Five weeks have passed since Ethereum’s highly anticipated Shapella upgrade, which was set to enhance the efficiency and manageability of Ethereum’s transactional model.

In the weeks preceding the upgrade, the market was ripe with volatility as it geared up for the imminent changes the upgrade was about to bring.

The Shapella upgrade’s influence extends beyond the Ethereum ecosystem. It carries implications for various industries that leverage Ethereum’s blockchain, potentially transforming business operations through enhanced efficiency and transparency.

Almost 40 days have passed since the upgrade was implemented on April 12, warranting a deeper look into Ethereum’s on-chain metrics.

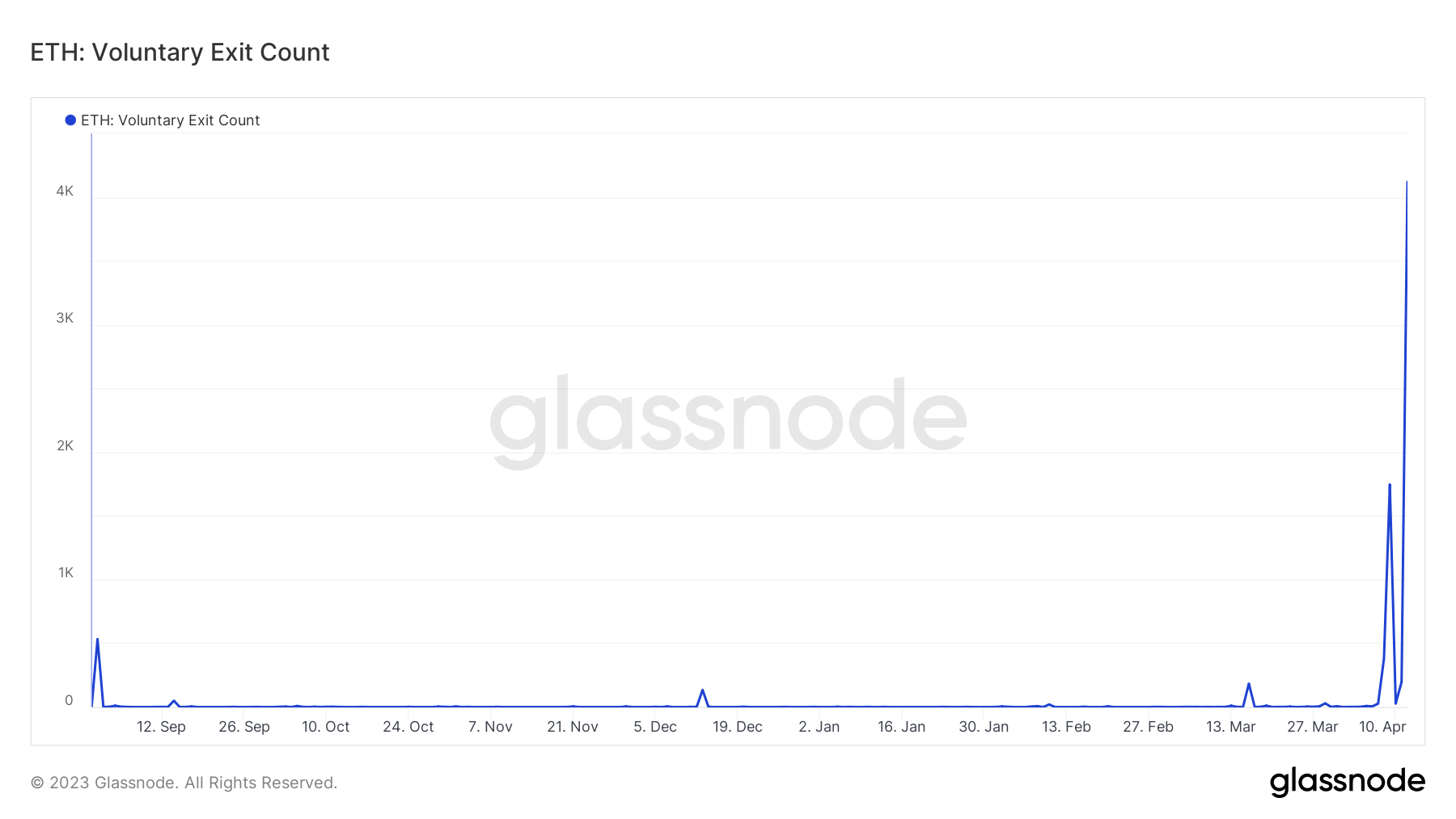

Leading up to Shapella, the voluntary exit count saw a significant uptick. Approximately 860,500 ETH was pending withdrawal on April 12, 12 hours post-upgrade, with around 296,280 validators waiting in the queue.

