The South African fiat currency’s exchange rate versus the U.S. dollar plunged to a new all-time low of 19.7640 per dollar on May 25 just moments after the South African Reserve Bank raised the benchmark interest rate to its highest since 2009. Although the currency has since made some recovery, prediction models show that the rand will soon breach the 20 rand per dollar mark.

First Back-to-Back Rate Hike Since 2009

The South African currency — the rand — fell to a new of 19.7640 per dollar on May 25, moments after the country’s central bank raised the key interest rate to 8.25%. The rand’s latest plunge came some two weeks after the currency fell to what was then the new all-time low of 19.51 units of the rand per dollar.

As reported by Bitcoin.com News, the rand’s plunge on May 12 followed U.S. allegations that South Africa had supplied weapons to Russia, which invaded Ukraine in February 2022. The allegations have raised fears that the United States might block South Africa’s access to the African Growth and Opportunity Act (AGOA) preferential duty-free market.

In addition to the U.S. allegations, the South African economy has been rattled by worsening electricity shortages and rising inflation. In its attempt to halt the economy’s descent, the South African Reserve Bank (SARB), like many of its peers, has adopted an aggressive monetary policy which has now seen it deliver what is being described as its first back-to-back 50-basis-point hikes since 2009. The latest increase brings the cumulative rate hike since Nov. 2021 to 475 basis points.

Currency Expected to Breach the 20 Rand per Dollar Mark

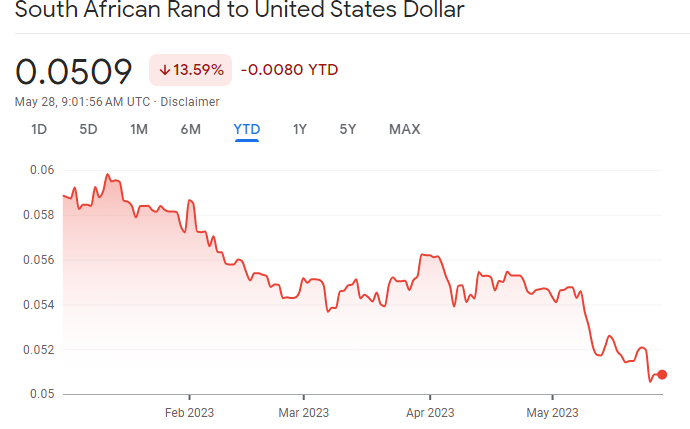

However, shortly after the latest interest rate increase was announced, the rand fell by as much as 2.6% before recovering and stabilizing at around 19.64 units per dollar. At the time of writing, available data shows the rand has depreciated by as much as 13.5% in 2023.

Meanwhile, a Bloomberg report said a prediction model shows that after the rate hike, the chances of the rand breaching the 20 units per dollar mark have gone up to 53%. Before the SARB’s latest rate decision, the same model put the probability of this happening at just 6.8%. According to the data on a website that forecasts the rand’s exchange rate versus the dollar, the South African currency is now expected to breach the 20 units per dollar level sometime in late May or early June.

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.