Dogecoin (DOGE) experienced a substantial surge on the price chart towards the end of June. However, despite this notable increase, it failed to ward off the sellers who swiftly entered the market.

Can Dogecoin regain its momentum and rise again, or will it succumb to the mounting pressure from the bearish sentiment?

Bitcoin (BTC) also experienced a downturn in the previous week, and this negative trend had a noticeable impact on the sentiment surrounding Dogecoin.

Unfortunately, the figures did not provide a strong basis for a potential recovery in DOGE. Instead, it indicated a looming decline towards the price range of $0.053 and $0.048.

DOGE Bearish Indicators Emerge

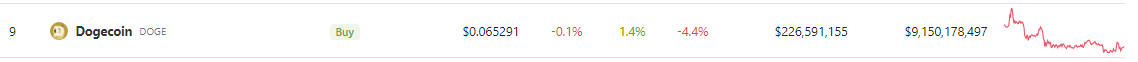

The current DOGE price on CoinGecko stands at $0.0652, experiencing a modest 0.7% rally within the past 24 hours. However, it is important to note that a decline of 5.8% has been recorded over the course of the past seven days.

This price movement has prompted a closer examination of the market conditions, revealing some bearish signals and underlying trends.

Based on a DOGE price report, it appears that bears are preparing to exert downward pressure on prices once again. The Relative Strength Index (RSI) has slipped below the neutral 50 level, indicating a shift in momentum towards the bearish side, suggesting that selling pressure may increase in the near future.

Additionally, the On-Balance Volume (OBV) has been unable to surpass a resistance level since May, reflecting a lack of interest from buyers. This suggests that market participants may be hesitant to make significant purchases, contributing to the downward pressure on DOGE prices.

Although some buyers noticed the recent short-term rally and made purchases as prices slowly edged higher, it is worth noting that this rally pales in comparison to the significant surge the meme coin experienced in early April, when Dogecoin reached the $0.1 level.

This discrepancy, referring to the difference between the current rally and previous ones, implies that the present market upswing may be lacking an equivalent degree of enthusiasm and support from buyers. This observation raises questions about the sustainability and strength of the crypto.

Outlook For DOGE

The bearish signals observed, such as the RSI dropping below the neutral 50 level and the lack of conviction from buyers indicated by the OBV, suggest a challenging road ahead for DOGE. These factors may contribute to increased selling pressure and further price declines.

Considering the current market conditions, it is important to approach the outlook for DOGE with caution. The short-term rally, although relatively subdued compared to past performances, could still offer opportunities for traders looking for quick gains. However, it is vital to remain vigilant and closely monitor the market dynamics.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock