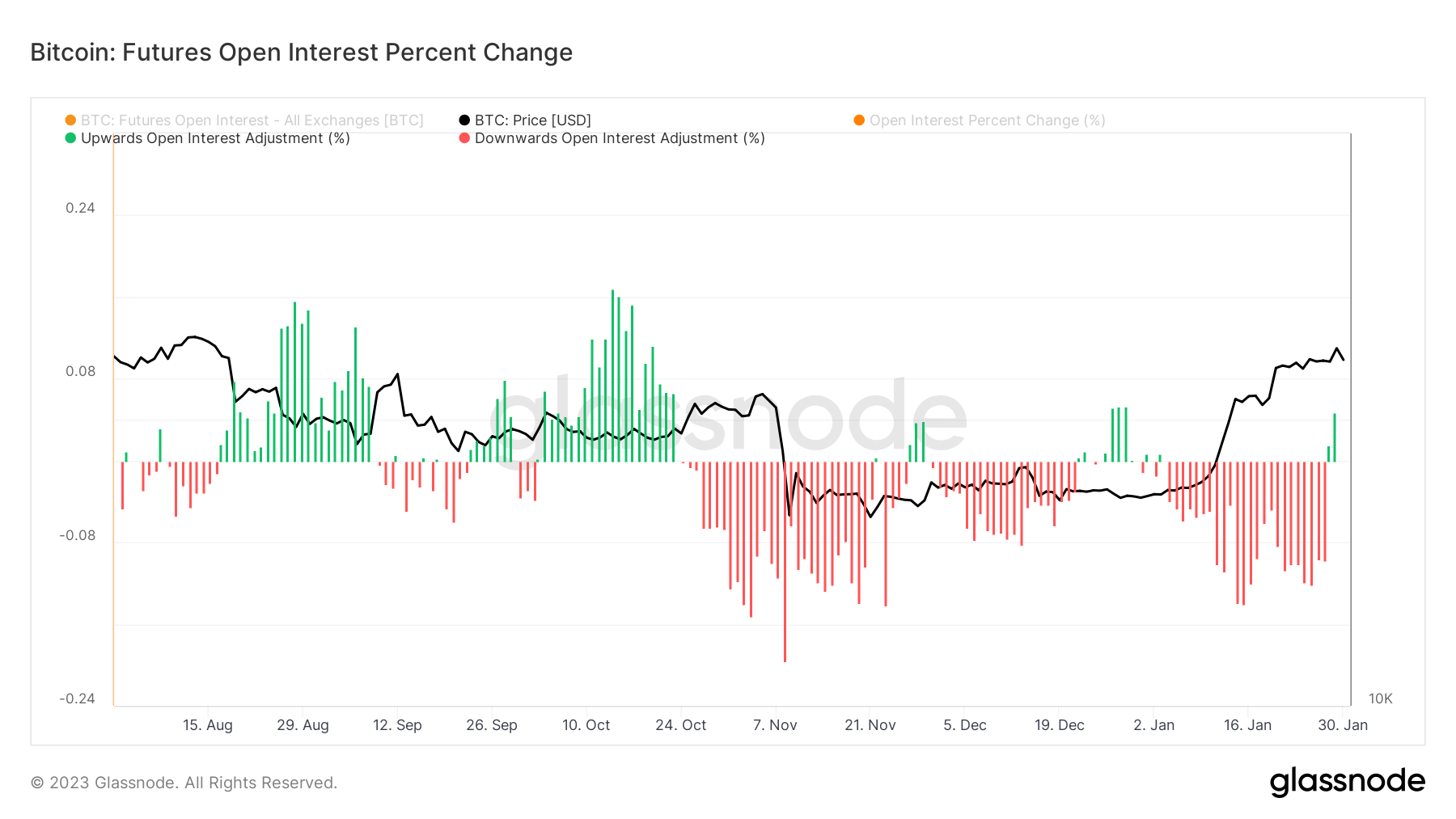

Futures open interest (OI) is the total number of open futures contracts for an asset held by market participants. Open interest on futures contracts for any given asset varies daily, representing the amount of cash flowing into the market.

A growing OI means that more money is moving into futures contracts, while a declining trend shows positions are being closed and money is moving out of the market. During price movements, an increase in OI is often used to confirm the prevalent trend in the market — rising OI during a bear market shows the trend will continue downwards. In contrast, an increase in OI during a bull run indicates upward movement.

CryptoSlate’s analysis of the open interest for Bitcoin futures showed a notable increase in OI.

This increase shows a significant rebound in the futures market. The collapse of FTX caused a massive decrease in OI, wiping out 40% of open futures contracts since mid-November.

There is currently around 433,000 BTC allocated into futures contracts — a sharp decrease from the 666,000 BTC recorded in November. A drop of at least 95,000 BTC can be attributed to the collapse of FTX.

The rebound in OI began in mid-January. Most of the growth can be attributed to increased institutional interest in Bitcoin futures — CryptoSlate analysis showed that 20% of the total Bitcoin futures OI came from CME. Largely inaccessible to retail investors, Bitcoin futures on CME are a good indicator of institutional interest in the crypto market.

On Jan. 30, Bitcoin futures OI saw the biggest increase since the beginning of the year — growing 6% which points to investors gearing up for a significant market movement.

This increase in OI is one factor contributing to the recent uptick in Bitcoin’s price.

Historically, market volatility tends to increase before and during the Federal Market Open Committee (FOMC) meetings. FOMC holds eight meetings yearly where it assesses and implements changes to monetary policy in the U.S.

