Quick Take

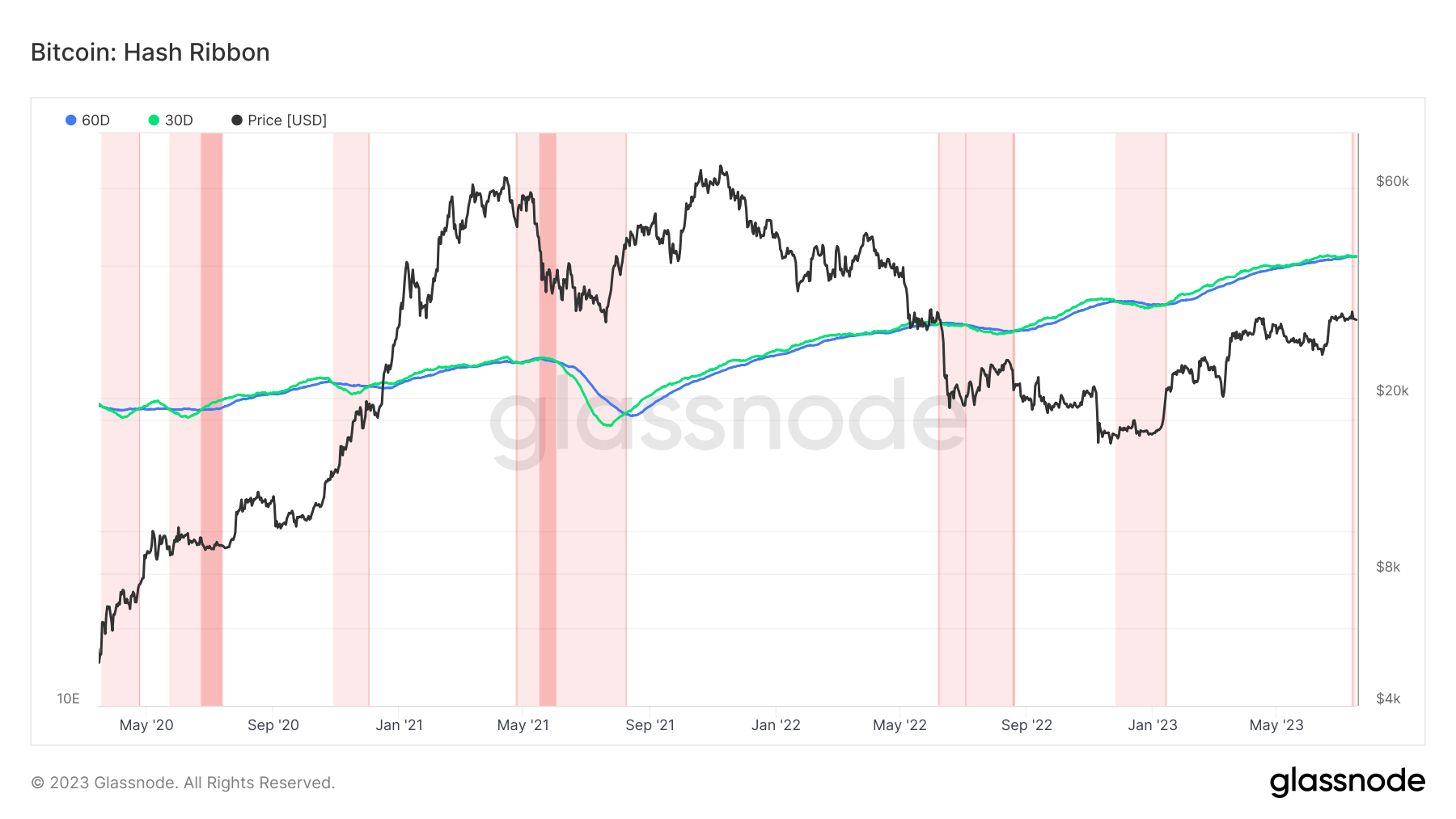

The Hash Ribbon, a market indicator defined by Glassnode, operates on the assumption that Bitcoin tends to bottom out when miners capitulate, which happens when the cost of mining Bitcoin exceeds the potential return.

The Hash Ribbon historically signals the end of the miner capitulation phase when the 30-day moving average (MA) of the hash rate surpasses the 60-day MA, transforming from light red to dark red areas on the below chart. This metric, coupled with a shift in price momentum from negative to positive, has historically indicated promising buying opportunities, as represented by the transition from dark red to white.

For the first time since the FTX collapse, the ribbon has inverted, marked by an 8% drop in the hash rate within a span of a few days. Interestingly, patterns of miner capitulation have been recurrent every summer, potentially due to a higher electricity cost during these months.

Historically, instances of miner capitulation were seen in June 2020, May 2021, June 2022, and most recently in July 2023. On average, these capitulation periods span one to two months.

The post Summer sparks Bitcoin miner capitulation: a recurrent seasonal trend appeared first on CryptoSlate.