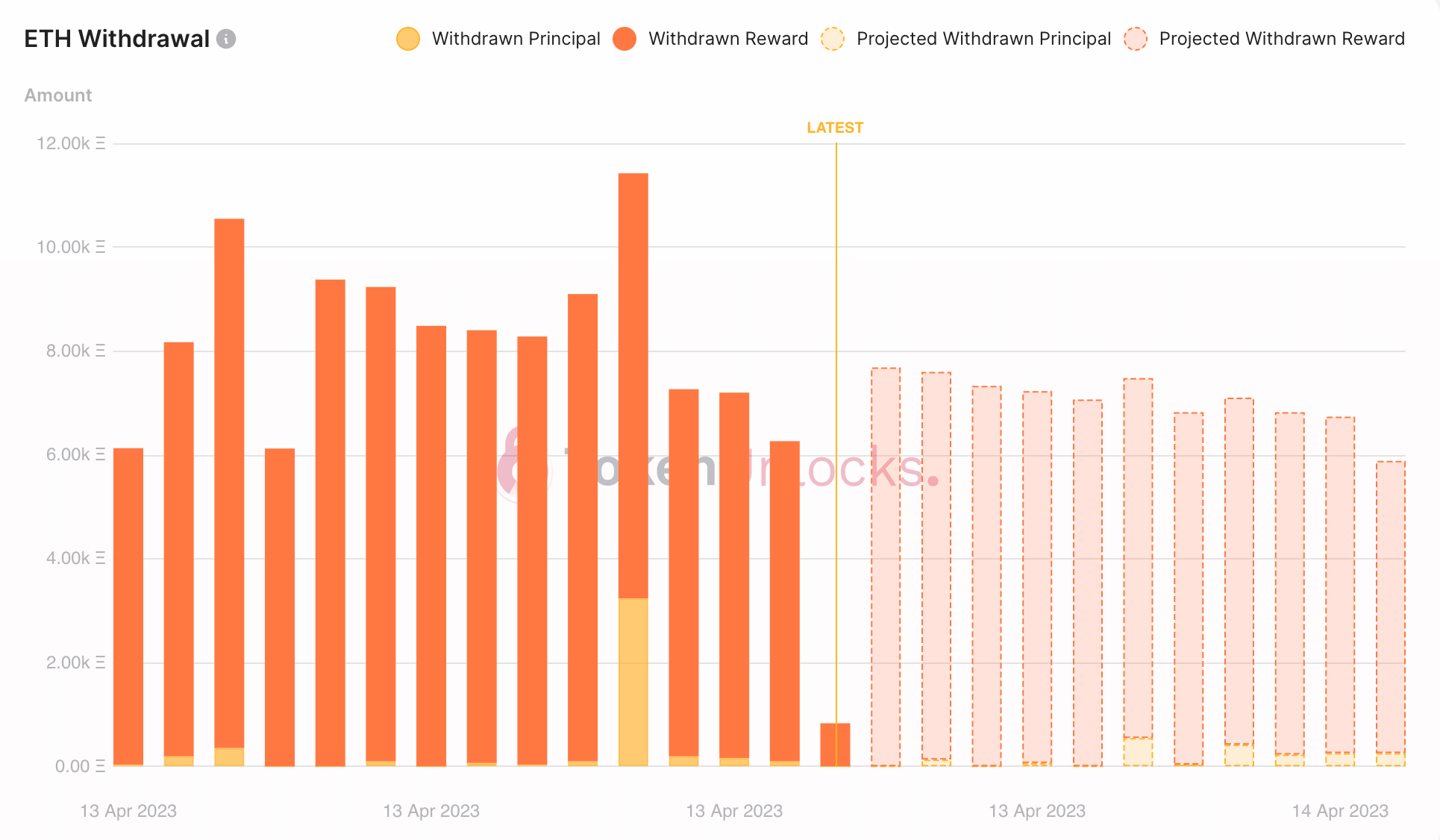

Data from April 13 showed only 17,000 validators were awaiting a full withdrawal. This indicates that a majority of the ETH being withdrawn came from staking rewards rather than the staking principal.

