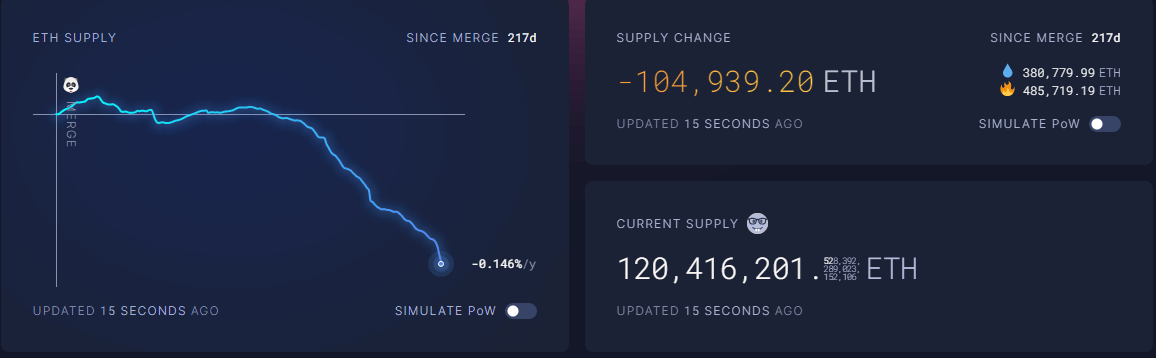

It has been 217 days since the Merge when Ethereum (ETH) shifted from the energy-intensive Proof-of-Work (PoW) consensus mechanism to the eco-friendly Proof-of-Stake (PoS) consensus mechanism.

Since then, the cryptocurrency has seen a significant drop in its native token — burning 104,939.20 ETH which amounts to over $200 million in current market value.

This decline corresponds to a 0.146% decline in the yearly supply of ETH, as per statistics data from the Ethereum monitoring site, ultrasound.money.

If Ethereum had not undergone the Merge and stuck and continued to rely on miners to secure the network, the supply of Ether would have grown by over 2.5 million coins — translating to a staggering $4.9 billion in the current market value. Moreover, the native coin supply of Ethereum would have surged by 3.53% every year.

London upgrade triggered Ethereum’s shift towards deflationary

While The Merge triggered the reduction in ETH supply by a significant amount, it was not directly responsible for the burning of ETH. The tokenomic aspect of burning ETH was implemented through Ethereum Improvement Proposal 1559 (EIP-1559) — which was rolled out via the London upgrade in August 2021.

The London upgrade split transaction fees into two parts — a base cost and a priority fee. The base fee gets burned and can no longer be used on the network — while the priority fee serves as payment to miners. However, with the transition to PoS, miners no longer exist for the network.

EIP-1559, which was implemented via the London upgrade, was designed to reduce inflation on the Ethereum network and exert deflationary pressure on the ETH supply. Despite this, the total supply of ETH has increased by 3.21 million coins since the upgrade was implemented.

In light of the increased burning of ETH since the Shapella upgrade — which enabled staked ETH to be withdrawn — it is expected that the trend of declining supply will continue in the coming months.

The post Post-Merge Ethereum: $4.9B in potential supply growth averted through Proof-of-Stake transition appeared first on CryptoSlate.