Rising interest rates and rampant inflation have made FOMC meetings in the past year major market movers as investors turn to derivatives in a bid to hedge the market.

For Bitcoin, FOMC meetings have been mostly bearish events. Bitcoin tends to be highly volatile the day before, during, and after the meetings. However, the momentum tends to swing upwards in the days following the FOMC meeting as more leverage gets added to the market.

Diving deeper into the futures market shows that the ongoing market volatility has the potential to turn into positive price action following the FOMC meeting.

Market movements depend on the difference between long and short futures contracts. Market swings tend to be positive when longs dominate OI, while OI dominated by shorts often leads to negative price movements.

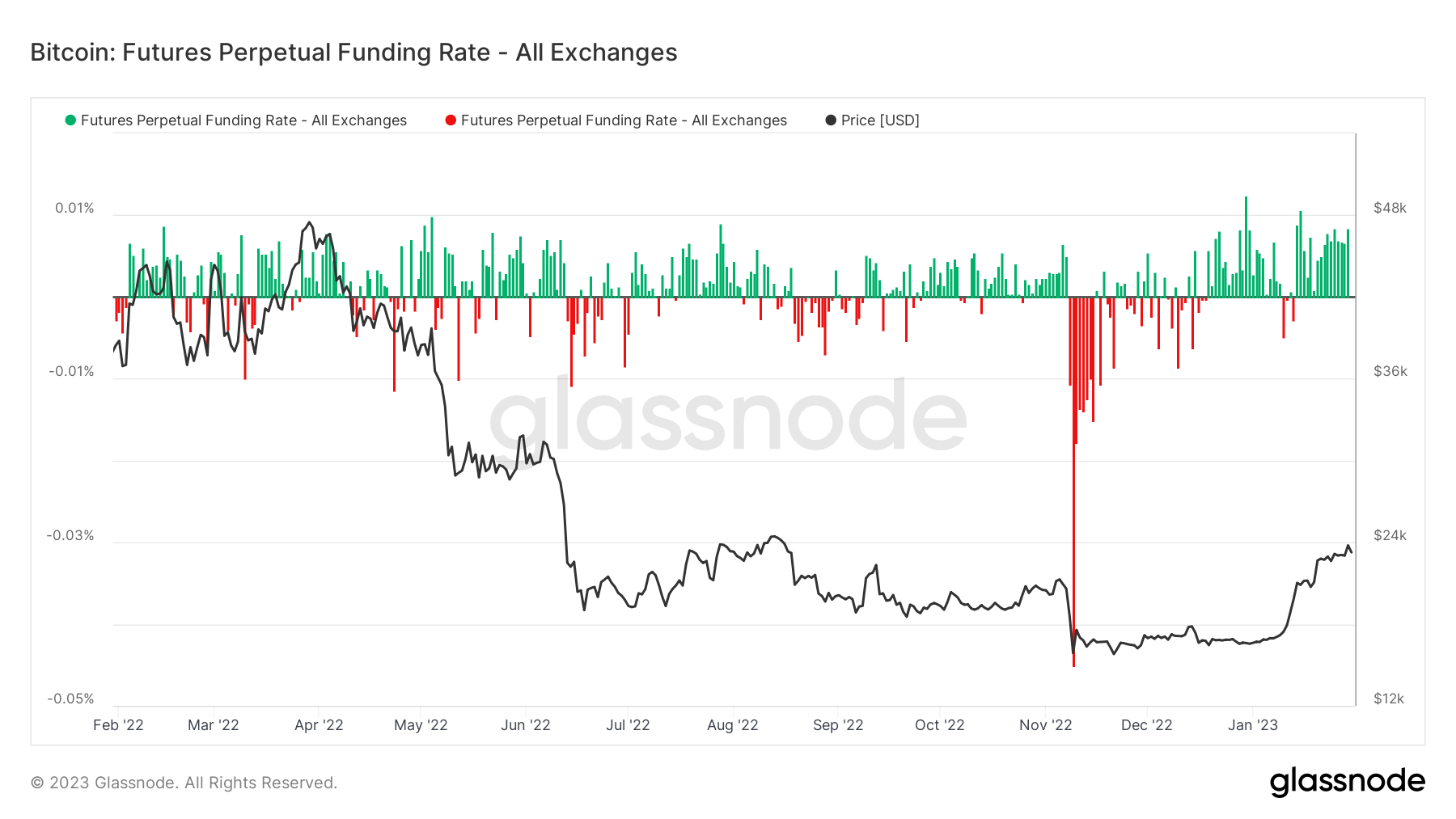

The perpetual funding rate is the average funding rate set by exchanges for perpetual Bitcoin futures contracts. When the rate is positive, long positions pay the funding rate to short positions. A negative rate means that short positions need to pay the rate to long positions to keep the value of the contracts relatively stable.

Data analyzed by CryptoSlate showed a positive perpetual funding rate, with longs dictating the market. The growing positive perpetual funding rate follows a period of aggressive shorting that peaked during the FTX collapse.

Aggressive shorting is often a bottom signal in a bear market, especially when followed by an overall increase in OI. If this pattern continues into the following weeks, it could mean that Bitcoin bottomed at around $15,500 following the FTX collapse and could continue its upward trajectory well into the first quarter.

The post Research: Bitcoin futures open interest grows ahead of FOMC meeting appeared first on CryptoSlate.