Chainlink has suffered a 6% blow during the past week as the asset’s downtrend continues. Does the coin have any hope for a turnaround soon?

Chainlink Has Been On A Decline Since Top Back In July

Last month, LINK observed a sharp surge where its price crossed the $8.4 mark. The asset couldn’t keep the rise up, however, as it slowly started to slide down. The past week seems to have been more of the same as this trend of gradual decline, as Chainlink has now dropped to the $7.2 level.

Here is a chart that shows how LINK has gone downhill since its top last month:

Chainlink’s 6% losses during the past week aren’t that bad when compared to some of the other top coins in the sector, as many of the assets are carrying significant losses, including the likes of XRP and Litecoin, which are down 13% and 11% in this period, respectively.

That said, the drawdown could still be worrying for the asset’s investors, as it means that the downtrend that has been going on during the past few weeks hasn’t subsided just yet.

Even in this bad period, though, there have been some developments related to the asset that could be promising for Chainlink investors.

LINK Sharks & Whales Have Accumulated While Dev. Activity Has Stayed High

In a new post on X (formerly Twitter), the on-chain analytics firm Santiment has revealed these constructive signs related to the asset.

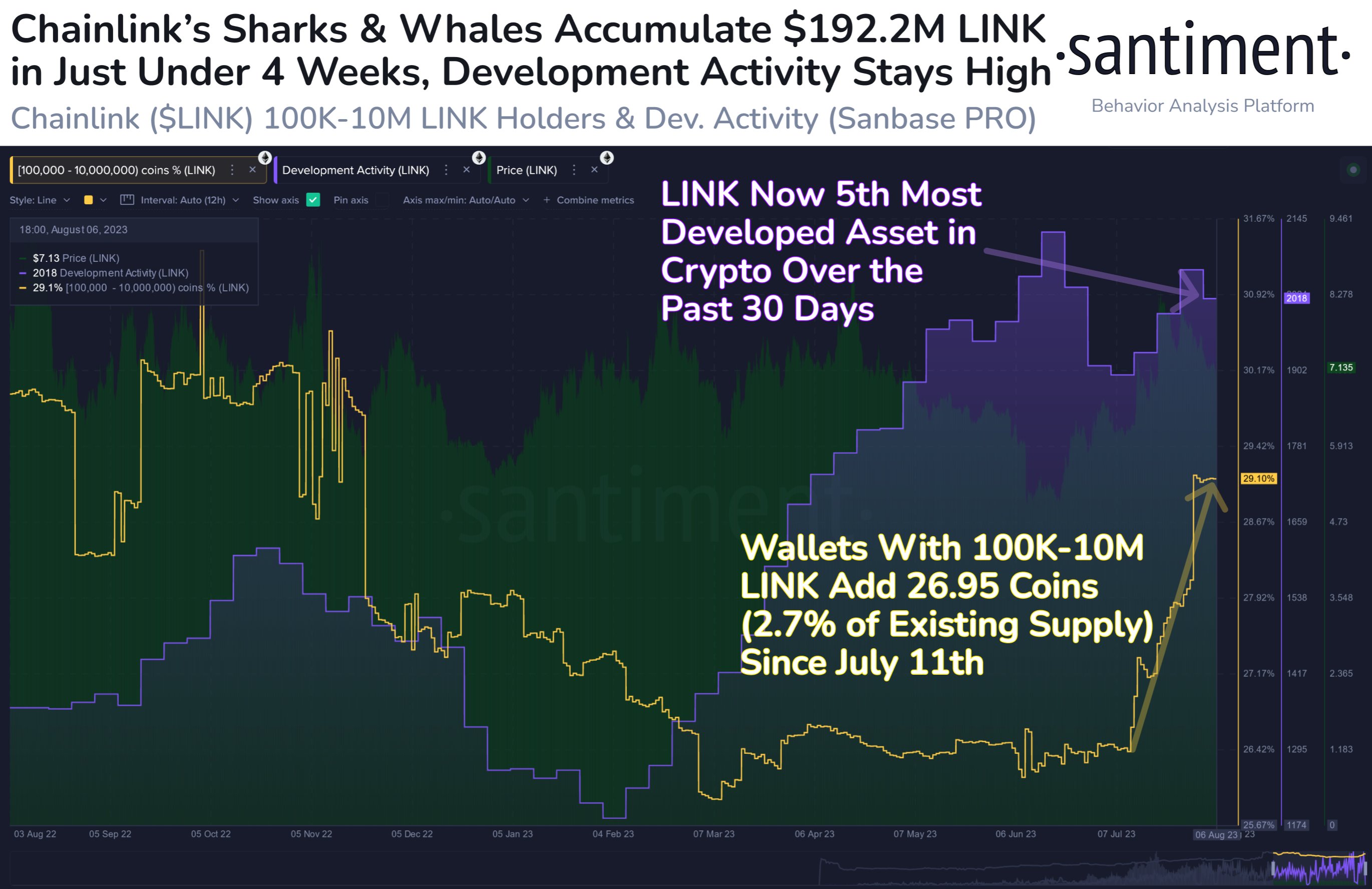

The below chart shows the trend in the relevant indicators over the past year:

The first of these metrics, the “development activity,” tells us about the total amount of work that the developers of the LINK project have been doing on its public GitHub repositories during the past month.

From the chart, it’s visible that the indicator’s value has climbed up during the last few months and is now at pretty high levels. This would suggest that the developers of the cryptocurrency have been working hard recently.

Generally, development activity can be one of the signs to look out for to see if a project is still alive or not. With the recent rise, the metric’s value for LINK has been the fifth-highest in the entire sector, implying that the coin is currently one of the most developed in the market.

The other indicator in the chart shows the combined supply held by the wallets carrying balances between 100,000 and 10 million LINK. These large investors are the sharks and whales, who hold notable influence in the market due to their sizeable holdings.

As displayed in the graph, the supply of these humongous entities has shot up recently, as they have bought an additional $192.2 million worth of LINK in the past four weeks.

Naturally, such accumulation from these investors is a positive sign, but most of all, what’s also uplifting is that since the decline in the cryptocurrency has begun, these investors haven’t participated in any net selling spree.

It’s hard to say if Chainlink would rebound in the near future based on these factors alone, but they are still nonetheless developments in the right direction for the coin.