Coinbase CEO Brian Armstrong sold $1.8 million worth of company shares on June 5, according to data from Dataroma, before news of the U.S. Securities and Exchange Commission (SEC) lawsuit against the company tanked its shares by more than 15% on June 6.

Roughly 30k shares sold

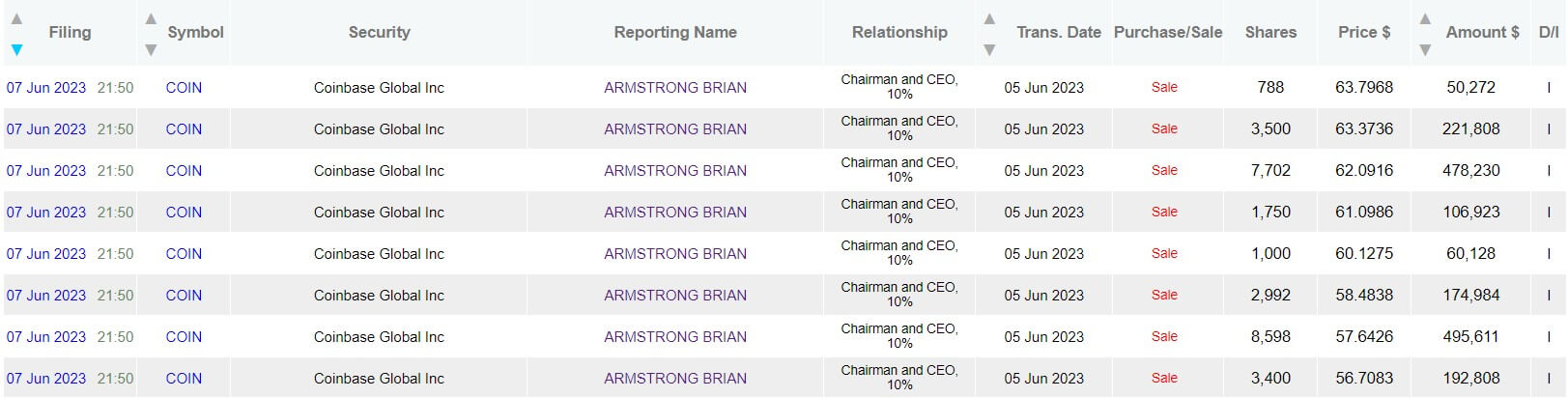

Armstrong sold 29,730 Coinbase shares in eight transactions on June 5, with the selling prices ranging between $56.70 and $63.79, according to the Dataroma data.

COIN shares dropped by over 15% to less than $50 on June 6. As of press time, it had slightly recovered to $54.90 — down 3.22% from Armstong’s least selling price.

Sales were pre-planned

The timing of these sales leading up to the SEC lawsuit raised concerns among the crypto community that he had prior knowledge of the lawsuit.

Fox Business journalist Eleanor Terrett dismissed these speculations, saying the stock sales were pre-planned since August 2022 in compliance with the SEC’s Rule 10b5-1.

According to Investopedia, company insiders can use Rule 10b5-1 to establish predetermined plans for selling stock, including details like price, quantity, and date. However, the insiders must certify that they are unaware of nonpublic information.

Terrett added:

“Setting a sale to happen on the 1st Monday of the month/start of the 3rd fiscal quarter, I’m told, isn’t too unusual.”

Armstrong’s previous sales

Meanwhile, this recent sale is similar to Armstrong’s previous selloffs. CryptoSlate reported that Armstrong sold 89,196 Coinbase shares for $5.8 million in March. At the time, almost half of these sales were made 24 hours before the U.S. SEC issued a warning to the exchange.

The Coinbase CEO also sold $1.8 million worth of the company’s stocks in April.

However, this sales trend began in November 2022 when Armstrong pledged to sell 2% of his stake at the crypto firm to fund scientific research and development through two startups — NewLimit and Research Hub.

The post Coinbase CEO’s $1.8 million stock sale raises eyebrows amid SEC lawsuit appeared first on CryptoSlate.