There was also a decrease in the number of active validators on April 12, with the network seeing the first back-to-back negative change in the number of validators.

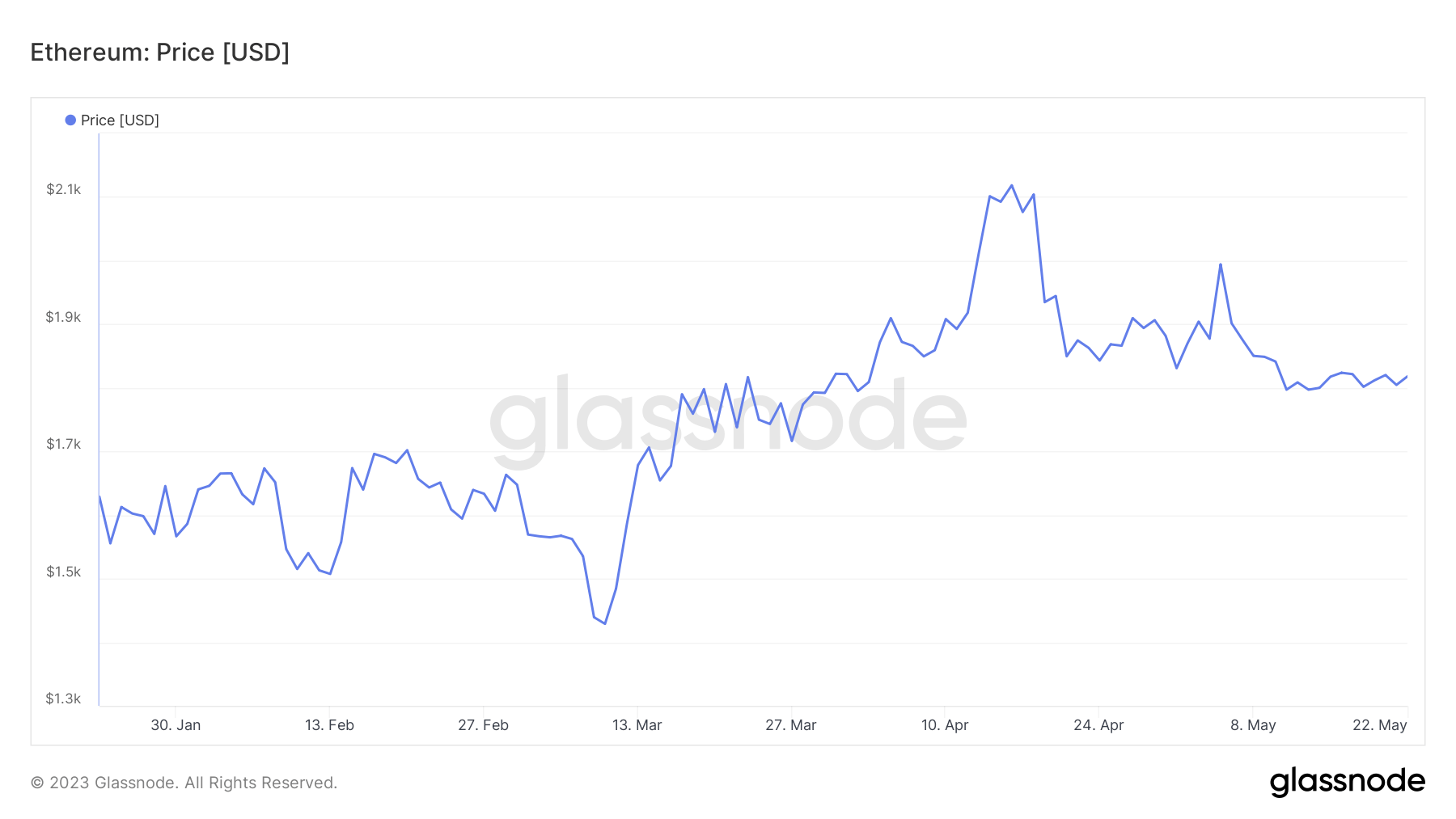

Ethereum’s realized price, the average price at which ETH last moved on-chain, stood at just over $1,400 pre-upgrade.

