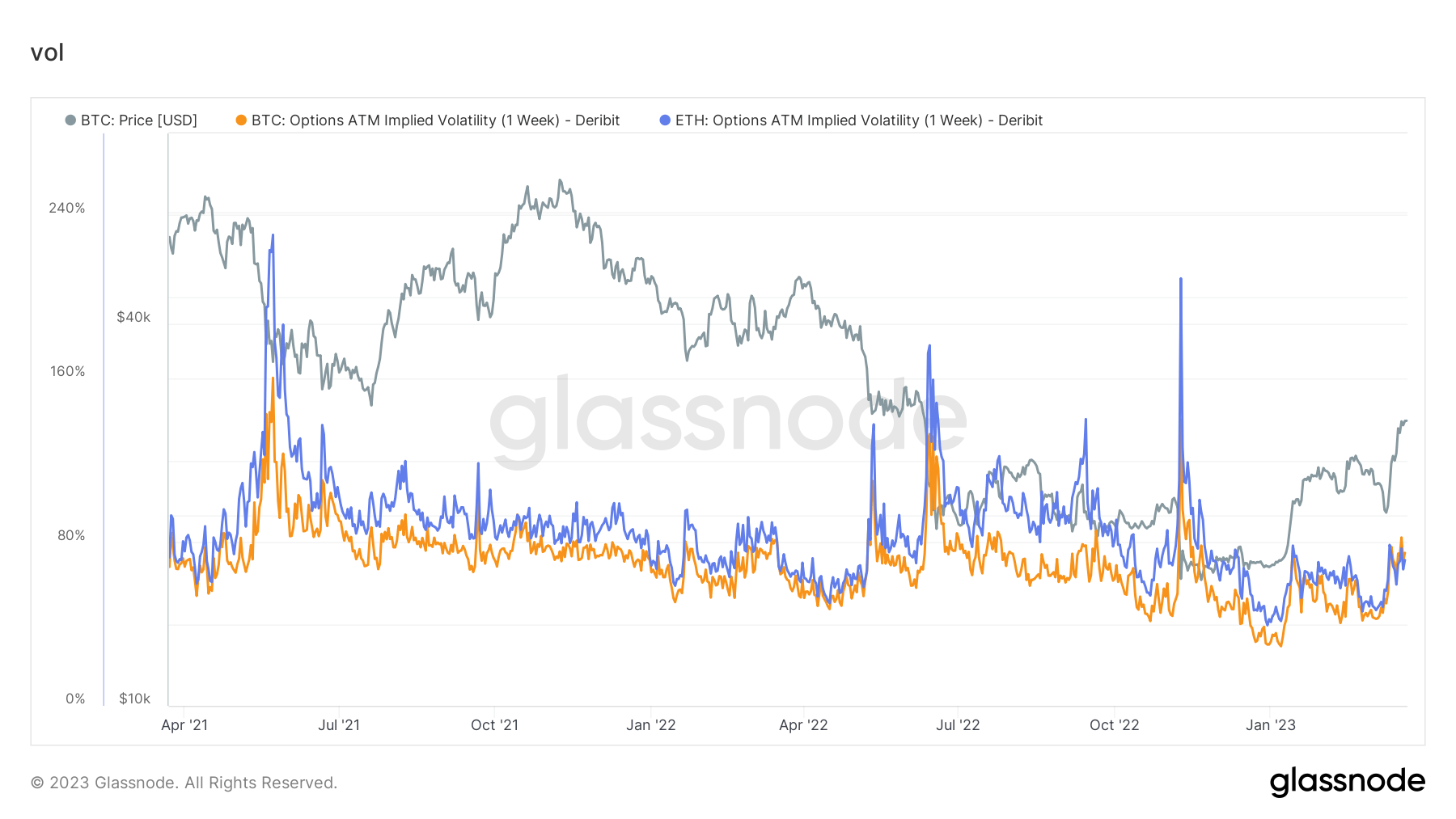

Definition

Implied Volatility is the market’s expectation of volatility. This metric shows the ATM implied volatility for options contracts that expire 1 week from today.

Quick Take

- For the first time since data has been recorded on Glassnode, Bitcoin implied volatility had exceeded Ethereum implied volatility ( 1 week).

- Due to the implications of the past few weeks of bank failures, Bitcoin is outpacing Ethereum in terms of price action.

- Options volume hitting two-year highs in Bitcoin recently are all contributing factors to this surge in implied volatility.

BTC implied volatility (1 week): 74.8%.

ETH implied volatility (1 week): 71.3%.

The post Bitcoin options ATM implied volatility exceeds ETH for the first time appeared first on CryptoSlate.