In a case poised to send ripples across the NFT landscape, luxury goods maker Hermès is suing artist Mason Rothschild over a 100-edition NFT collection it says violates its trademark of the iconic Birkin bag.

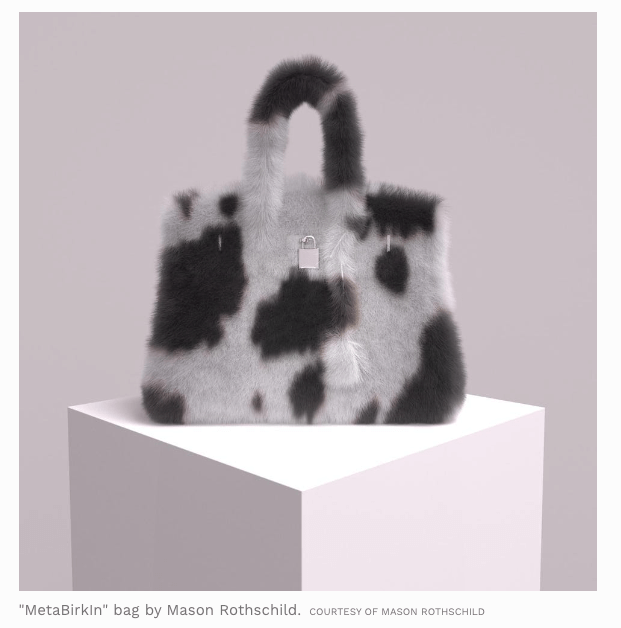

In December 2021, Rothschild uploaded a 100-edition NFT collection to OpenSea, releasing the “MetaBirkins” collection in what he said was:

“A tribute to Herm[e]s’ most famous handbag, the Birkin, one of ‘the most exclusive, well-made luxury accessories. Its mysterious waitlist, intimidating price tags, and extreme scarcity have made it a highly covetable ‘holy grail’ handbag that doubles as an investment or store of value.’”

Rothschild, who also describes himself as a “digital creator” and “web3cowboy”, sold 100 editions of the NFT for more than $1,000,000 in profit, including one edition that sold for 100 ETH.

Not long after, in January 2022, Hermès sent cease and desist letters to both Rothschild and OpenSea, causing the latter to take down the NFT collection from its marketplace.

Rothschild then responded by selling the NFTs on other platforms and registering the www.MetaBirkins.com domain with a disclaimer:

“We are not affiliated, associated, authorized, endorsed by, or in any way officially connected with HERMES, or any of its subsidiaries or its affiliates. The official HERMES website can be found at www.Hermes.com.”

Rothschild is arguing that his NFTs should be considered original artworks, not unlike Andy Warhol’s silkscreens of Campbell’s soup cans, which fall under the First Amendment, protecting individuals’ rights to freedom of speech and artistic expression.

In court filings made by Rothchild’s lawyers leading up the the trial, they cited a 1989 case, Rogers v. Grimaldi, which shields from infringement liability those works that are both an artistic expression and do not explicitly mislead consumers. The presiding court Judge Rakoff agreed, stating that while Rogers applied, questions attesting to what is a digital commodity versus what is a digital artwork have not been established.

The case will likely lead to an important precedent within the Web3 space, in which virtual metaverses are increasingly populated with virtual commercial goods, as well as art.

Legal experts add that the case will set an important precedent for defining trademarks across the Web3 space.

“[The Birkin case] will give us more guideposts for what to do with NFTs.”

Thomas Brooke, a lawyer at Holland & Knight, told The Wall Street Journal. He addedL

“With any new technology the courts are often having to apply existing law and figure out what works.”

Hermès is petitioning the court to have Rothschild cease and desist from all activities regarding the MetaBirkin NFT, including surrendering the MetaBirkins.com domain name and forfeiting damages including profits from the sale of the digital assets — which amount to over $1,000,000.

It is not the first time a case involving intellectual property rights and NFTs have been heard by U.S. courts. Nike is currently suing StockX, a sneaker reselling platform that integrates NFTs linked to the physical shoes it resells, for incorporating the brand’s iconic swoosh into its non-fungible assets.

StockX argues that it uses the NFTs as a quicker way to vet ownership with sellers looking to flip shoes without the burden of having to actually ship them.

Hermes International v. Rothschild is set to begin on Jan. 30 in the Southern District of New York.

The post Birkin vs. MetaBirkin, what one case heading to trial today may mean for the future of Web3 appeared first on CryptoSlate.