On-chain data shows Binance has continued to observe Bitcoin outflows amid recent uncertainty. Is this something you should worry about?

Binance Has Observed Peak Bitcoin Outflows Of 14,000 BTC

Just a few days ago, the US Securities and Exchange Commission (SEC) sued the cryptocurrency exchange Binance and its CEO, Changpeng Zhao, over alleged securities fraud.

Whenever there is uncertainty like this about an exchange, users of the platform may naturally display panic. One way to gauge market reaction around such FUD is by checking whether the investors are withdrawing their coins from the exchange or not. The netflow indicator can serve well for this purpose.

The “Binance netflow” is a metric that measures the net amount of Bitcoin entering or leaving the cryptocurrency exchange. The indicator’s value is simply calculated as the difference between the inflows and the outflows.

When the value of this metric is positive, it means that the inflows are overwhelming the outflows right now, and so, a net number of coins is being deposited into the platform. As one of the main reasons why an investor may transfer their coins to exchanges is for selling purposes, this kind of trend can have bearish implications for the price.

On the other hand, negative values imply Binance is observing the exit of a net amount of BTC supply at the moment. In normal circumstances, such a trend, when prolonged, can be a sign of accumulation from the holders, and hence, can be bullish for the asset’s value.

The on-chain analytics firm Glassnode has put out a new tweet that looks into the Bitcoin netflow data for the cryptocurrency exchange Binance to see how the users are holding up.

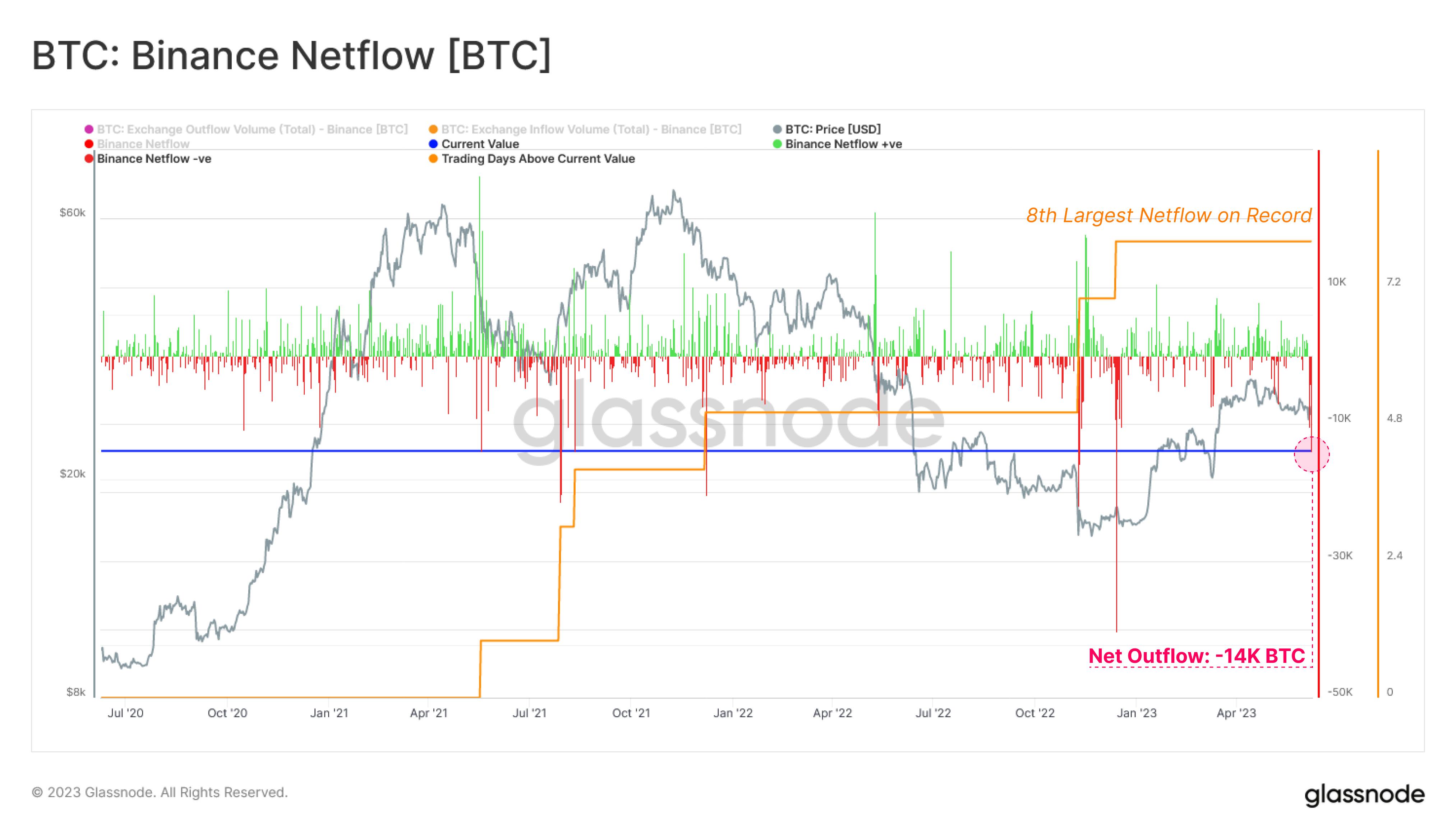

Here is a chart that shows how the indicator’s values have looked recently, and also how they compare with those observed during the past few years:

From the above graph, it’s visible that the Binance Bitcoin netflow has registered a deep negative spike recently. This means that the investors have been withdrawing coins from the platform.

