Polygon has continued to struggle during the past day as on-chain data shows the MATIC exchange supply has spiked.

Polygon Exchange Supply Spikes As Whale Deposits Huge Stack

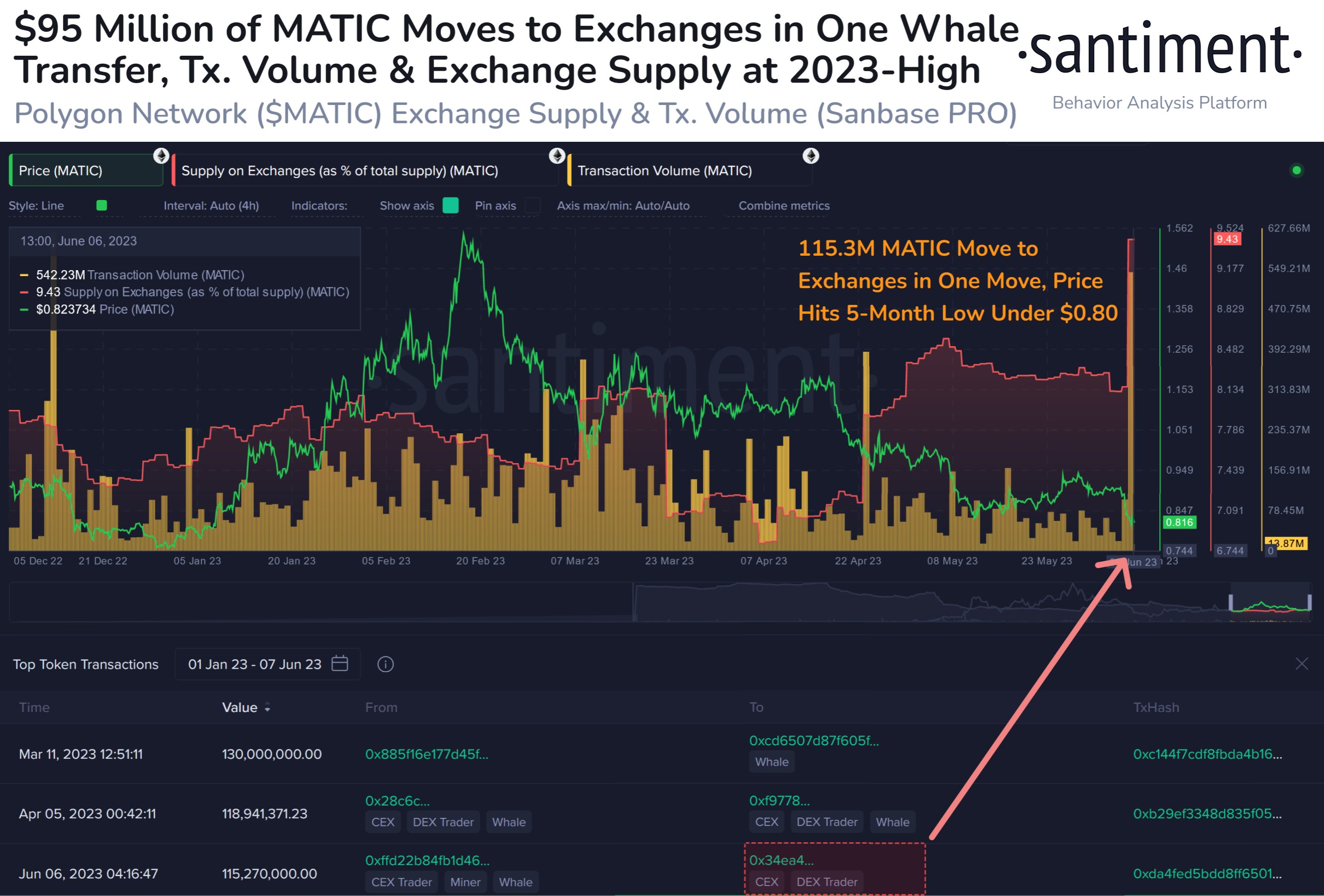

According to data from the on-chain analytics firm Santiment, a single whale has deposited around $95 million in MATIC to Binance during the past day. The relevant indicator here is the “supply on exchanges,” which, as its name already implies, measures the total percentage of the Polygon circulating supply that’s currently being stored in the wallets of all centralized exchanges.

When the value of this metric increases, it means that a net number of coins is currently entering into the wallets of these platforms. Generally, one of the main reasons why an investor would choose to deposit their coins to exchanges is for selling-related purposes, so this kind of trend can have bearish implications for the asset’s value.

On the other hand, lowering values of the indicator suggest that the investors are withdrawing their coins from the exchanges right now. Since holders usually transfer their coins into self-custodial wallets whenever they want to hold onto them for extended periods, such a trend can be a sign of accumulation, and hence, can be bullish for the cryptocurrency’s price.

Now, here is a chart that shows the trend in the Polygon supply on exchanges over the last six months:

As displayed in the above graph, the Polygon supply on exchanges has registered a rapid increase during the past day. The main contributor of this surge looks to have been a single whale, who has deposited a whopping 115.3 million MATIC (worth around $95.4 million at the time the transfer took place) to the cryptocurrency exchange Binance.

The indicator has now hit a value of around 9.43%, meaning that more than 9% of the entire circulating supply of the asset is now being held in the wallets of exchanges.

A couple of days back, MATIC, as well as the rest of the digital asset sector, saw a price crash after news came out of the US Securities and Exchange Commission (SEC) suing Binance and its CEO over alleged fraud.

During the past day, however, a lot of the market has observed a rebound, with Bitcoin even briefly recovering back above the $27,000 level. Polygon, however, has failed to amass together any such positive move, as its price has only gone downhill.

The massive deposit from the whale responsible for the spike in the supply on exchanges may have been made with the purpose of dumping, which would perhaps provide one of the reasons for why MATIC has performed much worse than the other coins.

MATIC Price

At the time of writing, MATIC is trading around $0.8051, down 9% in the last week.