Quick Take

The price of Bitcoin is currently above $31,000, with a notable uptick in spot buying. Moreover, a considerable amount of open interest and leverage has been flushed out, potentially influencing the market dynamics.

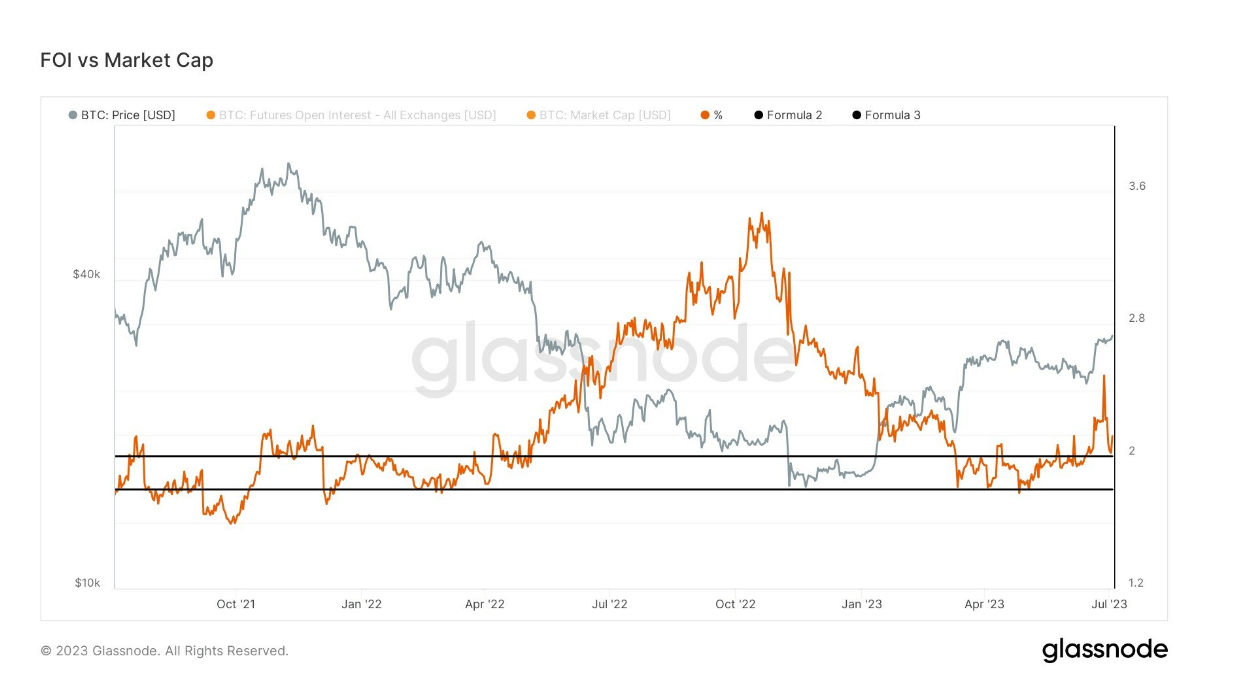

A metric that gives a sense of the leverage in the market is ‘futures open interest’ divided by the ‘market cap.’

The ratio is currently over 2.1%, comparable to the period when the BlackRock ETF was announced. The metric serves as a proxy for the leverage in the system and suggests a similar level of risk in the market.