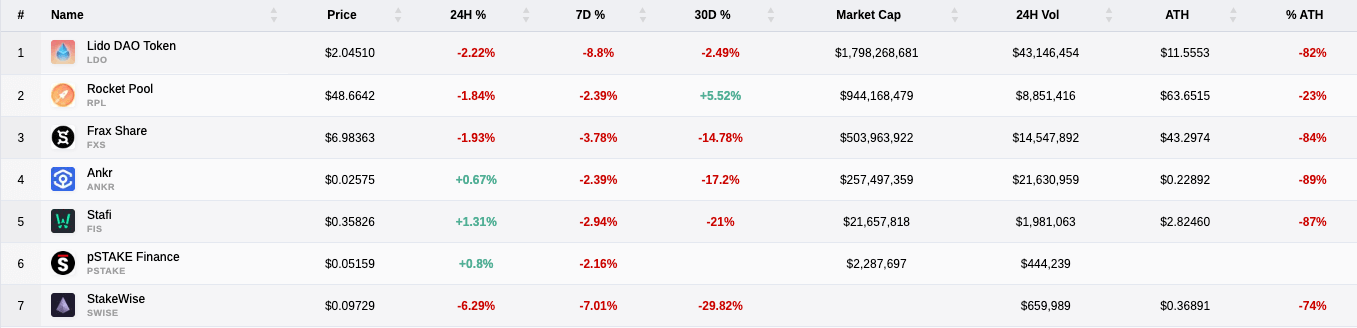

Despite Ethereum’s and Bitcoin’s prices holding steady, liquid staking tokens took a substantial hit. CryptoSlate data showed the sector dropped by 13% in the week preceding Shapella, between April 5 and April 12, indicating the market had been gearing up for the upgrade for a while.

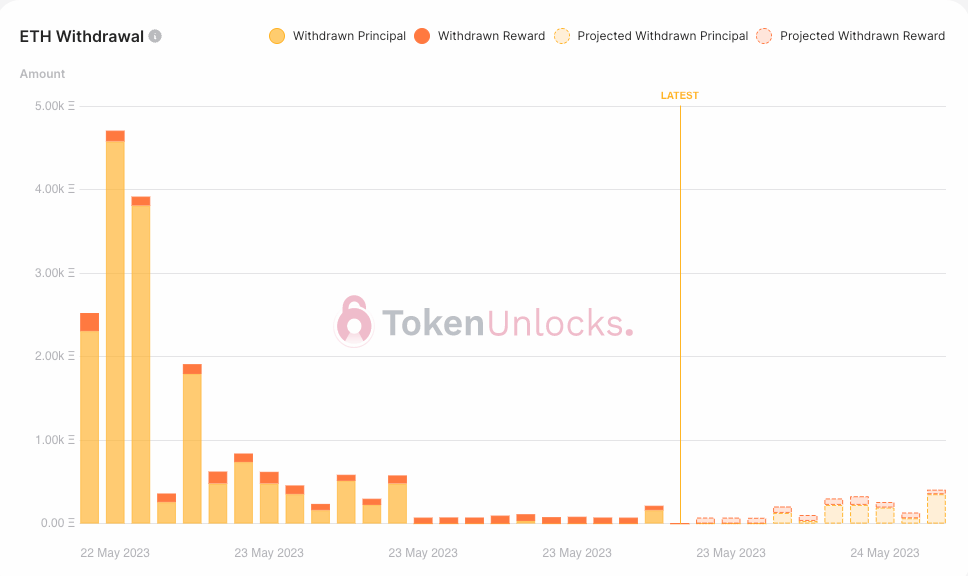

As the weeks passed, Ethereum began to feel the upgrade’s more profound impact. By May 21, five weeks after the upgrade, over 2.83 million of staked ETH was withdrawn from the network.

Data from TokenUnlocks shows that 527,350 validators have made a partial exit from the network since the upgrade, withdrawing just their accrued staking rewards. Only 811 validators made a full exit, withdrawing both their principal and rewards.

The majority of withdrawn ETH in the days after Shapella was made up of staking rewards. However, five weeks following the upgrade, the tides have shifted and most of the withdrawn ETH comes from staking principal.