As mentioned before, such values of the metric may be bullish for the price as they can be a sign of accumulation. However, that’s only in normal circumstances. Since these outflows have come after a breakout of FUD in the market, it seems likely that at least part of these is from investors’ panic withdrawing.

Glassnode points out, though, that even though the peak netflow of 14,000 BTC that’s been observed recently is the 8th largest netflow spike in the metric’s history, the scale of these withdrawals is still very small when compared to the platform’s total reserve.

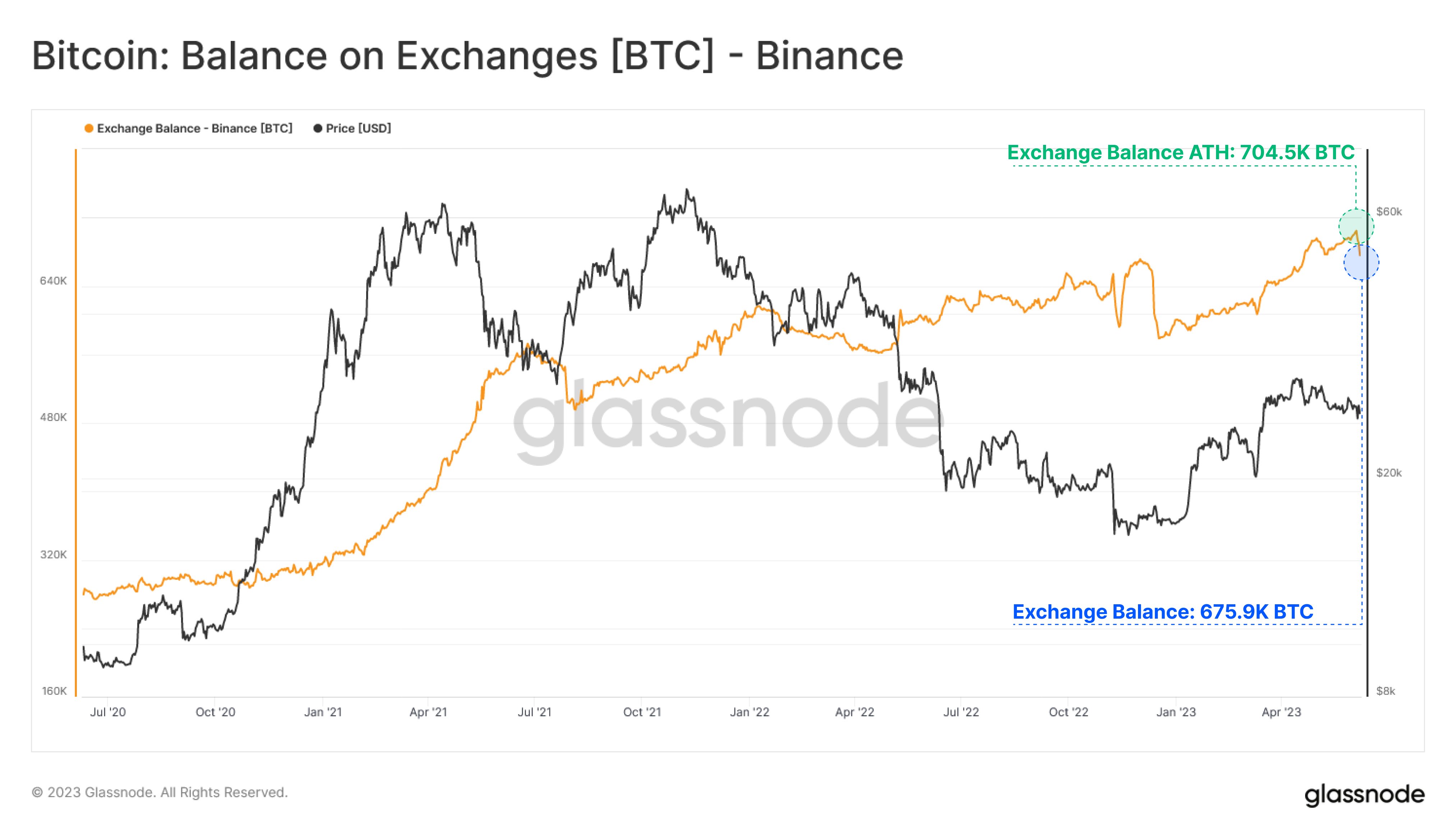

As the below chart shows, Binance’s total Bitcoin balance has barely moved because of these net outflows, as it remains just 28,600 BTC off its all-time high value.

“When assessing the severity of net outflows in relation to the balance held on the Binance Exchange addresses, the impact can be considered minimal,” concludes the analytics firm.

BTC Price

At the time of writing, Bitcoin is trading around $26,600, down 2% in the last week.