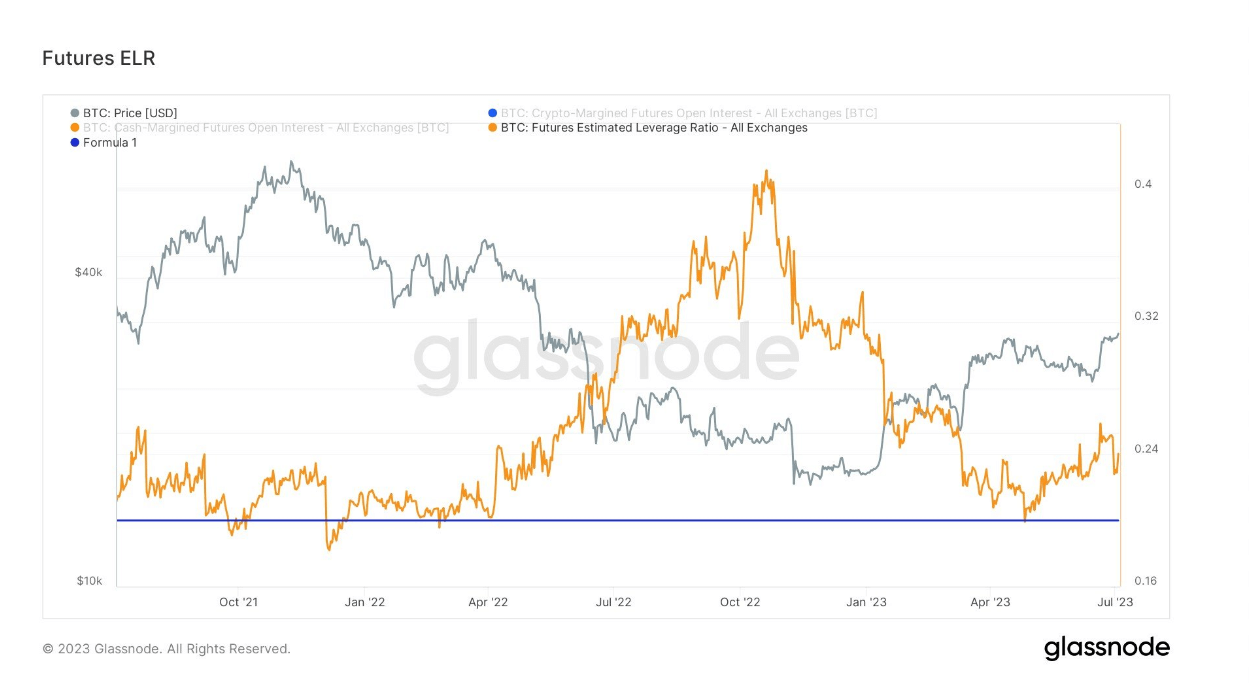

A further tool is the ‘estimated leverage ratio,’ defined as the ratio of the ‘open interest in futures contracts’ to the ‘balance of the corresponding exchange.’ This ratio has risen since April, indicating an increase in leverage and, consequently, risk.

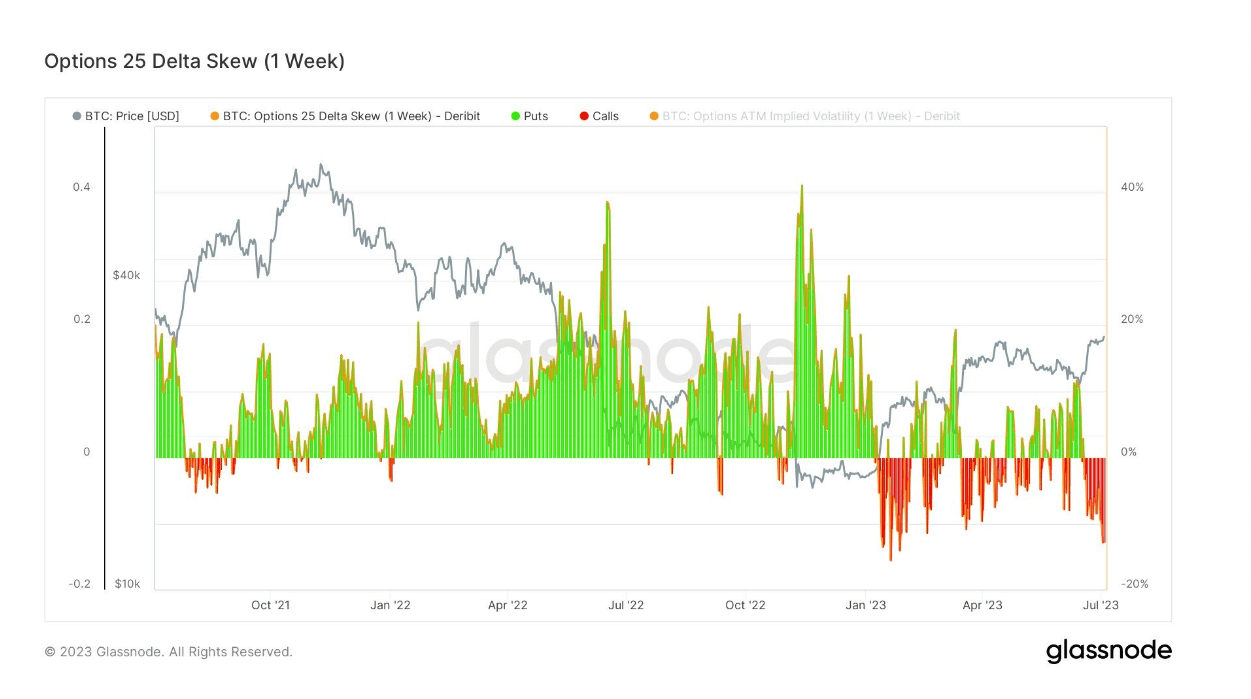

Furthermore, the options ’25 delta skew,’ a measure that depicts investor preference for either call or put options, leans heavily towards the call side. This skew suggests that investor sentiment is particularly bullish, and in fact, the market hasn’t seen this level of optimism in calls all year.

These factors paint an interesting picture of Bitcoin’s current market state, suggesting a solid bullish sentiment despite the increased leverage.

The post Bitcoin market dynamics shift with rising leverage amid bullish investor sentiment appeared first on CryptoSlate.