump at New Year with unusually high volume and is currently selling it with unusually high volume:

Remember the dump at the New Year? Turns out, Ripple bought the dump with unusually high volume and is now selling again with unusually high volume. What could be the reason? Pure speculation.

The data the researcher refers to come from the official API. “That’s how transparent they are. You don’t have to wait for the quarterly reports, you can get the weekly data from their API,” Mr. Huber explained.

Remarkably, the company is selling four times more XRP at the moment than it has on average over the last two years.

The researcher first published his investigation on Twitter back at the end of October last year. At the time, he wrote that he was surprised that no one has taken a closer look at the company’s XRP holdings that do not go back into the escrows.

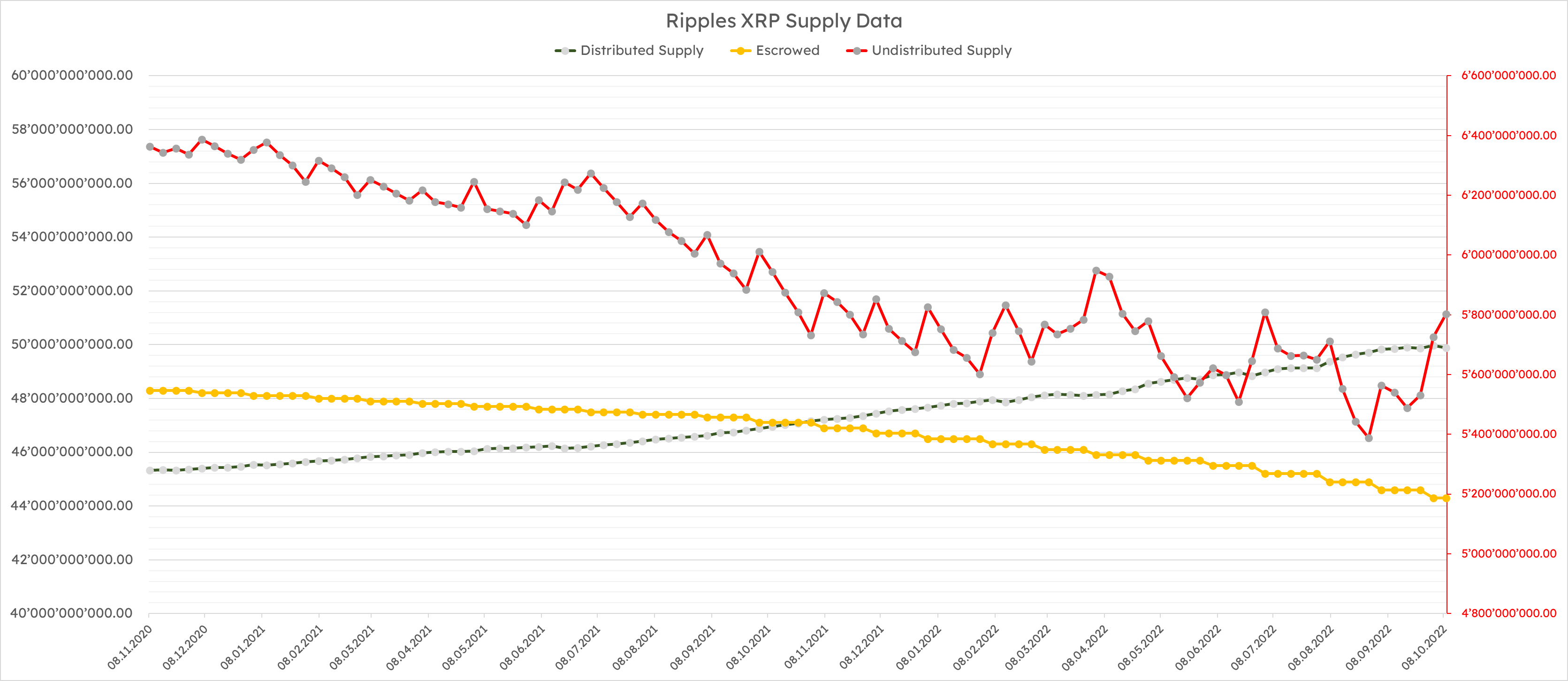

On October 23, Mr. Huber shared the chart below, showing the supply of XRP separated into distributed supply, escrowed, and undistributed supply. Red shows the fintech’s liquid XRP holdings. According to the researcher, they have been steadily decreasing since November 2020 until there was a reversal in September 2022.

The dataset since the beginning of 2022 revealed that the escrow holdings were getting smaller while the non-distributed supply was getting bigger. “At the red line you can see very well when Ripple sells and buys back. Ripple is now buying back,” the researcher wrote at the end of October.

An XRP community member asked the researcher in October if he believes XRP is actually inflated by the buybacks. Huber replied:

Ripple is very transparent about how many tokens it holds. But exactly how Ripple calculates that wasn’t clear. Apparently XRP that Ripple buys back are considered ‘non-circulating’. I have now discovered that you can use the API to track how much XRP Ripple is selling and buying.

As Huber explained, the reasons can only be speculated. Nevertheless, he wrote:

Now I think about it, what Ripple is basically doing is trying to keep the price as stable as possible.

In October, Huber suggested that the buys were related to the purchases of XRP on the secondary market. “It is exactly this! Ripple bought back about half a billion XRP since September! That’s probably why the price increased and why the circulating supply decreased though more XRP was released from escrow!”

Here’s What The Latest Quarterly Report Says

This is backed by the latest quarterly report (Q3 2022), in which the company wrote that it has been a buyer of XRP in the secondary market and expects to continue buying as On-Demand Liquidity (ODL) continues to gain global momentum.

In Q3 2022, Ripple’s total XRP sales, net of purchases, were $310.68 million, down from $408.90 million in the previous quarter. The company emphasized that it continues to sell XRP only in conjunction with ODL transactions.

In addition, it said that it has not conducted any programmatic sales (since Q4 2019) and “has no plans to do so going forward.”

At press time, the XRP price traded at $0.3879.

Featured image from iStock, Chart from TradingView.com