Quick Take

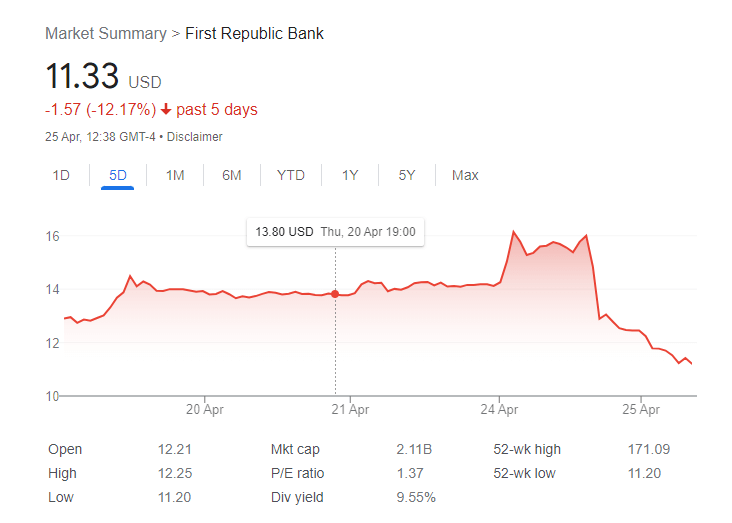

- First Republic Bank shares plunged during the opening bell of today’s trading session, 29% down.

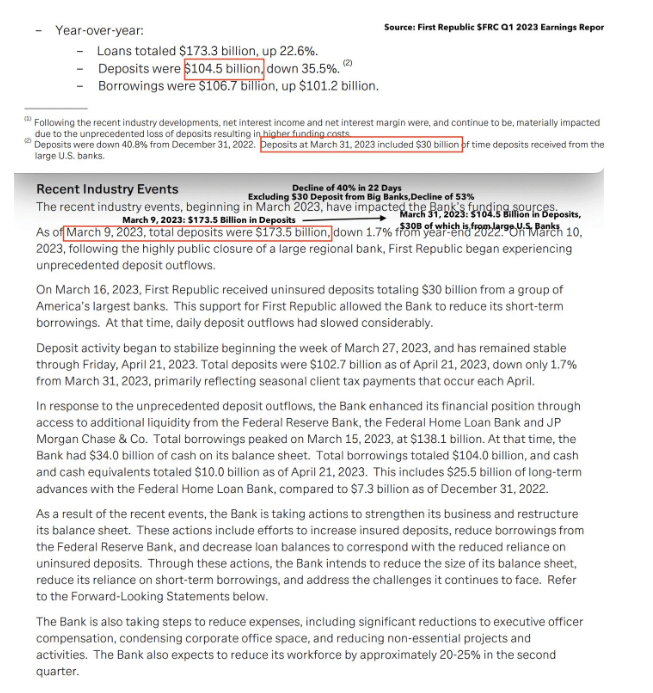

- As banking risks stayed high, First Republic Bank saw $100 billion in deposit outflows.

- It seems First Republic Bank is being kept on life support as they received $30 billion from the largest lenders on Wall Street.

- The bank’s deposits fell by 40% in 22 days; the decline could have been as big as 57% if not for the rescue package.

- Furthermore, the bank expects to reduce its headcount by 20-25% in the next two months.

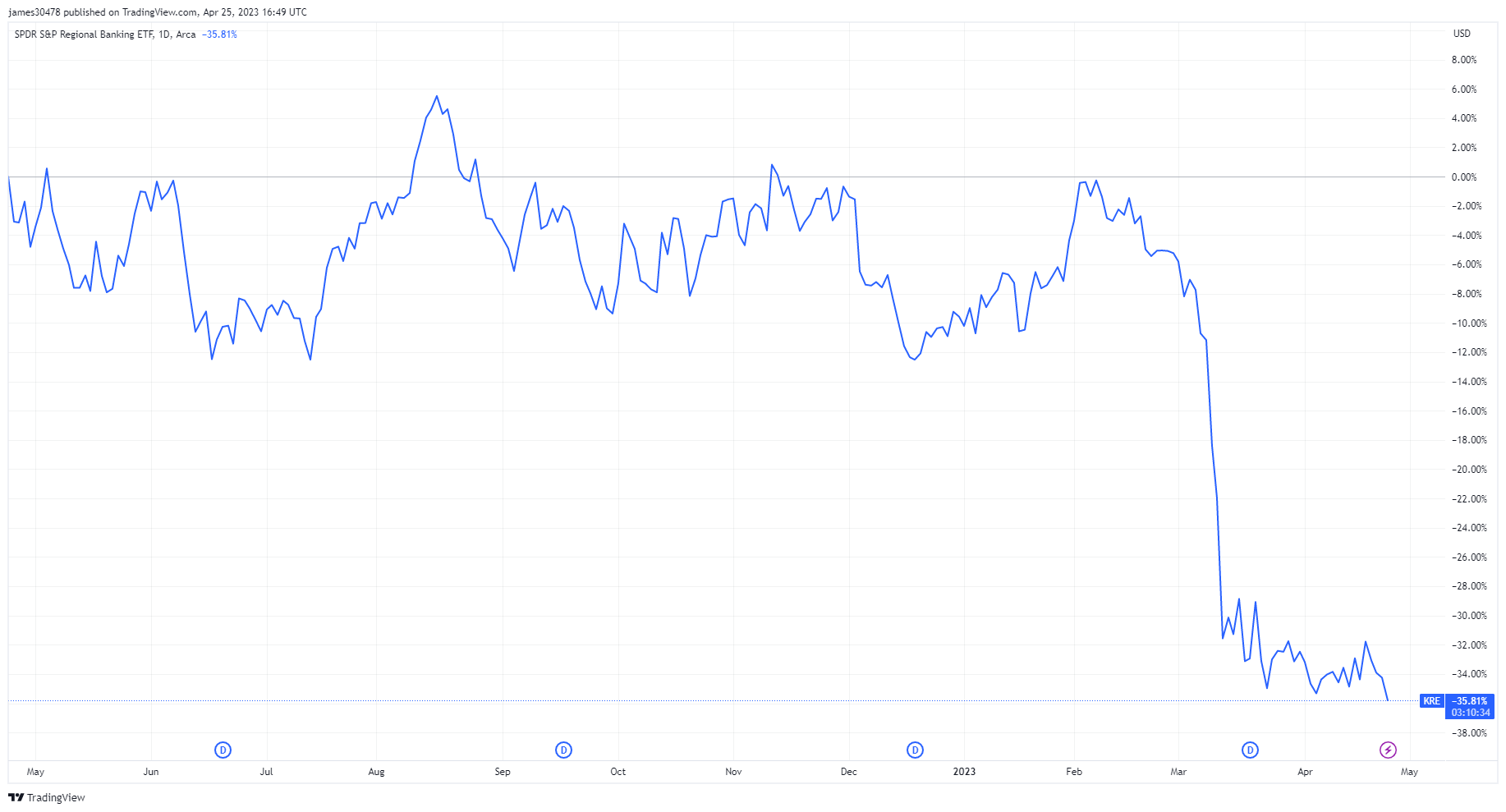

- The opinion was that the banking crisis was over. However, regional bank stocks (KRE) are trading at year-to-date lows.

- Bitcoin is up over 35% from the start of the banking collapse back in mid-march. Could another nose dive in the banking sector spur another rally for Bitcoin?

The post First Republic Bank stock halted amidst plunge: is this Bitcoin fault as well? appeared first on CryptoSlate.