Binance.US, the US subsidiary of popular cryptocurrency exchange Binance, has experienced a significant drop in liquidity, with market makers and traders reportedly fleeing the exchange in large numbers. According to data from crypto market data provider Kaiko, liquidity, as measured by aggregated market depth for 17 tokens on the exchange, has fallen nearly 80% over the past week.

On June 4, the day before the Securities and Exchange Commission (SEC) lawsuit, market depth was $34 million, but today, market depth is just $7 million.

Market Makers Exodus

Market makers are financial firms that facilitate trading in financial markets by providing liquidity. They buy and sell assets, such as cryptocurrencies, at quoted prices to profit from the difference between the buy and sell prices, known as the bid-ask spread.

In cryptocurrency exchanges, market makers are crucial in providing liquidity by placing buy and sell orders at different price levels. This allows investors to buy and sell assets at a desired price and helps to stabilize the market.

However, the decreased market depth has resulted in a more than 6% price difference between mainstream cryptocurrencies on Binance.US and other exchanges, which has since been flattened.

The drop in liquidity suggests that market makers are nervous and want to avoid volatility-induced losses and the possibility of their assets getting stuck on an exchange, like during the FTX collapse.

Binance.US has suffered the most out of the exchanges targeted in the lawsuits, with its market share dropping from 20% in April to just 4.8% today, according to Kaiko.

The drop in market depth for Binance.US indicates that market makers are rushing to exit the market, potentially due to regulatory concerns or other factors. This can have several implications for Binance.US, including decreased liquidity, increased volatility, and potential difficulty for investors to buy or sell assets at a desired price.

Coinbase, on the other hand, has seen its market share soar over the past week, from 46% to 64%, for unclear reasons. No particular asset saw an unusual surge in trade volume.

However, Coinbase may have the most to lose in the lawsuits, considering 80% of its business is in the United States. In contrast, the Binance.US entity accounts for a small fraction of global Binance activity.

Binance Sees $500 Million Drop In Open Interest

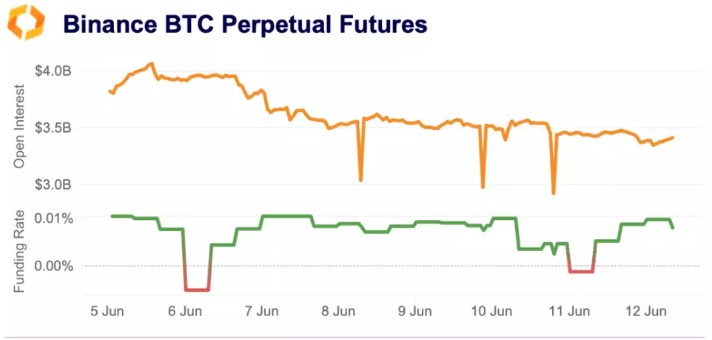

According to Kaiko research, over the last week, the cryptocurrency market has experienced a significant decline in open interest, with Bitcoin (BTC) open interest falling over 25% on Binance from peak to trough. From a high of $4.1 billion of open positions, BTC’s open interest on Binance dropped to a low of $2.9 billion as long positions were liquidated and prices fell.

Despite the decline in open interest, funding rates on Binance remained mostly positive throughout the week, only dipping negative for two funding payment periods on the 6th and the 11th.

This is interesting as funding rates typically become negative during a market downturn when there is a high demand for short positions. The fact that funding rates remained mostly positive during the market decline suggests that investors may still be bullish on cryptocurrency.

Featured image from Unsplash, chart from TradingView.com