On-chain data from Santiment shows the Ethereum shark and whale addresses have registered a growth of 5.7% over the past year.

Ethereum Sharks & Whales Numbers Have Gone Up During The Past Year

According to data from the on-chain analytics firm Santiment, there are now around 380 more sharks and whales in the market compared to 12 months ago.

The relevant indicator here is the “ETH Supply Distribution,” which tells us about the total amount of Ethereum that each wallet group in the sector is currently holding. Addresses are divided into these “wallet groups” based on the number of coins that they are carrying in their balances right now.

The 10-100 coins cohort, for instance, includes all wallets that are holding between 10 and 100 ETH at the moment. The Supply Distribution metric for this specific group would measure the sum of the individual balances of all addresses on the network that are satisfying this condition.

Related Reading: Bitcoin Accumulation: HODLers Are Buying 15,000 BTC Per Month

In the context of the current discussion, the investors of interest are those holding at least 1,000 ETH, meaning that the relevant range here would be 1,000 to infinite coins.

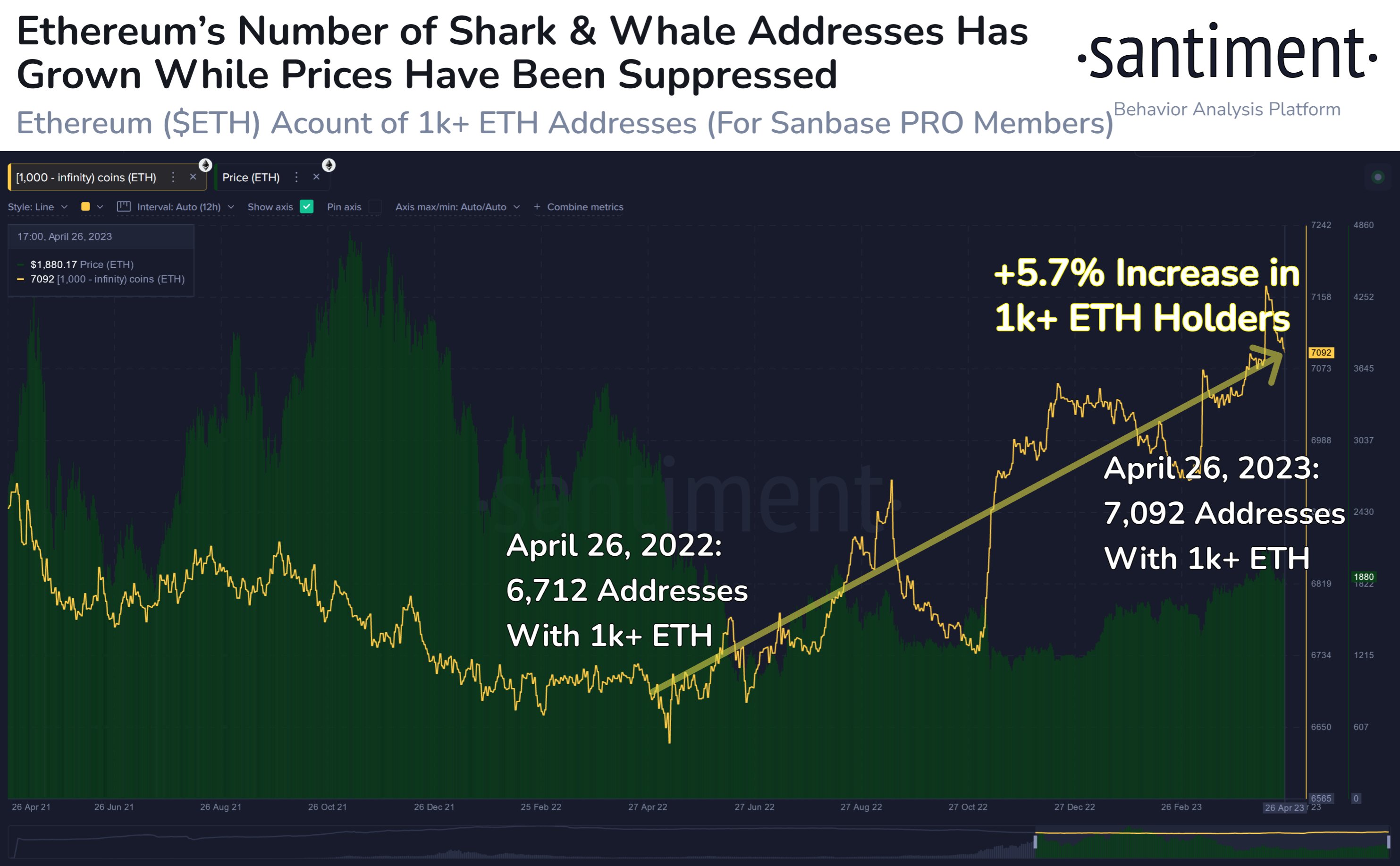

Here is a chart that shows the trend in the Ethereum Supply Distribution for such investors over the last couple of years:

This wallet range of at least 1,000 ETH (worth about $1.9 million at the current exchange rate) includes two very important cohorts for Ethereum: the sharks and whales.

These investors can be quite influential in the market as they hold such large amounts in their wallets (with the whales naturally being more powerful than the sharks since they are the larger of the two. Because of this reason, their behavior may provide hints about where the market may be headed in the long term.

As displayed in the above graph, the Supply Distribution for the 1,000+ ETH range had a value of 6,712 a year ago. Since then, the indicator has enjoyed an overall uptrend and its value has risen to 7,092 today.

This implies that 380 new addresses belonging to sharks and whales have come up on the network during the last year, representing an increase of about 5.7%.

Ethereum saw a decline during most of the past year as the bear market tightly gripped the cryptocurrency. Overall, the asset is still down 35% in this period, meaning that these humongous holders have been buying while the value of the asset has been relatively low.

From the chart, it’s visible that the most significant buying spree in this period came just following the collapse of the cryptocurrency exchange FTX. This suggests that the sharks and whales saw the lows following this crash as a profitable buying opportunity.

And indeed, their accumulation there looks to have paid off so far, as those lows now appear to be the lowest point for this bear market. These holders have also continued to buy a net amount in the current rally so far, meaning that they are supportive of the price surge. Naturally, this can be a positive sign for bullish momentum in the long term.

ETH Price

At the time of writing, Ethereum is trading around $1,900, down 1% in the last week.