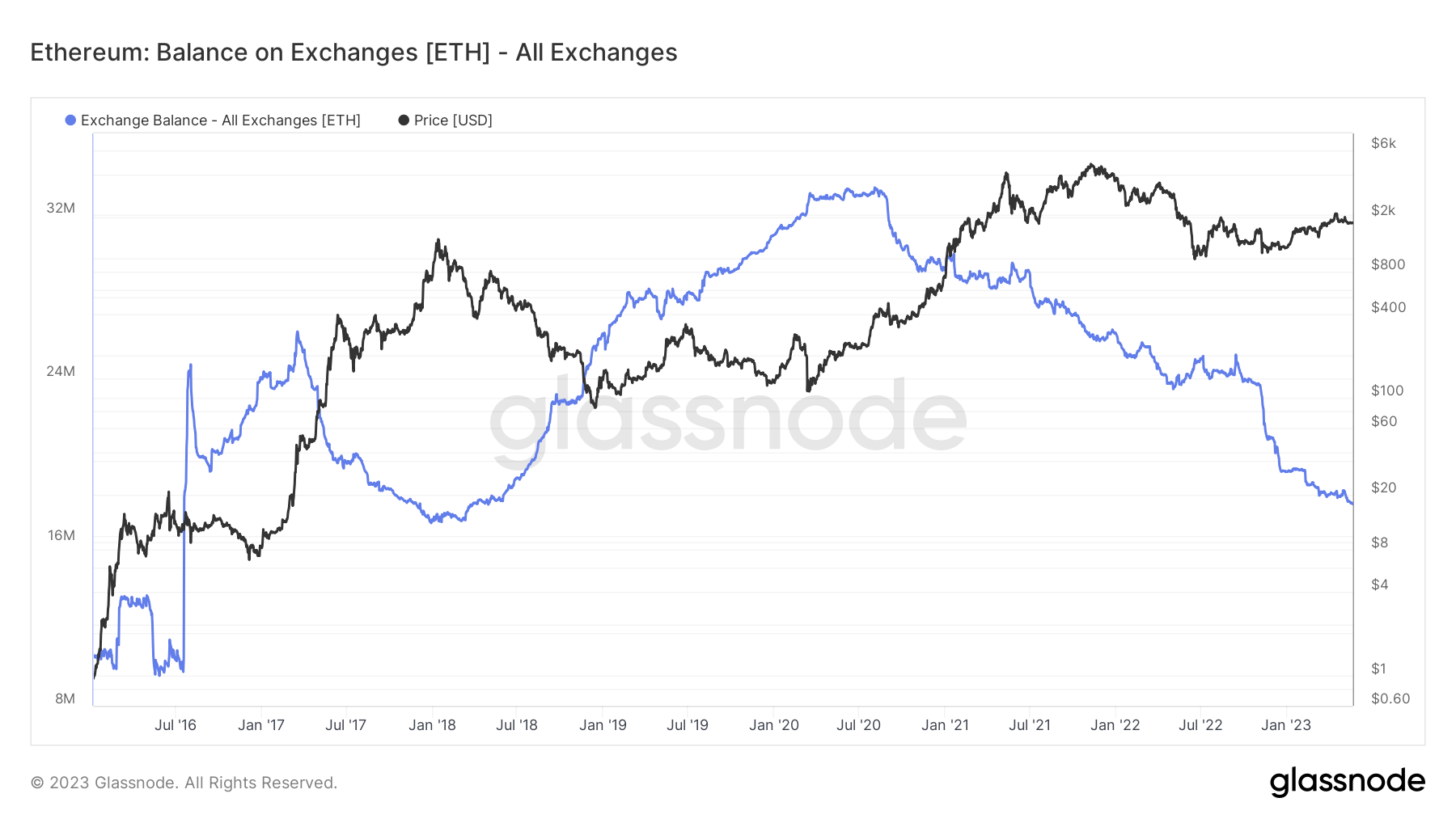

By May 21, Ethereum’s balance on centralized exchanges decreased significantly. CryptoSlate reported that the number of ETH across exchanges dropped to a five-year low, potentially indicating a shift away from trading and a new focus on self-custody for investors.

Liquid staking tokens continue to show weak performance even five weeks following the upgrade, with the majority of the tokens posting double-digit losses in the past month.

In the month leading up to Shapella, Ethereum’s price saw a notable increase as the market began gearing up for the upcoming volatility. ETH peaked four days after the upgrade, reaching $2,110 on April 16. However, the rally was short-lived and ETH began a rapid decline that pushed its price below $1,800. Currently standing at just over $1,817, ETH seems to be showing some signs of stability.

While the upgrade brought about anticipated improvements, it also instigated shifts that influenced validators’ actions, staking tokens’ performance, and the Ethereum network’s overall state. As the blockchain terrain continues to evolve, these metrics will play a crucial role in guiding analysis and forecasting Ethereum’s future trajectory.

The post Research: Liquid staking tokens remain in the red five weeks after Ethereum’s Shapella upgrade appeared first on CryptoSlate.